📊 Latest Futures Market Snapshot

U.S. stock index futures are showing modest gains as markets look for direction ahead of key economic data and central bank signals. The S&P 500, Nasdaq 100, and Dow futures are trading near recent highs, reflecting cautious optimism among traders. Data shows U.S. futures indexes climbing slightly in pre-market trading, albeit with mixed volatility. (Investing.com India)

📌 Key Market Drivers

📈 Equity Futures:

• Index futures (S&P 500, Nasdaq 100) continue to hover near or around record levels, indicating a bullish undertone but limited breakout strength — suggesting range-bound trading. (Investing.com India)

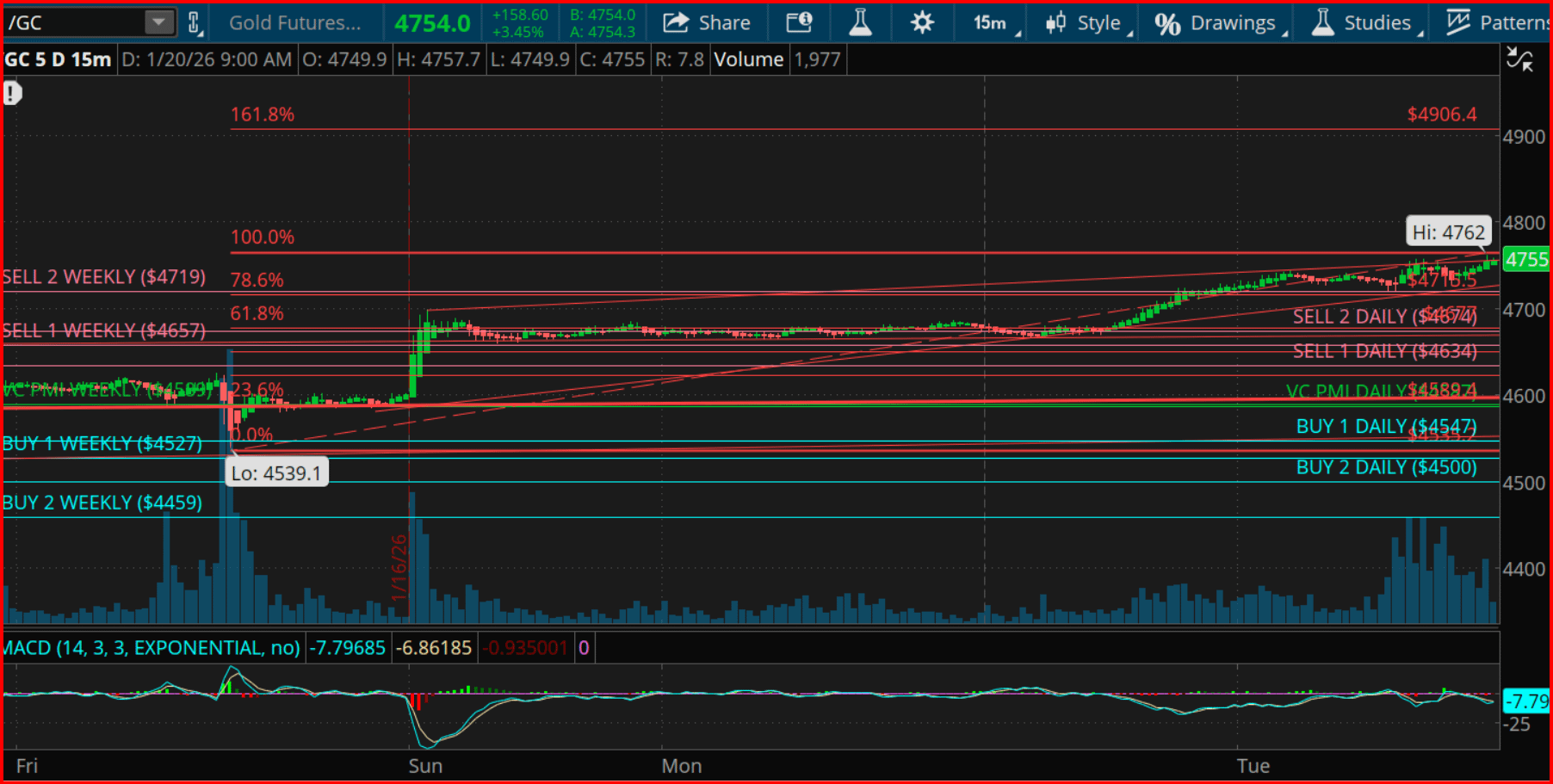

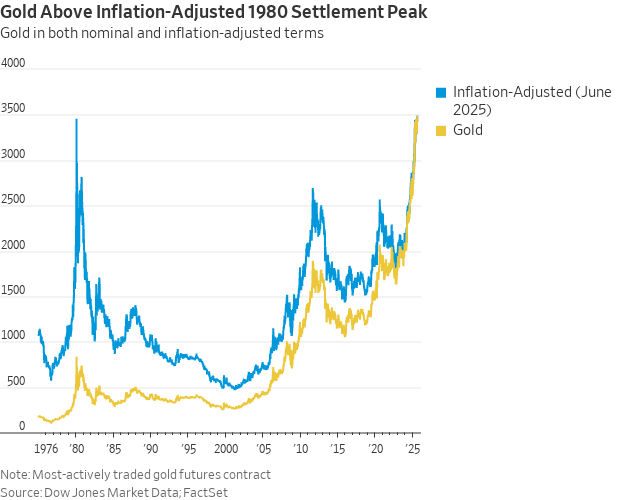

⛏️ Commodities & Precious Metals:

• Gold futures recently surged above the $5,000/oz level as the U.S. dollar weakened and geopolitical risks rise, drawing safe-haven demand. (MarketWatch)

• Meanwhile, exchanges like CME have raised margin requirements on gold and silver futures to dampen extreme volatility. (Reuters)

📉 Volatility & Risk:

• Futures markets are pricing in continued uncertainty, with volatility indexes edging up slightly, reflecting cautious sentiment ahead of macro data releases and policy decisions. (Barron's)

⚠️ What Traders Are Watching

Federal Reserve cues: Upcoming economic reports and potential rate moves remain major catalysts for equity and interest-rate futures.

Economic data: Inflation figures, job reports, and manufacturing activity could shift futures pricing quickly.

Geopolitical risks: Heightened tensions or policy shifts often spark safe-haven flows into gold and energy futures.

🧠 Quick Take

Futures trading currently reflects a cautious but constructive tone — with equity contracts near recent highs and commodities showing strong moves amid macro uncertainty. Traders remain alert to data releases and central-bank expectations that could spark rotation or volatility across index, metal, and energy futures. Volatility remains a key theme, so risk management (e.g., position sizing & stop limits) is crucial in leveraged futures markets. (Reuters)

Note: Futures are derivative contracts to buy/sell assets at a future date — useful for hedging and speculation across indices, commodities, currencies, and more. (investopedia.com)