Short intro:

Bitcoin — the largest cryptocurrency — has been hit by volatility, dipping but also showing signs of short-term support. These swings are shaping how traders interpret risk in a broader downturn.

📰 What happened

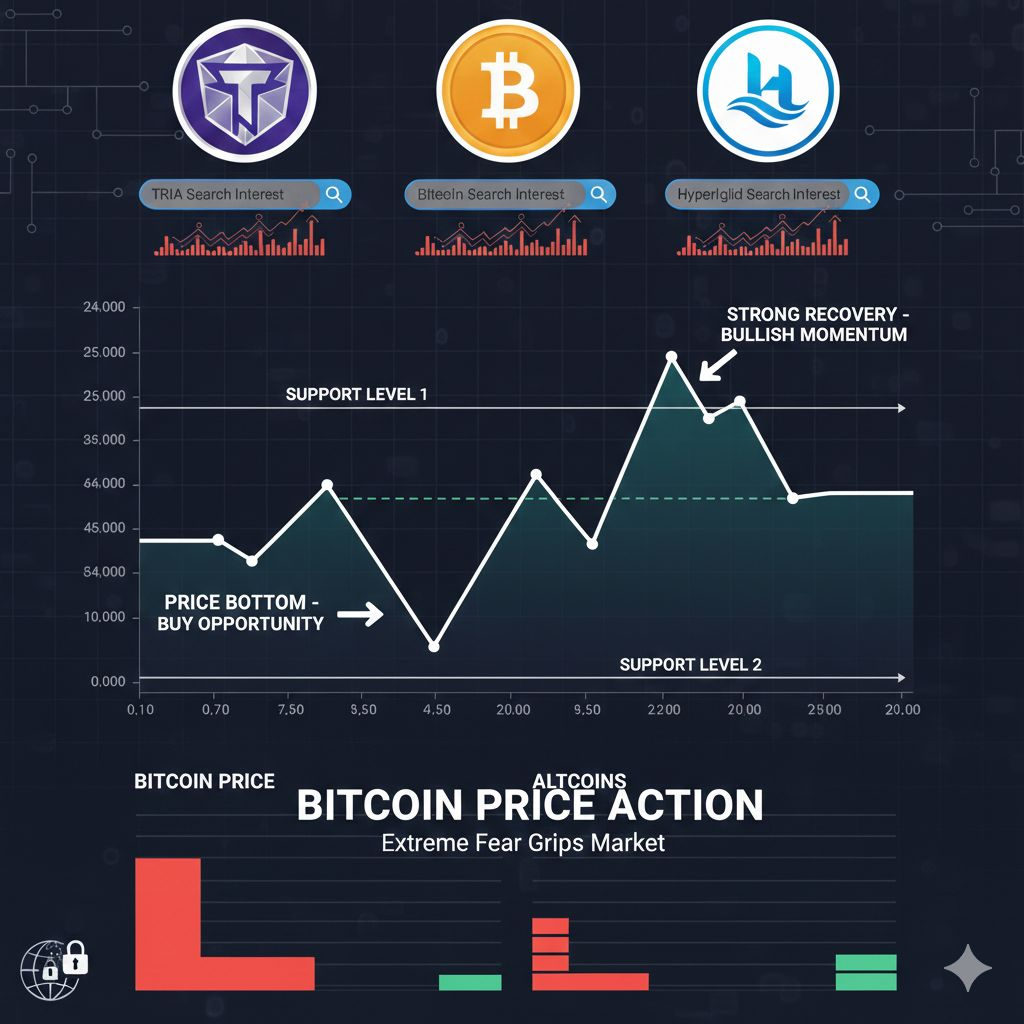

Bitcoin briefly fell to around $73,000–$75,000 before rebounding toward the mid-$70,000 range. While still lower than recent highs, this bounce shows demand stepping in at key levels as broader markets react to sentiment shifts.

Wider crypto markets — including Ethereum and XRP — also dipped amid risk-off sentiment tied to macroeconomic news.

📘 Why it matters

Bitcoin’s price action often reflects risk appetite in crypto markets. Dips followed by rebounds can signal that buyers are stepping in at historically important price points — a concept useful for beginners learning about support/resistance levels and market psychology without implying forecasts.

📌 Key takeaways

Bitcoin dipped sharply but bounced back in a volatile session.

Altcoins are moving with Bitcoin, highlighting market correlations.

Price swings reflect sentiment shifts, not long-term valuations

#BitcoinVolatility #Bitcoin $BTC #MarketTrends