We’re now living in a high stakes financial era where gold isn’t acting like a boring safe haven anymore it’s behaving like a last line of defense. By late January 2026, the yellow metal stopped whispering and started shouting. On Wednesday, January 28, gold smashed through the $5,300 psychological level and printed a high of $5,305.56 per ounce. This wasn’t a normal rally. It felt like a warning.

A GLOBAL SYSTEM UNDER PRESSURE

Gold’s near vertical move isn’t happening in isolation. It’s being driven by rising geopolitical stress and a growing loss of confidence in institutions that once anchored the global financial system. Tensions between the U.S. and NATO over Greenland have turned an icy backwater into a strategic flashpoint. At the same time, trade tensions have escalated sharply, with the U.S. openly floating 100% tariffs even against close partners like Canada.

Then there’s the issue no one wants to talk about, the expanding Powell investigation. A criminal probe into the Federal Reserve’s independence has rattled markets and pushed the U.S. Dollar Index to its lowest level in four years. Central banks aren’t just diversifying anymore they’re defending themselves. Gold buying is running at roughly three times its historical pace as nations quietly prepare for a world where the old monetary order no longer holds.

SILVER STEALS THE SHOW

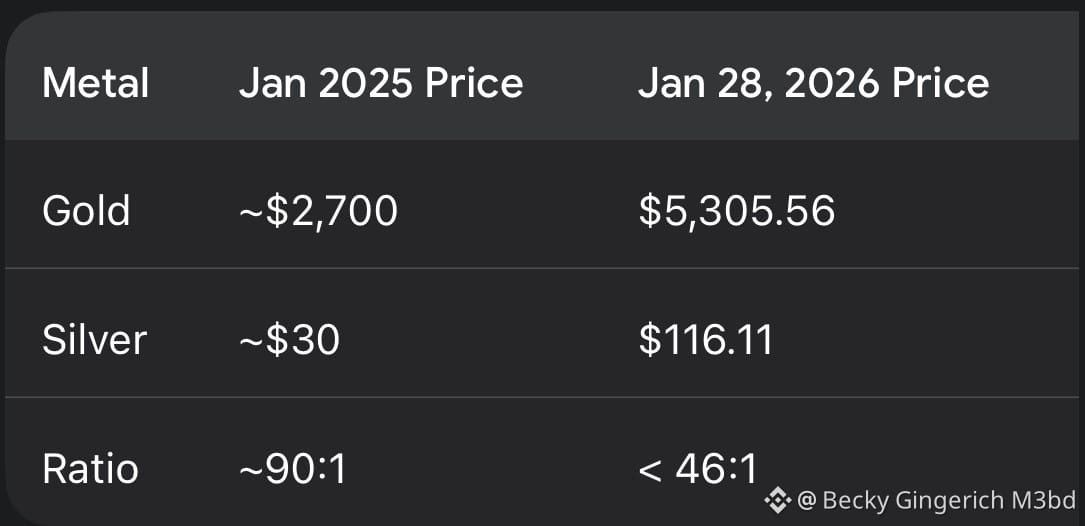

While gold has reclaimed the throne, silver has turned into the surprise breakout of the cycle. In just one year, prices have surged from around $30 to $111, marking a staggering 270% gain. This move isn’t driven by hype alone. China has restricted exports, the U.S. has designated silver a critical mineral, and industrial demand tied to energy and defense continues to surge.

Physical supply is tightening fast. The gold silver ratio has collapsed below 50:1, signaling a structural shift in how the market values silver. On the CME, trading volume hit a record 3.3 million contracts in a single session, confirming that this move has global participation not just speculative froth.

HOW FAR CAN THIS GO?

Wall Street is clearly playing catch up. Major banks are revising forecasts almost weekly, with some now projecting $6,000 gold by spring and even floating upside scenarios toward $7,000+ if trade wars deepen or Washington stumbles into another shutdown.

Still, caution is warranted. Gold is up roughly 84% year over year, and markets don’t move in straight lines forever. A sharp pullback toward the $4,800 zone would not be unusual. But in this environment, corrections are being treated as opportunities, not exits especially by central banks and long term capital.

THE BIGGER QUESTION

#PreciousMetals #Marketvotality #Globalmarket