Bitcoin’s (BTC) 30% drawdown from all-time highs did little to deter large investors, who continued to increase their holdings throughout January.

Key takeaways:

Large holders are buying the dip, signaling long-term confidence.

Chartists warn that a bull trap could still drive BTC sharply lower.

Bitcoin sharks are buying the dips

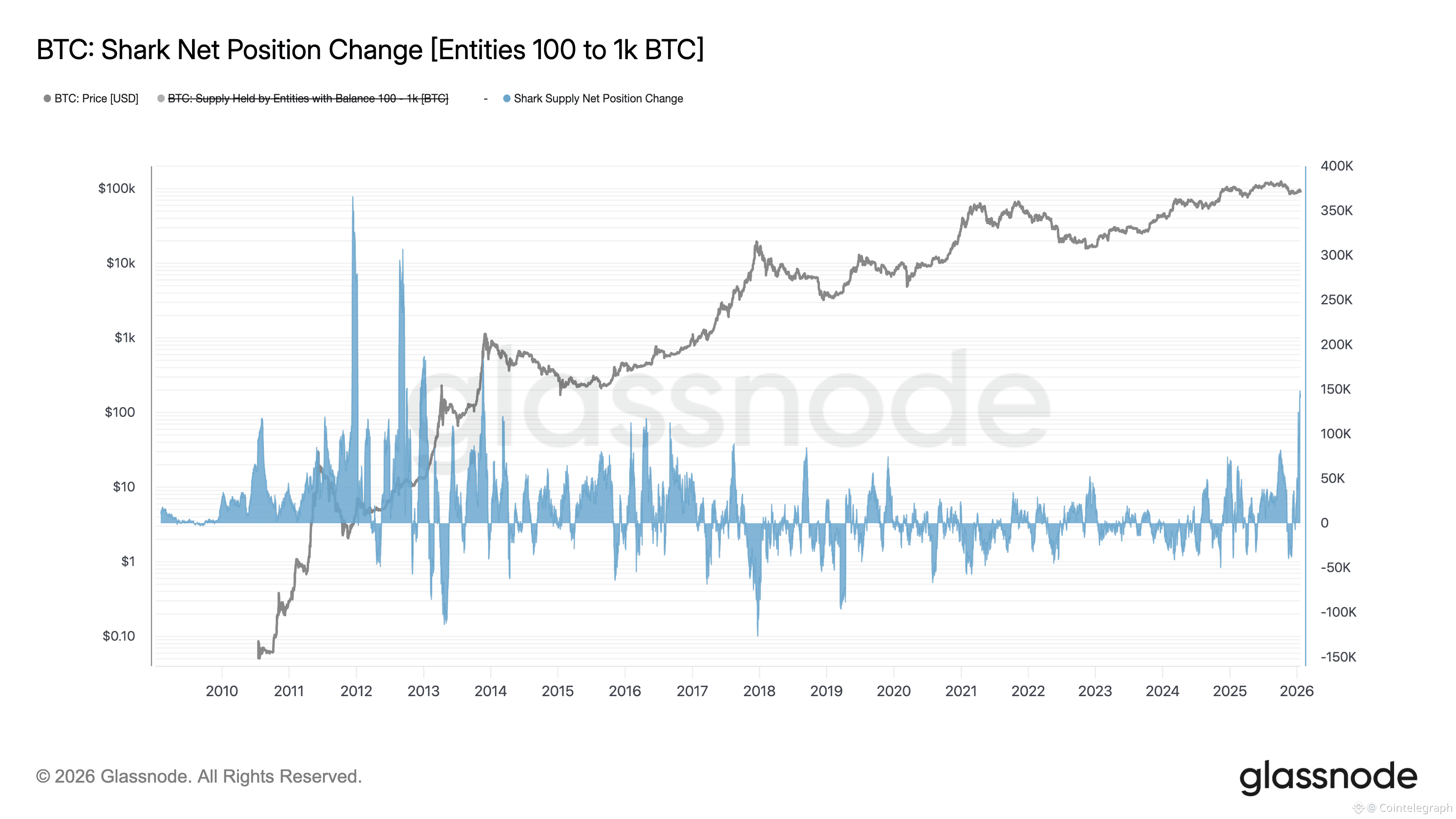

As of Wednesday, so-called “sharks,” which represent entities holding 100-1,000 BTC, were accumulating Bitcoin at their fastest pace since 2013, data from Glassnode showed.

BTC shark net position change (30-day average). Source: Glassnode

BTC shark net position change (30-day average). Source: Glassnode

These entities, which typically include early adopters and institutional trading desks, accumulated Bitcoin despite the latest correction to around $87,900 from nearly $98,000.

