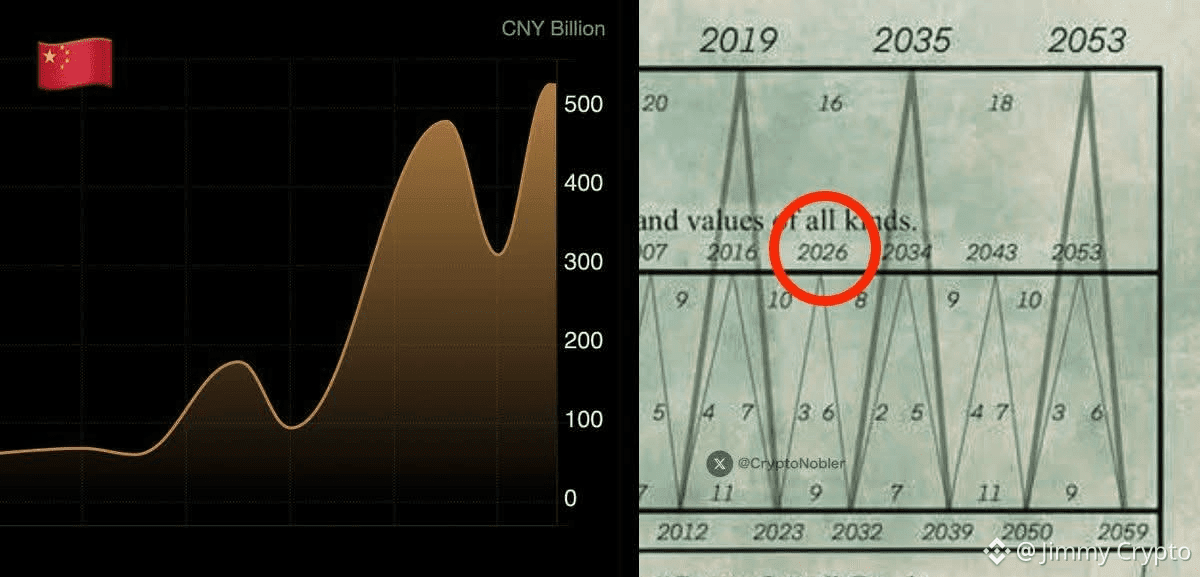

The Bank of China just released fresh macro data—and it’s alarming.

China is flooding the system with trillions in liquidity, marking the largest money-printing event in its history.

This isn’t normal stimulus.

This is a historic liquidity surge.

China’s M2 money supply has gone parabolic, now exceeding $48 TRILLION (USD equivalent).

Let that sink in.

That’s more than double the entire U.S. M2 supply.

And here’s the key point most people miss:

When China prints money, it doesn’t just inflate stock prices.

It flows straight into the real economy—especially hard assets and commodities.

China is converting paper into real stuff:

Gold. Silver. Copper. Strategic resources.

Now look at the other side of the trade.

Major Western banks are reportedly sitting on enormous gold and silver short positions—roughly 4.4 BILLION ounces of silver.

For perspective:

Global silver mine production per year is only ~800 million ounces.

That means these banks are short over 550% of the world’s annual silver supply.

Yes—550%.

This is not sustainable.

This is a macro accident waiting to happen.

On one side:

China debasing its currency

Massive demand for commodities

Exploding use of silver in solar, EVs, and infrastructure

On the other:

Western institutions betting against rising metal prices

Short positions that cannot physically be covered

You can’t buy 4.4 billion ounces of silver.

It doesn’t exist.

If silver starts moving—and Chinese demand accelerates—this won’t be a normal rally.

It will be a short squeeze of historic proportions.

And in a market this tight, a squeeze doesn’t mean “slightly higher prices.”

It means a full repricing of gold, silver, and hard assets.

Fiat money is infinite.

Metals in the ground are not.

As central banks race to destroy purchasing power, the only rational move is owning what cannot be printed.

A global market shock is forming.

Ignore it at your own risk.

I’ve called major market breaks before.

I’m calling this one too.

Pay attention.

#ChinaCrackdown #USNonFarmPayrollReport #BTCVSGOLD #CryptoMarketAnalysis #SECxCFTCCryptoCollab