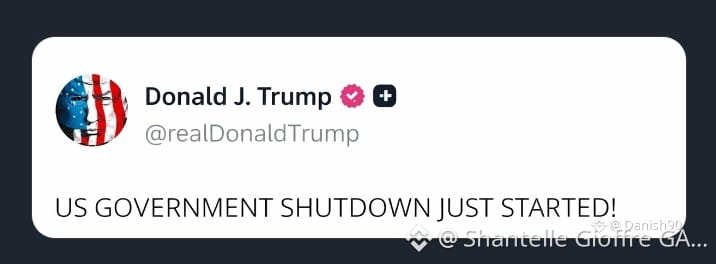

The United States government has officially shut down, triggering what could become one of the largest data blackouts in modern financial history. For investors holding stocks, crypto, or alternative assets, this moment matters more than most people realize.

When the government shuts down, so does the flow of critical economic information that markets rely on to function efficiently.

📉 What Data Goes Dark?

During a shutdown, multiple federal agencies suspend operations, meaning key economic reports are delayed or completely halted:

No inflation data (CPI, PCE)

No jobless claims

No GDP updates

No CFTC reports (Commitment of Traders)

No federal balance sheet transparency

Delayed or missing regulatory disclosures

In short: the data pipeline investors depend on goes silent.

🧭 Markets Flying Blind

Without fresh data, both the Federal Reserve and institutional investors lose visibility into real economic conditions. Monetary policy decisions become harder to justify, risk models weaken, and volatility tends to rise.

Markets don’t like uncertainty — and a lack of data is uncertainty at its worst.

📊 What This Means for Stocks

Equity markets often struggle during data blackouts. Valuations rely heavily on inflation trends, employment strength, and growth metrics. When those signals disappear, investors either:

Reduce exposure, or

Trade purely on sentiment and headlines

Neither outcome is stable.

₿ Why Crypto Traders Are Watching Closely

Crypto markets, unlike traditional finance, operate independently of government reporting cycles. Historically, periods of institutional confusion and macro uncertainty have pushed some capital toward decentralized assets.

When trust in centralized systems weakens, alternative financial systems get attention.

That doesn’t guarantee upside — but it does shift narratives.

⚠️ Volatility Is the Real Risk

A shutdown doesn’t automatically mean markets crash or pump. What it does mean is:

Fewer facts

More speculation

Faster emotional reactions

Price moves during these periods can be sharp, sudden, and misleading.

🔍 The Bottom Line

The U.S. government shutdown creates more than political drama — it creates a financial information vacuum.

For investors, this is a time to:

Stay cautious

Question narratives

Manage risk tightly

Avoid trading purely on hype

When the lights come back on, markets will reprice fast. Until then, everyone — including the Fed — is navigating in the dark.

If you want, I can:

Rewrite this in a Crypto Twitter thread

Make it shorter and more aggressive

Turn it into a news-style article

Or adapt it specifically for stocks vs c#tr rypto audiences

Just tell me the vibe. 🔥