Over the past 24 hours, the sudden price spike in $BIFI has sparked intense discussion across crypto communities. Many traders rushed to label it as a bull-run signal, claiming that “this is exactly how bull markets begin.” Some even shared exaggerated success stories of buying at $100 and selling above $7,000.

However, a deeper look at the market structure tells a very different story.

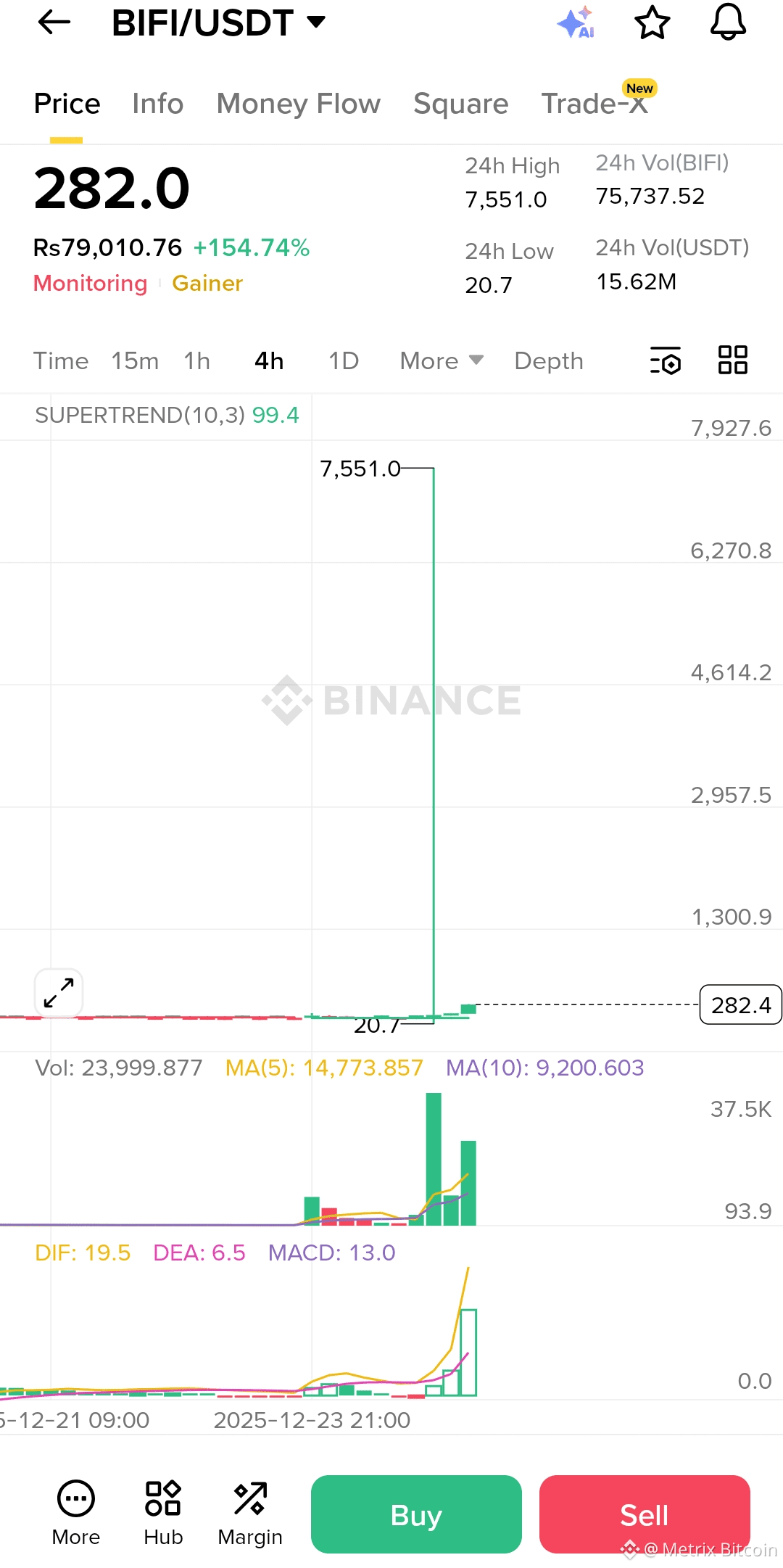

🔍 Understanding the #BIFI Spike

$BIFI has an extremely limited total supply of only 80,000 tokens. What makes this even more critical is the fact that approximately 84% of this supply is held by just three wallets. Another 8–10% sits with other large holders, leaving only a tiny fraction available for open market trading.

This heavy supply concentration results in very low liquidity, especially on centralized exchanges like Binance. When liquidity is thin, the order book lacks enough sell orders at different price levels.

⚠️ How the $7,551 Price Printed

In such a low-liquidity environment, a single aggressive market buy — whether triggered by a bot, a whale, or even a mistake — can cause the system to jump to the next available sell order, regardless of how far it is from the current price.

That is exactly what happened here.

The $7,551 price appeared for only one second, representing the execution price of a single trade, not the fair market value of BIFI. Once that trade was completed, the price immediately snapped back to normal levels.

❌ Not a Bull Run — Just a Wick

This move was not a sustainable rally, nor was it driven by organic demand. It was simply a wick/spike, caused by:

Low liquidity

Extreme supply concentration

Thin order books

Such behavior is very common in low-supply, whale-controlled tokens.

🐳 Intentional or Accidental?

In some cases, these spikes are intentional, executed by bots or whales to:

Create artificial liquidity

Trigger stop-losses

Attract attention and volume

The entity placing the trade may even accept a small loss, as they already control a significant portion of the supply.

🧠 Final Takeaway

Not every vertical candle is a bull-run signal.

Before celebrating massive price spikes:

Check total supply

Analyze wallet distribution

Look at order book liquidity

Without these fundamentals, such moves are often illusions, not opportunities.

Trade smart. Avoid hype. Respect market structure.