The revision of the United States' third‑quarter GDP is generating significant anticipation, as the updated figure may confirm the recent strength of the American economy or reveal signs of a slowdown. Preliminary estimates showed above‑average growth, supported by resilient consumer spending and a stable labor market. Even so, GDP revisions often bring meaningful adjustments, and investors are watching closely for details that could shift the macroeconomic outlook—especially in an environment of high interest rates and lingering inflation pressures.

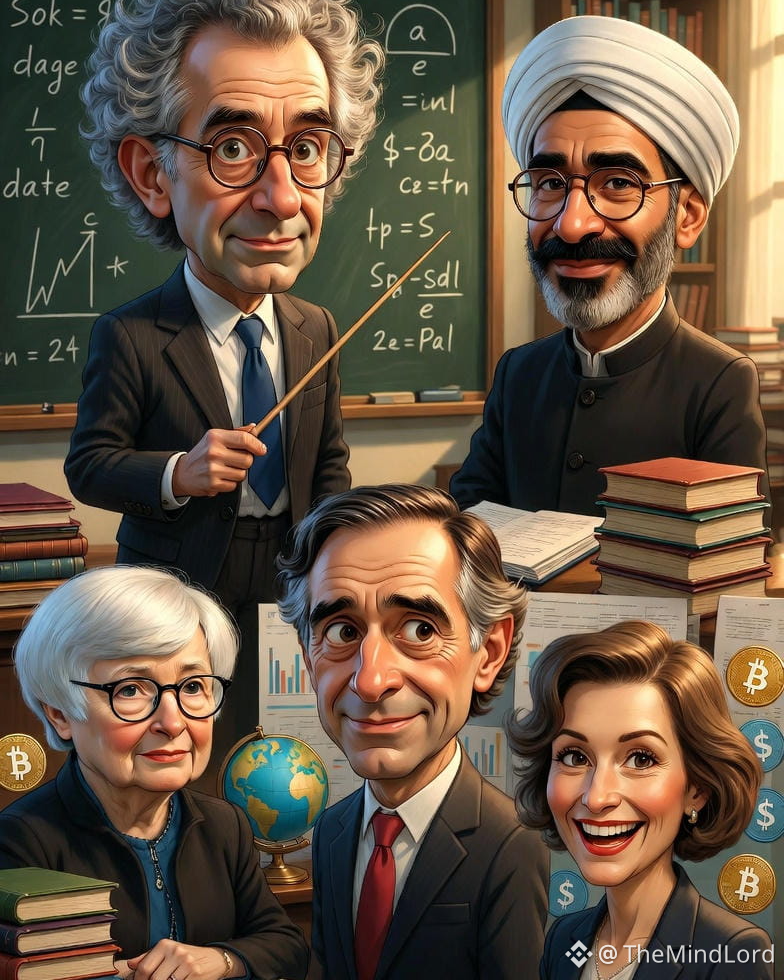

Several renowned experts have shared their forecasts. Paul Krugman (Nobel Prize–winning economist and professor at the City University of New York) believes the revision should reinforce the narrative of solid growth, highlighting consumer resilience. Meanwhile, Mohamed El‑Erian (President of Queens’ College at Cambridge and Chief Economic Advisor at Allianz) warns that even a slight downward revision could indicate weakening momentum in industrial sectors. Janet Yellen (U.S. Secretary of the Treasury) emphasizes that the focus should remain on maintaining balance between growth and inflation, pointing to the possibility of a soft landing. Ray Dalio (founder of Bridgewater Associates) notes that if the revised numbers suggest overheating, the Federal Reserve may maintain a tighter stance for a longer period. On the other hand, Cathie Wood (CEO and CIO of Ark Invest) argues that a revision signaling deceleration could strengthen expectations of rate cuts and benefit technology‑driven assets. Collectively, these analyses paint a comprehensive picture of how crucial this revised GDP figure is for calibrating expectations.

For investors, the ideal approach is to look at the broader landscape: upward revisions tend to support cyclical sectors and strengthen the U.S. dollar, while downward revisions may favor growth companies and put pressure on Treasury yields. Still, GDP is only one piece of the puzzle; inflation, employment data, and Federal Reserve communications remain critical variables. The most prudent stance at this moment is to remain balanced, adjusting exposure as the true pace of the economy becomes clearer.

#USGDPUpdate #Market_Update #InvestSmartly #NewsAboutCrypto #USGovernment