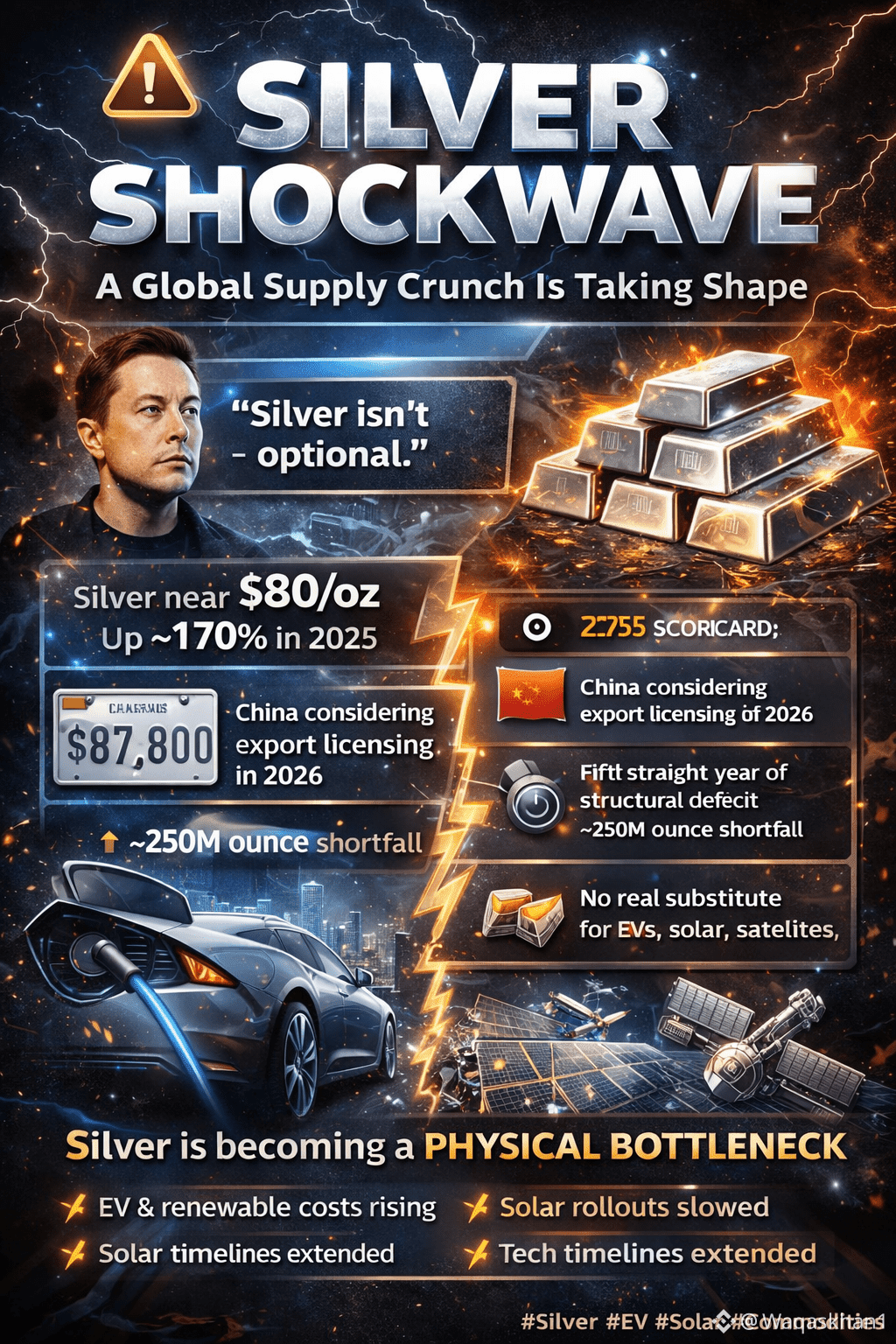

This isn’t hype anymore. Silver is becoming a critical choke point for modern industry—and the warning signs are flashing fast.

Elon Musk summed it up bluntly: silver isn’t optional. It’s a core input for today’s most important technologies, and supply is no longer keeping up.

What’s Driving the Pressure?

Silver near $80/oz, up roughly 170% in 2025

China considering export licensing in 2026, a direct threat to global supply chains

5th straight year of structural deficit, with estimates showing a shortage of up to 250 million ounces

No real substitute for silver in EVs, solar panels, satellites, AI hardware, and advanced electronics

This is no longer a “commodity trade.”

Silver is turning into a physical constraint on the green energy transition and next-gen tech expansion.

Real-World Impact Is Coming:

Higher costs for EVs and renewable energy

Slower solar and infrastructure rollouts

Increased pressure on tech manufacturing timelines

Markets often ignore bottlenecks—until they become impossible to avoid.

Silver is now crossing that threshold.

This isn’t about sentiment anymore.

It’s a supply-side shock with real economic consequences.

Watch closely. Capital doesn’t wait for headlines—it prices scarcity first.

#Silver #Commoditie #GreenEnergy #SupplyShock #EV #Solar #Macro