Based on the LINK/USDT data provided, here is the trade setup analysis:

---

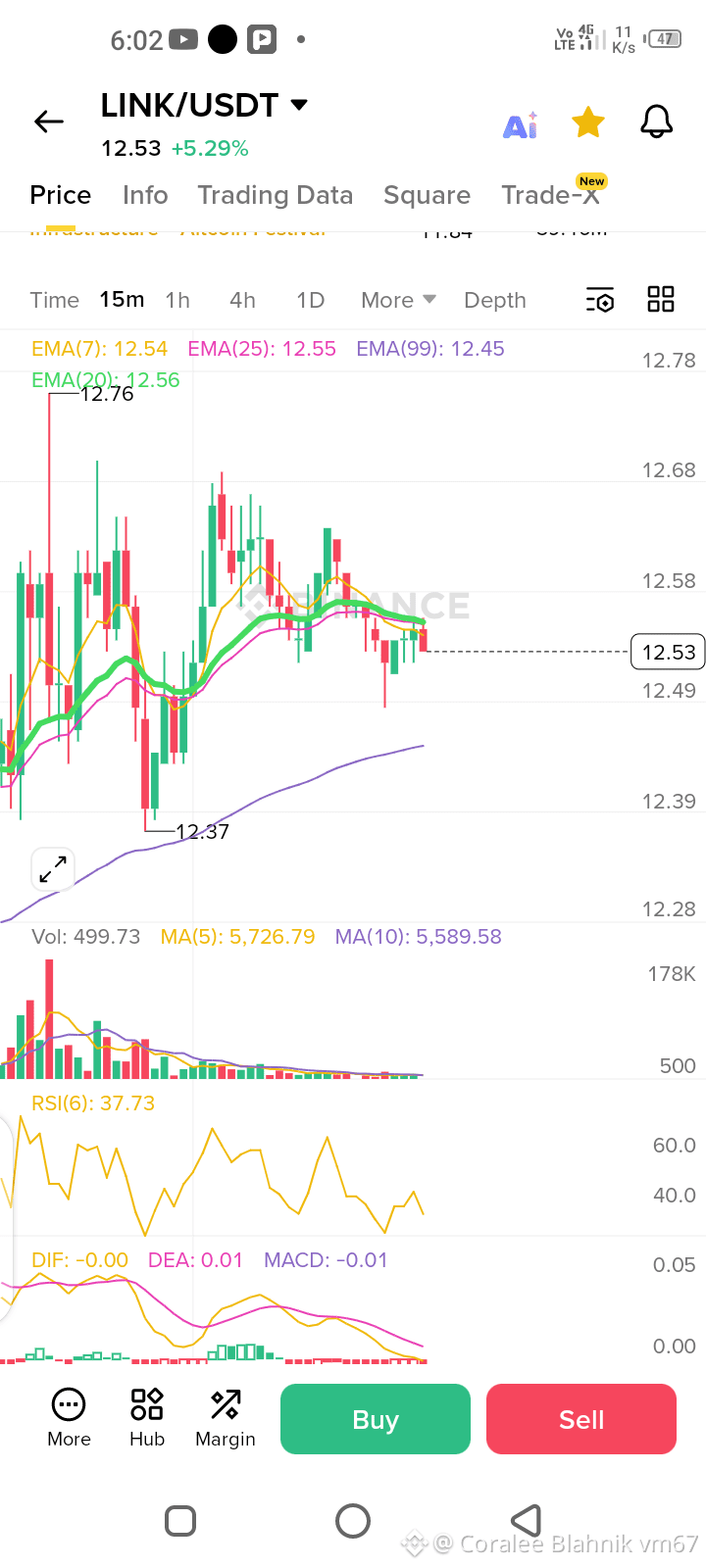

📊 Technical Snapshot

· Last Price: ~12.53

· 24h Change: +5.29% → Bullish momentum

· Mark Price: Not shown, but likely near last price

---

📈 Indicator Analysis

1. Moving Averages (EMA)

· EMA(7): 12.54

· EMA(25): 12.55

· EMA(99): 12.45

· EMA(20): 12.56

Interpretation:

Price is just below EMA(7, 20, 25) but above EMA(99).

Short-term consolidation with medium-term uptrend intact.

---

2. RSI(6): 37.73

· Neutral to slightly oversold, but not extreme.

· Room for upward movement without being overbought.

---

3. MACD

· DIF: -0.00

· DEA: 0.01

· MACD Histogram: -0.01

· Interpretation: MACD is flat and near zero → lack of strong momentum, but close to potential bullish crossover.

---

4. Volume

· Current Volume: 499.73

· MA(5) Volume: 5,726.79

· MA(10) Volume: 5,589.58

· Volume is significantly lower than recent average → Low interest at current levels, potential consolidation.

---

5. Price Levels

· Resistance: ~12.76 (likely recent high)

· Support: EMA(99) at 12.45

· Current price is in the middle of this range.

---

🎯 Trade Setup Assessment

✅ Case for LONG Trade

1. Price > EMA(99) → Uptrend still valid.

2. RSI neutral → Not overbought, potential to rise.

3. MACD near zero, could cross bullish with slight upward movement.

4. Recent 24h gain of +5.29% shows underlying strength.

Long Entry Zone: 12.45–12.50 (near EMA 99 support)

Stop Loss: Below 12.30

Target: 12.76 → 13.00+

---

⚠️ Case for SHORT Trade

1. Price below short-term EMAs (7, 20, 25) → Short-term bearish alignment.

2. MACD negative → Slight bearish momentum.

3. Volume low → Lack of buying interest.

Short Entry Zone: Rejection at 12.55–12.60

Stop Loss: Above 12.76

Target: 12.45 → 12.30

---

🧠 Conclusion & Action Plan

Higher Probability Setup = LONG

Trend is upward in the medium term, RSI is neutral, and pullback to EMA(99) offers a good risk/reward entry.

Recommended:

· Wait for a dip toward 12.45–12.50 to enter LONG.

· Confirm with rising RSI and bullish MACD crossover.

· Avoid shorting unless price clearly breaks below 12.45 with volume.

---

Final:

Long trade is valid on a pullback. Short trade is lower probability without a clear breakdown of EMA(99) support.