@Falcon Finance $FF #FalconFinance

DeFi was supposed to simplify finance.

Instead, for many users, it became a maze of vaults, incentives, rebalancing rules, and silent risks that only reveal themselves when something breaks.

Falcon Finance is interesting precisely because it does not try to win this complexity game. Its design feels aimed at people who no longer want to manage DeFi, but simply want systems that behave predictably under pressure.

To understand Falcon Finance properly, it helps to separate what it does from what it refuses to do.

DeFi Became Complex Because Risk Was Pushed to Users

Most DeFi protocols offer freedom, but with that freedom comes responsibility:

Choosing strategies

Monitoring positions

Managing exits

Reacting to market stress

Over time, complexity didn’t disappear — it was outsourced to the user.

Falcon Finance approaches this from the opposite direction. Instead of asking users to actively manage risk, it tries to structure risk at the protocol level, so that fewer decisions need to be made under stress.

This is not about maximizing yield.

It’s about minimizing decision fatigue and error.

Falcon’s Core Idea: Reduce Cognitive Load

Falcon Finance is built around a simple but rare principle in DeFi:

If users need to constantly think about what to do, the system is already fragile.

Rather than stacking features, Falcon focuses on:

Clear capital flows

Controlled interactions

Predictable behavior during low-volatility and high-volatility periods

This is why Falcon often feels “quiet.” It doesn’t chase attention because attention usually arrives with complexity.

Why This Matters Most in Sideways Markets

Sideways markets are where DeFi complexity becomes unbearable.

There is no strong trend to cover mistakes.

Rewards shrink.

Volatility appears in short bursts.

In these conditions:

Over-engineered strategies underperform

Incentive-heavy protocols lose users

Systems relying on constant activity start breaking

Falcon Finance is designed to remain functional even when nothing exciting is happening. That’s not a marketing choice — it’s an architectural one.

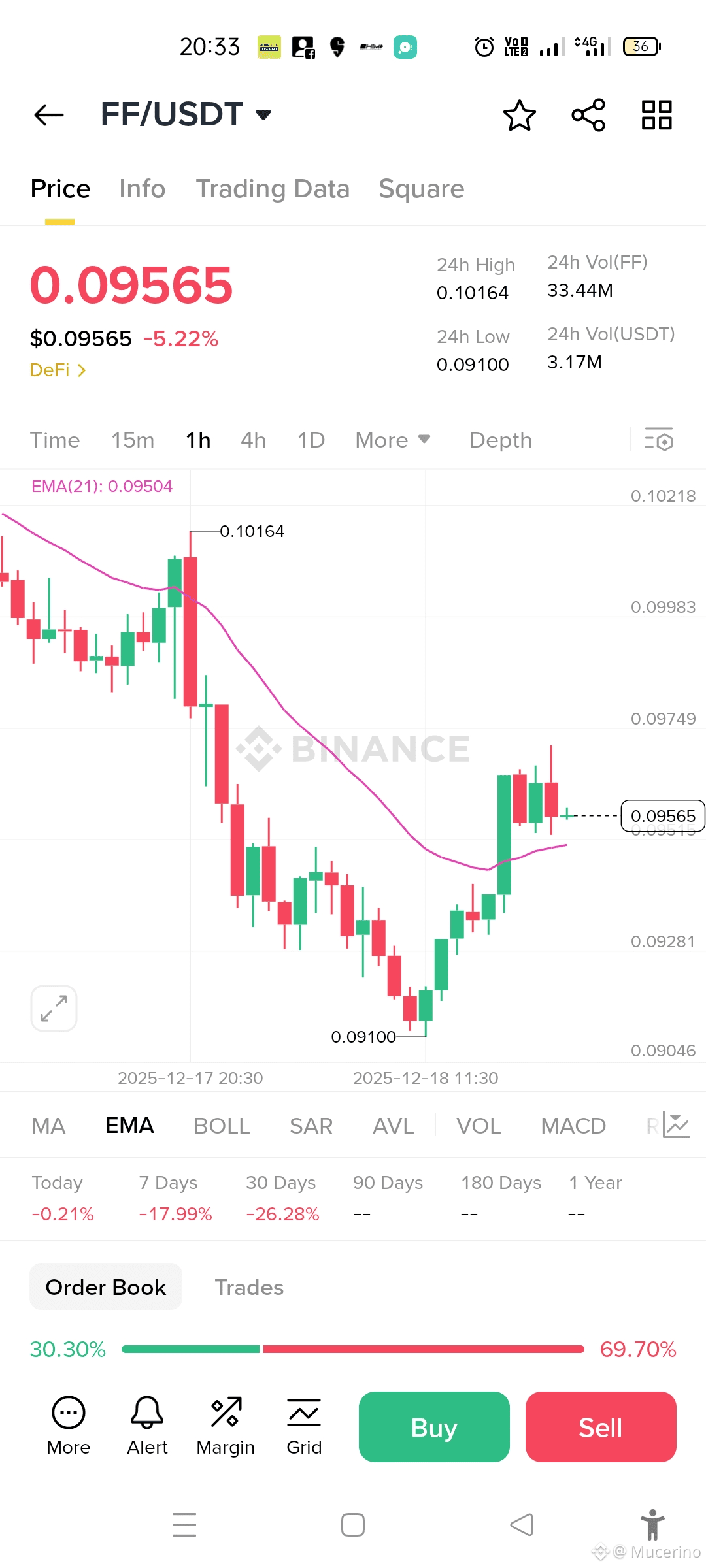

Reading the FF/USDT Chart Through This Lens

Let’s now look at the chart you shared, not as a trading signal, but as a reflection of market behavior.

1️⃣ Structure, Not Noise

On the 1H chart, FF shows:

A clear move down from ~0.1016 to ~0.0910

Followed by a measured recovery toward ~0.095–0.096

This is not impulsive price action. It’s controlled, range-bound behavior, which aligns with a market that is cautious rather than euphoric.

2️⃣ EMA(21) as a Decision Zone

Price is currently hovering very close to the EMA(21) (~0.0950).

This tells us two things:

Buyers are willing to defend higher lows

Sellers are still present near resistance

In complex DeFi narratives, price often violently rejects or overshoots averages. Here, price is respecting structure, which suggests balanced participation rather than speculation.

3️⃣ Higher Low After the Bottom

The bounce from 0.0910 created a higher low and a short-term higher high near 0.097–0.098, before consolidating.

This is typical of:

Accumulation phases

Market participants positioning cautiously

No aggressive distribution or panic

Again, this mirrors Falcon’s positioning: slow, controlled, non-reactive.

4️⃣ Volume and Sentiment

Order book data shows:

Buy pressure around 30%

Sell pressure around 70%

This imbalance explains why price struggles to break higher. But importantly, price is not collapsing. That usually means sellers are active, but not confident.

This kind of environment favors protocols that do not rely on hype cycles to function.

Why This Chart Matches Falcon’s Philosophy

The FF chart does not look exciting — and that’s the point.

It reflects:

A market pricing uncertainty

Reduced speculative behavior

Gradual positioning instead of emotional moves

For a protocol built to reduce DeFi complexity, this kind of price behavior is not a failure. It’s a natural consequence of not optimizing for attention.

Falcon Finance makes sense for people who are tired of:

Constant strategy switching

Monitoring dashboards every hour

Wondering what hidden risk they missed

Its value is not in outperforming the market every week.

Its value is in not demanding constant mental energy from users.

The chart reflects this reality:

No hype spikes

No collapse

Just controlled movement in a difficult market

For many DeFi users today, that kind of predictability is not boring — it’s relief.

And that is exactly who Falcon Finance seems to be built for.