Crypto trading has created real opportunitiesnbut it has also created fake “experts.”

They flood social media with profit screenshots, bold claims, and flashy language.

Yet behind the confidence, many of them don’t trade at all.

If you want to survive long term in crypto, you must learn how to identify fake traders before their advice costs you money.

1. They Display Results, Not Reasoning

Fake traders focus on:

Green PnL screenshots

“1000% profit” claims

One perfect entry shown after the move

What they avoid:

Entry logic

Risk management

Stop-loss explanation

Losing trades

Real traders explain why. Fake traders only show what already happened.

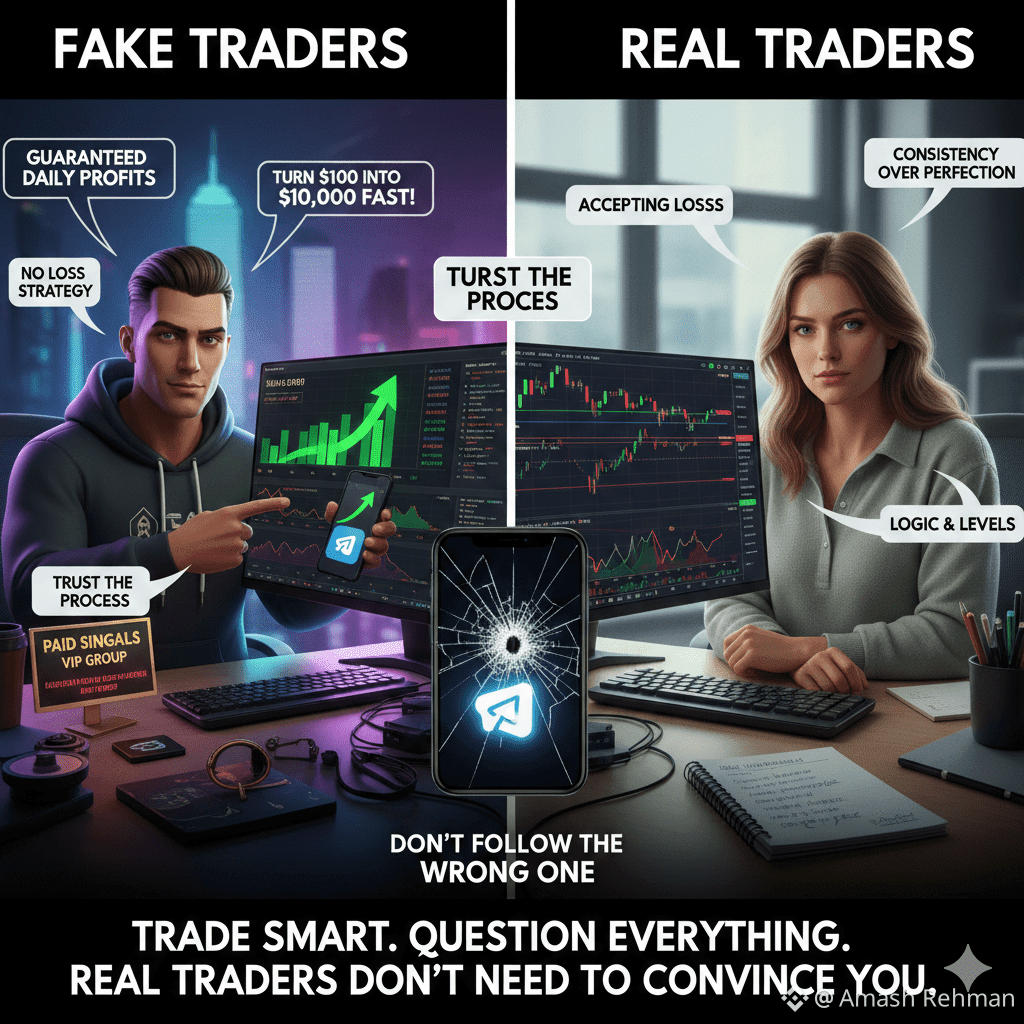

2. They Promise Speed Over Skill

If someone says:

“Turn $100 into $10,000 fast”

“Guaranteed daily profits”

“No loss strategy”

That’s not trading that’s marketing.

Real trading is slow, boring, and disciplined.

Anyone promising fast money is selling a dream, not a strategy.

3. They Never Share Losses

Every real trader loses.

No exceptions.

Fake traders:

Delete losing posts

Only post wins

Disappear during market crashes

Professional traders:

Accept losses publicly

Talk about mistakes

Focus on consistency, not perfection

If someone never loses, they’re not trading they’re performing.

4. Their Analysis Is Vague and Flexible

Fake traders use phrases like:

“Market can go up or down”

“Big move coming soon”

“Just trust the process”

Why?

Because vague predictions are impossible to prove wrong.

Real traders give levels, invalidation points, and clear scenarios.

5. Their Main Goal Is Selling, Not Trading

Ask yourself:

Are they pushing paid signals constantly?

Is every post a funnel to a Telegram or VIP group?

Do they earn more from subscriptions than trading?

If yes, trading is their advertisement, not their income.

Good traders make money from the market first, content second.

6. They Ignore Risk Management

Fake traders talk only about:

Entry

Target

“Moon”

They never talk about:

Stop loss

Position sizing

Capital preservation

Risk management is what keeps traders alive. Anyone who ignores it isn’t serious.

Conclusion:

The crypto market is already risky.Following fake traders makes it dangerous.

Before you follow anyone:

Study their logic.Watch how they handle losses.Check if they educate or just impress.In crypto, the loudest voice is rarely the smartest one.Trade smart.Question everything.And remember real traders don’t need to convince you.

#Binance #BinanceSquare #Write2Earn #faketraders #CryptoNews