The most logical crypto to try to double $2 with expert discipline is a very volatile altcoin but with good liquidity like Solana (SOL), which today is moving with drops of around 1–1.5% daily and almost 16–26% in the last week/month, providing strong opportunities for aggressive trading. Still, trying to go from $2 to $4 in one go remains an extreme risk operation, with a real possibility of losing it all.

Why $SOL is a candidate

Solana is trading today around $136–138, with a drop of ~1–1.4% in 24h, almost -16% in the last week and -25% in the last month, showing high recent volatility and wide ranges of movement. This combination of volatility and liquidity means that small price movements (2–4%) occur frequently, which is key to leverage if risk is managed.

Aggressive signal in SOLUSDT (futures)

Signal model for Binance Futures with a professional but ultra-aggressive approach (adjust exact prices to what you see on your chart):

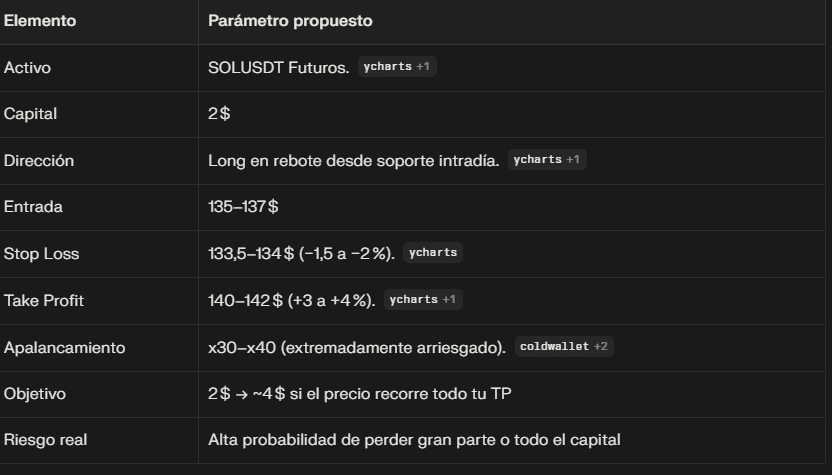

Active: SOLUSDT perpetual futures.

Capital: 2 $.

Target: +100 % (bring it to ~4 $) in a single speculative trade.

Idea: Take advantage of an intraday technical rebound in a recent support zone, using high leverage (x25–x50) and a very tight stop.

Operation structure (numerical example)

Assuming approximate current price of SOL: 136.5 $.

Type: Long (buy) on rebound.

Ideal entry zone: 135–137 $, when you see:

Bullish rejection candle on 5–15 min frames.

Increase in buying volume after a rapid drop.

Stop Loss: ~133.5–134 $ (drop of ~1.5–2 % below your entry).

Unique Take Profit (to aim for doubling): 140–142 $ (approximate rise of 3–4 % from the entry zone).

With leverage x30–x40, a favorable movement of +3–4 % in the price of SOL can approximate +100 % in your account, while a drop of -1.5–2 % can come very close to liquidation if the stop is not respected.

Table of the play in SOLUSDT

This signal is entirely speculative: it should only be used with money you can afford to lose 100 %, without chasing losses or increasing leverage after a stop. If you want, a more realistic plan can be made to go from 2 $ to 4 $ in several trades with targets of +15–25 % each, using less leverage and less risk per trade.