Every cycle, Bitcoin tells the same uncomfortable story.

Not with indicators. Not with narratives. But with attention.

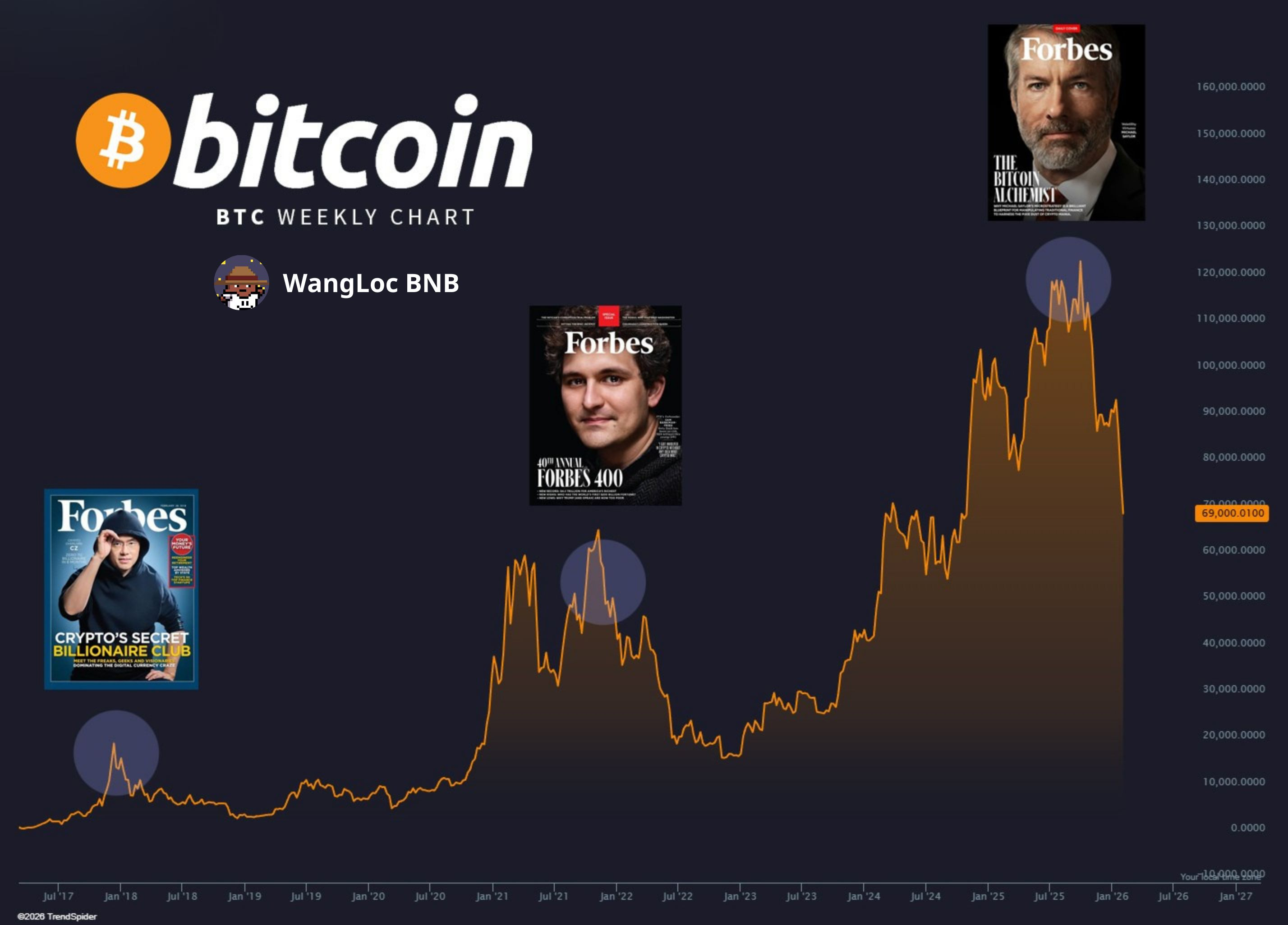

Look at the chart. Every major Bitcoin cycle top has one strange thing in common:

Mainstream validation arrives at the peak.

2017: “Crypto’s Secret Billionaire Club”

2021: Sam Bankman-Fried on Forbes

2024–2025: The Bitcoin Alchemist institutional praise, legacy media approval

Each time, the timing is almost cruel. Price is already extended. Smart money is already distributing.

And only then does Bitcoin become acceptable to the masses. That’s the curse.

The weekly chart makes it clear:

Vertical expansion into the cycle high

Media hype peaks after price momentum

Volatility compresses at the top

Then structure breaks

This isn’t coincidence. It’s reflexivity.

Markets don’t top when fear is high.

They top when belief is universal.

When Bitcoin no longer needs to convince you that’s when it’s most dangerous.

Forbes covers Bitcoin when:

Risk feels gone

Volatility feels “managed”

Institutions feel “safe”

But safety in markets is an illusion created after the opportunity has passed. By the time legacy media blesses the trend:

Early buyers are exiting

Late buyers are arriving

Liquidity is shifting hands

The curse isn’t bearish by default It’s a timing signal.

Not necessarily. The curse doesn’t mean the cycle is over forever. It means the easy phase is over.

After every cursed moment:

Bitcoin enters redistribution

Narratives fracture

Time, not price, does the damage

Only later when nobody cares again does the next real opportunity form.

Bitcoin doesn’t top on bad news. It tops on magazine covers.

And once again… The curse is still alive.

#BTC #bitcoin #MarketAnalysis $BTC