As a result, the accumulation suggested that large investors view the ongoing BTC pullback as a buying opportunity, signaling confidence in its longer-term bullish outlook.

Historically, similar spikes in shark accumulation preceded strong rallies, including a roughly 160% price gain within a year and the mid-2024 move that saw BTC climb from around $54,000 to over $116,000.

BTC will crash to $35,000 in February, analyst warns

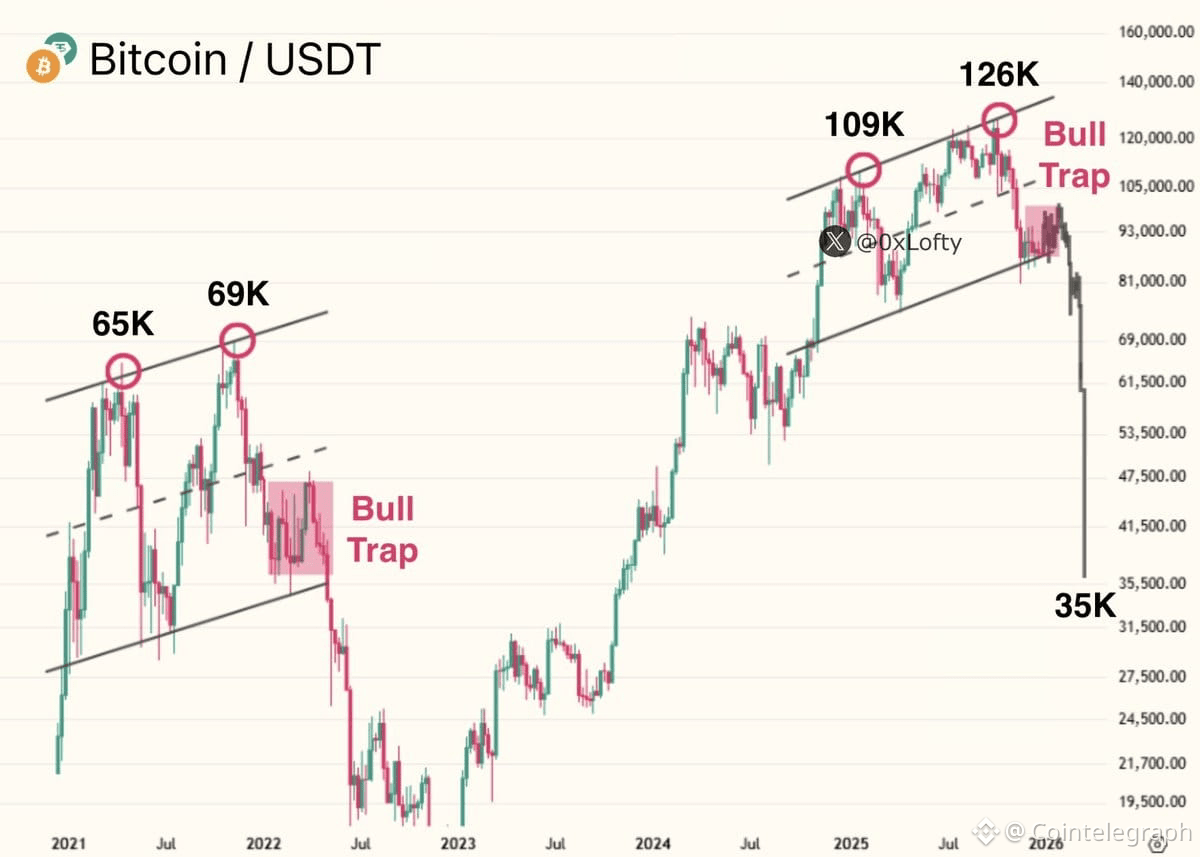

Chartists tracking Bitcoin’s four-year cycle warned that the multi-month slump will continue in the coming weeks.

For instance, analyst Lofty said BTC price can dump to $35,000 in February, citing a “perfect bull trap” after Bitcoin failed to hold above its rising channel’s upper boundary, as shown below.

BTC/USDT chart comparing 2021 and 2026 trends. Source: TradingView/Lofty

BTC/USDT chart comparing 2021 and 2026 trends. Source: TradingView/Lofty

He compared the structure to Bitcoin’s 2021 double top, where successive breakout attempts trapped late buyers before a sharp, multi-month sell-off followed.

However, several top crypto companies argued against such bearish scenarios, noting that Bitcoin’s four-year cycle is dead. That included Grayscale Investments, which expected BTC’s price to reach a new record high in the first half of 2026 due to institutional adoption.

Bitwise also predicted 2026 to be an “up year” for Bitcoin.