Technical Breakdown - BNB Tests Key Support at $850

📉 BNB/USDT Price Alert: Breach Below $850

BNB has declined below the critical $850 support level, now trading around $848.50 (Binance spot). The move signals weakening near-term sentiment and requires close attention to key technical levels ahead.

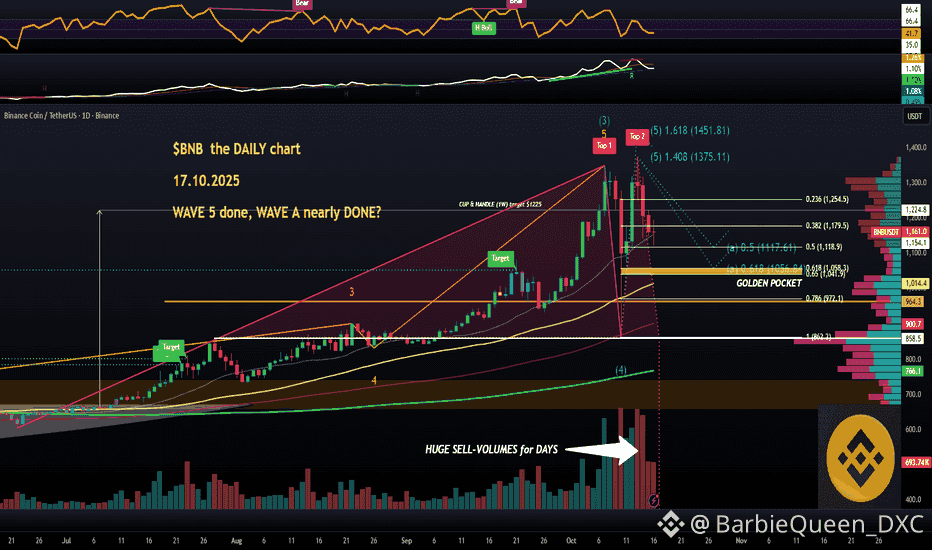

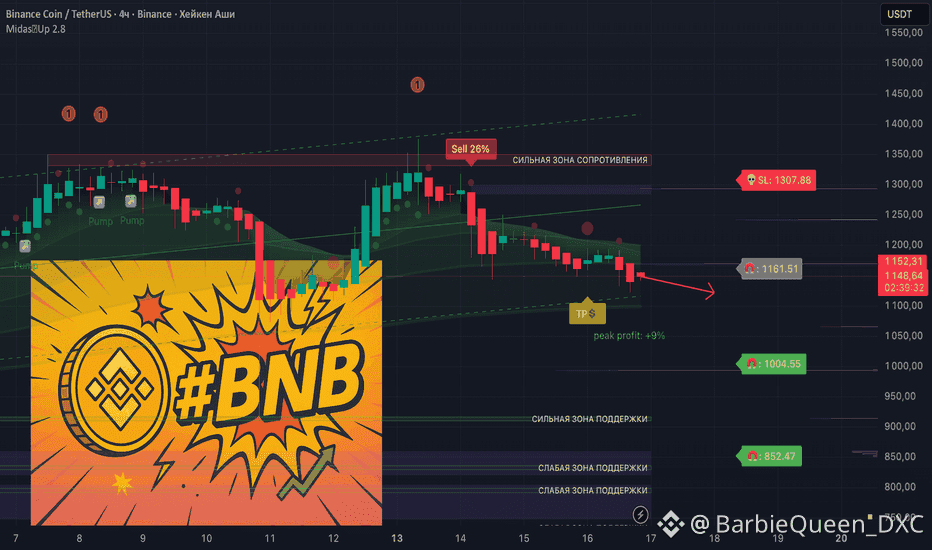

📊 Key Technical Observations:

1. Support Breakdown: The $850 zone (previous resistance-turned-support) has failed to hold on the 4H chart. This opens the path toward the next significant support near $820 - $825 (200-day EMA & previous swing low).

2. Momentum Indicators:

· RSI (4H): Currently at 38, showing bearish momentum but not yet oversold. Watch for potential divergence on approach to $820.

· MACD: Remains below the zero line with bearish histogram expansion, confirming selling pressure.

3. Volume: Moderate sell-side volume accompanied the break, suggesting genuine conviction behind the move.

4. Immediate Resistance: The former support at $850** now becomes the first hurdle. A reclaim above this level is needed to invalidate the breakdown. Further resistance sits at **$870 (4H 50-period MA).

🔍 Critical Levels to Watch:

· Immediate Support: $820 - $825

· Secondary Support: $800 (psychological & long-term trend level)

· Immediate Resistance: $850 - $855

· Key Resistance: $870 - $875

📈 Potential Scenarios:

· Bearish Continuation (60%): Failure to recover $850 swiftly could lead to a test of $820-825. A break below this could target $800.

· Bullish Reversal (40%): A strong, high-volume reclaim above $865 could signal a false breakdown and a retest of the $880 zone.

🎯 Strategic Implications:

· For Traders: The break of $850 suggests caution. Wait for either a confirmed reversal signal (bullish engulfing at $820, RSI divergence) or a successful reclaim of $855 before considering long entries. Shorts may target $825, with a stop above $865.

· For Investors: This is a test of BNB’s higher-timeframe market structure. The $800 - $820 region is a major accumulation zone from Q1 2024. Monitor for buyer response in this area for potential DCA opportunities.

⚠️ Important Context:

· Market Correlation: BNB is moving in sync with broader crypto market weakness (BTC below $65K).

· BNB Chain Fundamentals: Despite price action, network activity and quarterly burn mechanism remain core strengths. This dip is primarily technical/macro-driven.

Bottom Line: BNB is in a technical correction phase after failing to hold $850. The $820-825 support cluster is the next major battleground. Trade the confirmed break, not the anticipation.

Disclaimer:

This is technical analysis, not financial advice. Always conduct your own research (DYOR) and manage risk appropriately. The market can remain volatile longer than expected.

#bearishmomentum #CryptoAnalysis #tradingview #SupportBreak #BNBUSDT $BNB