@Falcon Finance #FalconFinance $FF

@Falcon Finance :In the fast-moving world of decentralized finance, bold questions often surface. One of them is whether FF Coin, the native token of Falcon Finance, could ever “break” the blockchain of Bitcoin.

The short answer: no—Bitcoin cannot be broken in that sense.

The more interesting answer lies in how Falcon Finance interacts with Bitcoin’s liquidity and what role FF Coin actually plays.

Understanding the Question: What Does “Break Bitcoin” Mean?

When people ask whether a DeFi protocol or token can break Bitcoin, they usually mean one of three things:

Overloading Bitcoin’s network

Undermining Bitcoin’s security or consensus

Replacing Bitcoin as the dominant store of value

Falcon Finance does none of these. Its design does not compete with Bitcoin’s base layer—it builds around it.

Bitcoin’s Blockchain: Built to Resist Disruption

Bitcoin’s blockchain is secured by:

Global proof-of-work mining

Tens of thousands of independent nodes

A conservative upgrade philosophy

This makes Bitcoin extremely resistant to attacks or manipulation from external protocols. No DeFi token, including FF Coin, has the ability to alter Bitcoin’s consensus rules or halt its network.

Bitcoin does one thing exceptionally well: secure, censorship-resistant value transfer.

What Falcon Finance Actually Does

Falcon Finance operates in a different layer of the crypto stack.

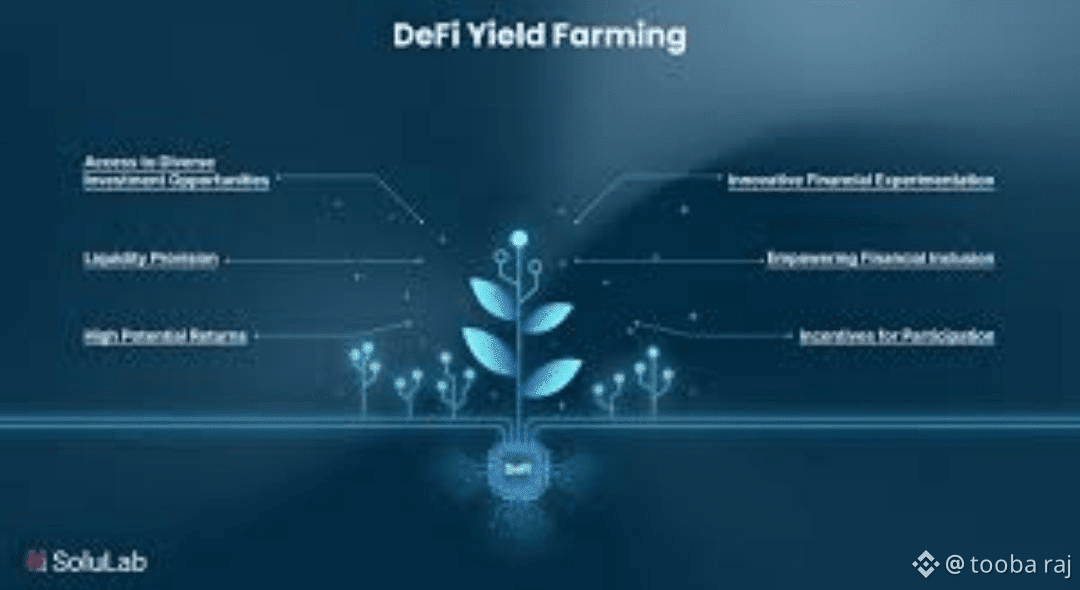

Instead of changing Bitcoin, it focuses on:

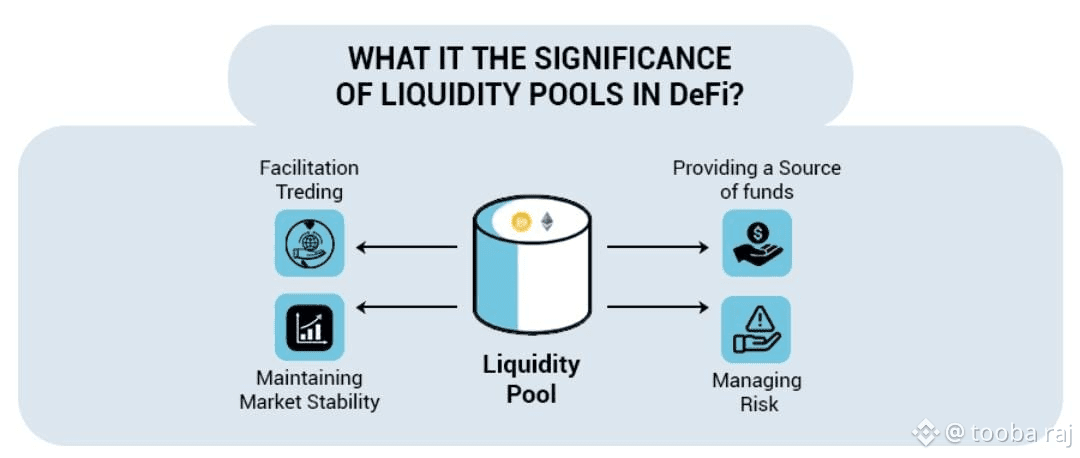

Unlocking liquidity from crypto assets

Creating capital efficiency through collateralized mechanisms

Enabling yield and utility without forcing asset sales

FF Coin is not an attack vector—it’s a coordination and incentive asset within Falcon Finance’s ecosystem.

FF Coin’s Role in the Ecosystem

FF Coin is designed to support:

Governance participation

Protocol incentives

Liquidity alignment

Risk management mechanisms

Importantly, FF Coin does not run on Bitcoin’s blockchain, nor does it execute transactions on Bitcoin’s base layer. Any Bitcoin exposure occurs through wrapped or tokenized representations on smart-contract networks.

Does Falcon Finance Compete With Bitcoin?

No—it complements it.

Bitcoin is often criticized for being “idle capital.” Falcon Finance addresses that by enabling:

Liquidity without selling BTC

Yield strategies tied to BTC value

On-chain financial primitives using Bitcoin as collateral

This strengthens Bitcoin’s role as productive collateral rather than weakening it.

Could DeFi Stress Bitcoin Indirectly?

Even indirectly, the impact is minimal:

Falcon Finance does not increase Bitcoin block congestion

It does not modify Bitcoin’s monetary policy

It does not introduce systemic risk to Bitcoin’s consensus

Any activity happens off Bitcoin’s base layer, preserving Bitcoin’s simplicity and security.

The Real Shift: From Breaking to Extending

The more accurate question isn’t whether FF Coin can break Bitcoin—it’s whether protocols like Falcon Finance can extend Bitcoin’s usefulness without compromising its principles.

So far, the answer is yes.

Bitcoin remains the foundation.

Falcon Finance builds financial structure around it.

Final Verdict

FF Coin and Falcon Finance cannot break Bitcoin’s blockchain.

What they can do is reshape how Bitcoin is used in decentralized finance, turning static value into flexible, on-chain capital.

Bitcoin stays immutable.

DeFi evolves around it.

That’s not disruption—it’s evolution.