In a market where narratives shift in minutes and every headline can trigger a volatile surge or sharp retracement, XRPstands out as one of the most debated and watched assets in crypto. From regulatory breakthroughs to ETF speculation and structural scarcity, XRP's trajectory in 2026 is shaping up to be one of the most compelling stories in digital assets. Let’s dive deep. 🔍

📊 Real-Time Market Pulse — Where XRP Stands Now

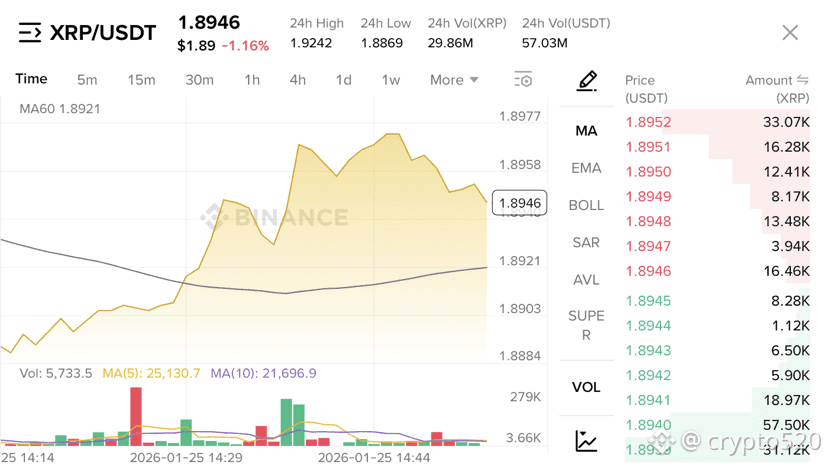

As of January 25, 2026, XRP is trading around ~$1.89–$1.90, holding its spot as a top-5 global cryptocurrency by market capitalization. Its 24-hour performance shows mild volatility, and price action remains within a consolidation range that market technicians are closely watching.

This phase of muted movement, rather than signaling weakness, can indicate structural positioning before a major breakout or breakdown — particularly as major catalysts develop. Social sentiment has hovered in “fear” territory historically preceding rebounds, while institutional flows paint a different, more optimistic picture.

📈 Bullish Catalysts — The Engines Driving XRP’s Next Move

🏦 1. Institutional Demand & ETF Infrastructure

XRP’s narrative shifted dramatically with the emergence of ETFs tied to its performance and liquidity flows. Analysts highlight that multi-billion-dollar institutional inflows via ETFs could propel XRP beyond current ranges — potentially toward $5, $8, or even higher by late 2026, assuming continued macro support and regulatory clarity.

🌍 2. Real World Utility — Not Just Speculation

XRP’s core utility isn’t just price action — it’s cross-border settlement and liquidity provisioning. Ripple’s On-Demand Liquidity (ODL) solution continues to onboard banking corridors, and adoption of stablecoins like RLUSDenhances XRP’s settlement utility, embedding it deeper into real global financial workflows.

🔒 3. Supply Dynamics & Scarcity

On-chain data shows liquid exchange supply tightening as ETFs and institutional wallets lock up XRP, reducing tradable float. Limited supply with sustained demand historically increases upward pricing pressure, especially when coupled with steady settlement use.

📉 Bearish Pressures — Why Caution Matters

⚠️ 1. Technical Resistance & Momentum Signals

Despite optimism, XRP has grappled with resistance near critical price clusters. Breaking significant levels like $2.10–$2.30 with meaningful volume is essential to confirm a sustainable uptrend. Failure to do so could mean continued range trading or even downside tests.

⚠️ 2. Regulatory & Adoption Risks

While major litigation hurdles have cleared in key jurisdictions — notably the SEC case — global regulators remain in flux. New regulatory delays or negative rulings in major markets can reintroduce uncertainty and cap institutional participation.

⚠️ 3. Competitive Pressures

Rivals in cross-border settlement and stablecoin ecosystems — from Stellar to Ethereum-based solutions — continue to innovate. If other chains capture more remittance or tokenization volume, XRP’s utility advantage could be diluted.

🚀 Predictive Layers — Scenario Mapping for Traders & Investors

Here’s how the roadmap might unfold across three probabilistic scenarios:

📌 Bull Case — XRP breaks above key resistance with renewed institutional flows and utility adoption; price range $3.00–$8.00+ by late 2026.

📌 Base Case — Sideways movement as markets digest catalysts, oscillating between $1.70–$3.00 before clear breakout patterns emerge.

📌 Bear Case — Macro headwinds or stalled adoption push XRP back into a deeper consolidation, potentially retesting lows near $1.50–$1.80.

💡 Fundamental Synthesis — What Sets XRP Apart

Beyond price, the true story of XRP lies in its institutional onboarding, real payment utility, and evolving ecosystem support. Unlike purely speculative tokens, XRP serves a defined economic role in global liquidity and payments — and when real adoption aligns with liquidity demand, it’s often reflected in price behavior.

🧠 Key Insights for Binance’s Community

🔥 Engage, but Strategize: XRP isn’t simply a “pump and dump” play — it’s a utility-driven asset with real global financial implications.

🔥 Watch Macro With Micro: Institutional flows, ETF adoption, and regulatory milestones will likely move XRP more than short-term sentiment.

🔥 Risk First: Always balance upside expectations with volatility risk — altcoins like XRP can move swiftly in both directions.

🧾 Final Take — XRP at the Inflection Point

XRP in 2026 finds itself not just trading numbers, but navigating regulatory evolution, real world adoption, and liquidity transitions. Whether you’re a trader, investor, or blockchain enthusiast, XRP’s story this year will be defined by execution, not hype.

Will 2026 be the year XRP cements its place as the global settlement token of choice? Or will competition and market dynamics temper expectations? Only time — and smart analysis — will tell. 🌐🔥