If you think gold prices move freely based on supply and demand, you are badly mistaken.

What’s happening in gold and silver right now has very little to do with real metal.

It has everything to do with paper contracts, leverage, and exchange rules.

Over the last three months, almost all precious metals have rallied: gold, silver, platinum, copper, and others.

On the surface, this looks bullish.

Underneath, the structure of the market is extremely fragile.

The gold and silver markets are dominated by paper contracts, not physical metal.

For every single ounce of real gold or silver that exists, there are hundreds of paper claims trading through futures and derivatives.

In some cases, the ratio is estimated at 100x, 200x, even up to 400x paper claims versus physical supply.

This means something very important:

If even a small share of contract holders demanded real delivery, the system could not deliver.

There is simply not enough metal.

Even if mining production were increased aggressively, it would still be impossible to meet that level of paper obligation.

This creates a dangerous imbalance.

Now add the role of large institutions.

Some major banks are heavily net short gold and silver. They benefit if prices fall. They suffer badly if prices rise.

If gold or silver prices move too far up, these banks risk a short squeeze, where rising prices force them to buy back at higher levels while physical supply is limited.

That kind of squeeze would expose the entire paper system.

So instead of letting prices move freely, pressure is applied through the futures market.

This is where margin hikes come in.

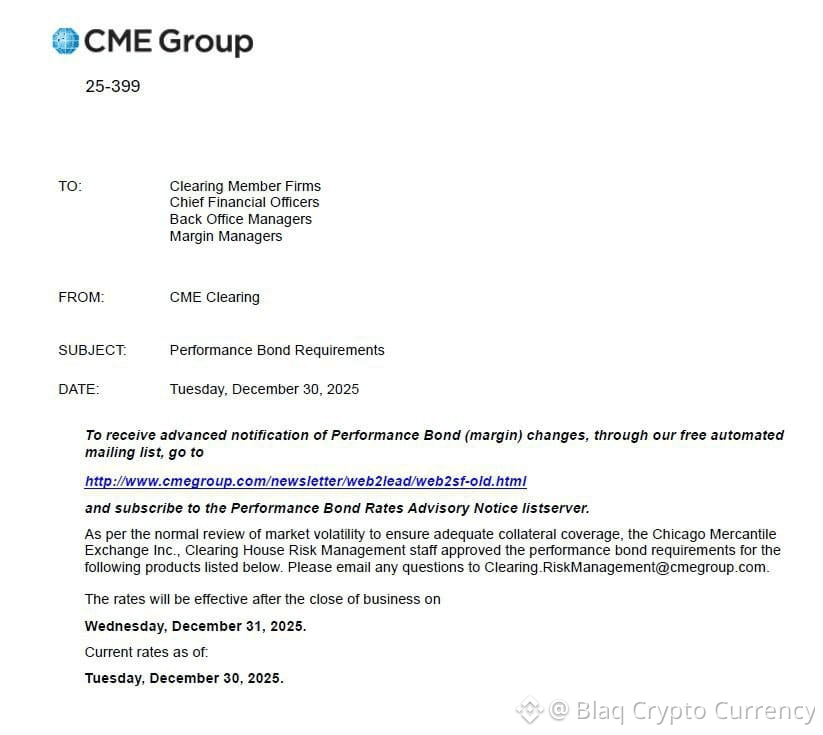

Recently, the CME has raised margin requirements on precious metals futures twice in just 3 days.

For gold, margins were increased again.

For silver, margins were raised first from around 22,000 to 25,000, and then aggressively from 25,000 to 32,500, roughly a 30% jump.

This matters because margin hikes force action.

When margins rise:

• Traders must post more cash

• Leveraged players cannot hold positions

• Forced liquidations happen

• Prices get pushed down

What’s important is this:

Gold’s volatility did not spike enough to justify these margin hikes.

So this is not about risk control.

It is about price control.

By forcing liquidations, selling pressure appears.

That helps relieve pressure on large short positions without those shorts being liquidated themselves.

In simple terms, margin hikes act like a hidden bailout for trapped players.

We have seen this before.

In 1980 and again in 2011, silver experienced strong rallies.

Then exchanges raised margins aggressively.

What followed:

• Mass liquidation

• Sharp tops

• Long bear markets

The pattern is very clear.

Even when the macro backdrop supports higher metal prices, structural tools can be used to cap rallies and reverse trends.

This is similar to what happened with MicroStrategy stock.

Even when Bitcoin hit new highs, repeated margin pressure stopped the stock from reaching its own all-time high.

The same logic is now playing out in gold and silver.

If prices continue to rise from here, exchanges may hike margins even more aggressively.

This means Gold and Silver will most likely form a top soon, and then liquidity will move into risk-on assets.#StrategyBTCPurchase #Binanceholdermmt