The key event this week is on Tuesday, December 16th 🗓️, when U.S. labor data is released 📊. Markets are already positioning for it, and what happens before the number matters more than the headline itself. 💡

Weak Data Expectations 😟

Expectations are moderate 📉:

🔹ADP payrolls were weak. 📉

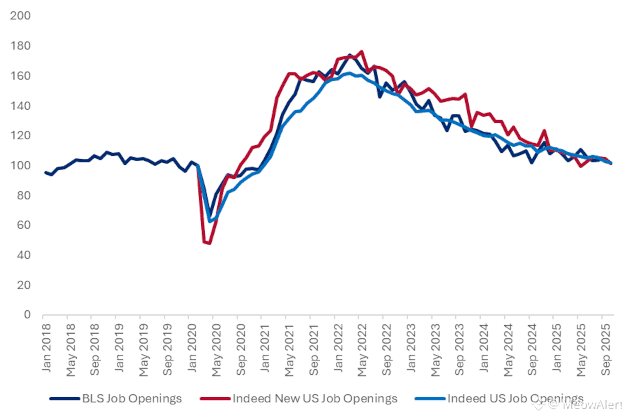

🔹Job offers are not improving. 😥

🔹Layoffs are slowly increasing. ⬆️

🔹Wage growth is expected to cool. 🥶

The Weekly Deleveraging Pattern 🔄

We have already seen how this setup plays out:

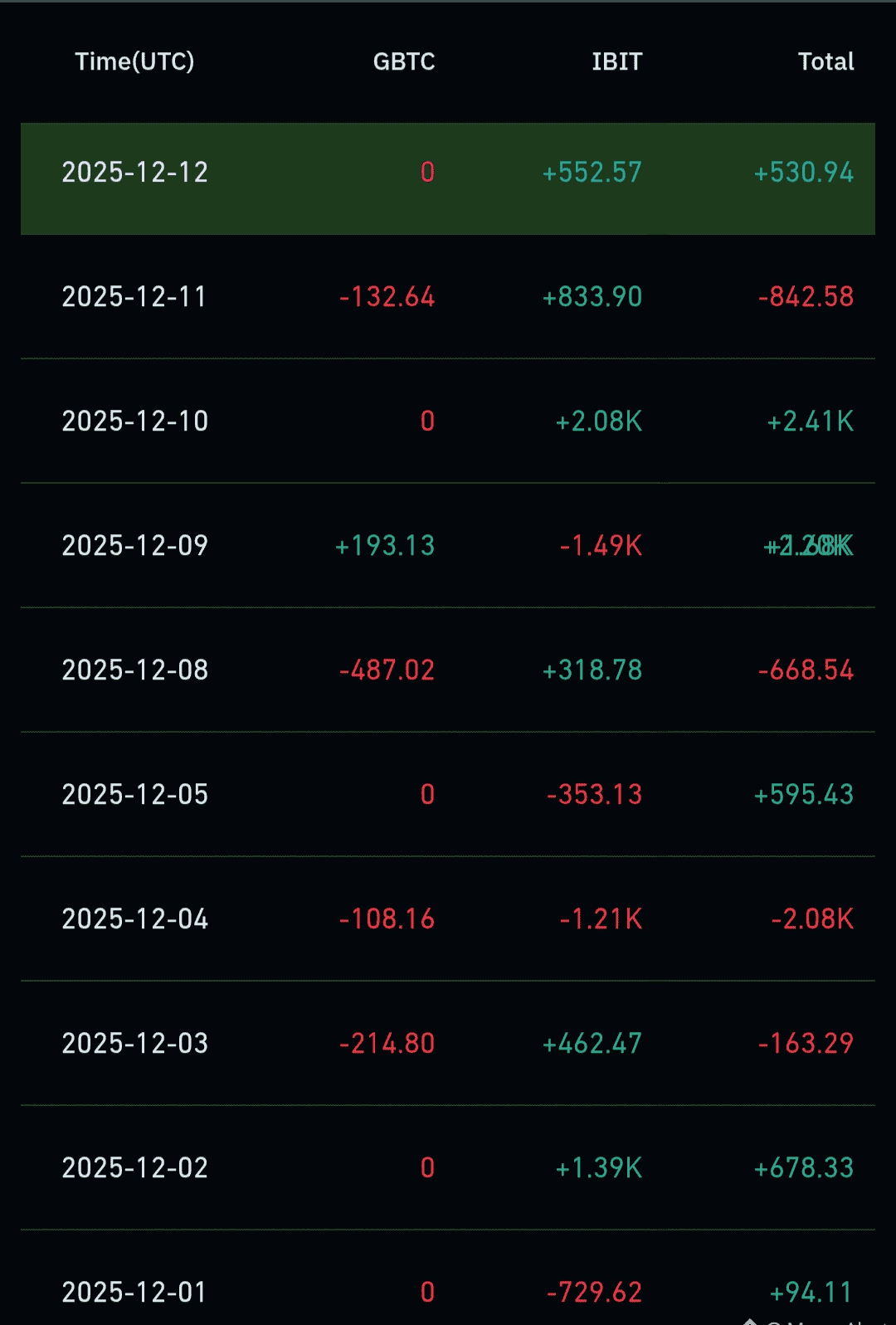

✅Thursday/Friday: ETF Outflow/Inflow. 🏦➡️📉

✅Monday: $BTC bleeds as leverage is rebuilt. 🩸

That tells me that the ETFs are not chasing strength. 🏃♂️❌ They buy after stress, not before uncertainty. 🛡️ When Friday's entries cause traders to return to leverage, Monday often becomes the cleanup day. 🧹

Derivatives and the Confirmation of the Drop ⬇️

The futures base remains negative. 🔴

Open interest has cooled, but remains elevated. 🥵

The long proportions are increasing again. 📈 (Inviting the drop!)

That generally invites a further drop or a slow bleed 🐌 before the event.

Conclusion for Monday and Tuesday 🎯

So a shakeout on Monday makes sense 💥, not because labor data is expected to be bad, but because liquidity needs to be cleared first. 💨

If Monday restarts leverage (shakeout) and Tuesday's labor data is soft or mixed 😌, $BTC may stabilize and move higher with ETF support. 🟢

If the data surprises to the upside 😲, the move extends, it is not a breakout. 🚧

This labor report is a liquidity check point 💧, not a verdict. ⚖️

Monday restarts the positioning. ⚙️ Tuesday helps decide the direction. 🧭

Follow #Alezito50x — I explain what happens next, before the market does. 🧠

$FOLKS $ZEC #CPIWatch #TrumpTariffs