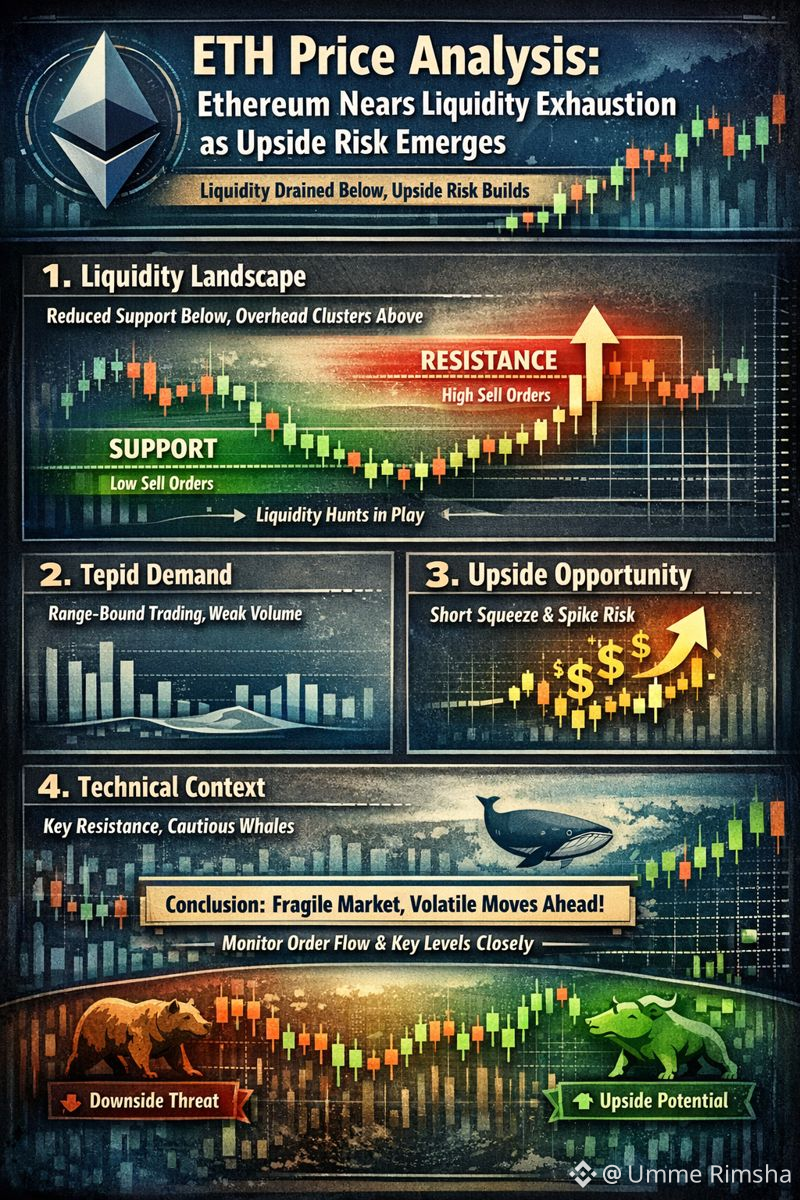

$ETH Ethereum’s price action in mid-December 2025 reveals a market at a crossroads — one where liquidity dynamics and trader behavior may increasingly dictate price moves. Recent order book data suggests that much of the immediate downside liquidity — the cluster of sell orders beneath the market — has already been absorbed. This potential liquidity exhaustion risks leaving the price perched closer to overhead supply than support, setting the stage for sharp reactions on either side. The Tradable

1. Liquidity Landscape: Dynamics Shift

Liquidity is the hidden scaffolding of price structure. When sell orders cluster below a price, they can act as a magnet for downward moves — fueling stops and cascading liquidations. Conversely, when these orders are digested, the probability of deeper sell-offs diminishes.

According to recent analysis:

Most sell orders just below current levels have been traded through, reducing immediate downside drag.

With fewer bids left below, ETH is now closer to remaining clusters of higher orders, implying that the next significant move may be upward if the price taps those overhead liquidity pools. The Tradable

This setup often fosters “liquidity hunts” — short bursts where market makers or leveraged traders push price into areas with concentrated resting orders, triggering stops or fills and then reversing quickly.

2. Tepid Demand and Range Bound Trading

Despite the diminished downside liquidity, the market is not yet showing robust directional conviction.

Analysts note:

Buying interest remains thin, with small, choppy moves inside a tight range.

Price seems to drift in reaction to where orders sit rather than reflecting strong buying or selling momentum. The Tradable

This reflects a broader theme seen across ETH markets lately — a compression phase where volatility contracts, traders stay cautious, and volume remains subdued while positions wait for catalysts. reddit.com

3. Upside Opportunity: Proximity to Overhead Liquidity

With the downside largely cleared, upside risk emerges because remaining sell orders above the market represent a natural target for price action.

This dynamic can translate into:

Short squeezes — quick rallies as stops stack above and short sellers cover.

Spike moves — sudden bursts that occur without strong trend conviction, triggered more by order flow than sentiment.

However, this is not a guaranteed breakout scenario. Without renewed institutional demand or spot accumulation, the price can continue oscillating until fresh catalysts arrive.

4. Broader Technical Context

Ethereum’s price context remains nuanced:

Wider price swings and critical resistance zones (e.g., near multi-year peaks) continue to influence trader psychology and technical setups. ACY Securities

On-chain and derivative metrics suggest cautious positioning among whales, with reduced leverage appetite potentially slowing large upward moves. coinglassThese factors help explain why even reduced downside liquidity doesn’t necessarily produce a strong breakout yet — the market is guarded and pricing in risk.

5. What Traders Should Watch Next

To gauge where ETH goes from here, focus on:

Key Levels

Overhead order clusters: Breaks above these could accelerate upside moves.

Residual support below: A renewed sweep of orders below could signal a deeper breakdown.

Volume and Demand Signals

Sustained spot buying or institutional inflows would support higher prices.

Persistent low volume increases the risk of whipsaws.

Volatility Expansion

Given tightened liquidity zones, a breakout in either direction could involve a sharp, rapid move rather than a smooth trend.

Conclusion: A Fragile but Opportunistic Market

Ethereum’s current setup — near exhaustion of downside liquidity but lacking strong buying conviction — creates a paradoxical landscape. Risk of sudden price swings remains elevated, and the next meaningful move could be rapid once liquidity is tapped. Traders should remain vigilant, monitor order flow dynamics closely, and respect the tight risk-reward margins defining the current market.#BinanceBlockchainWeek