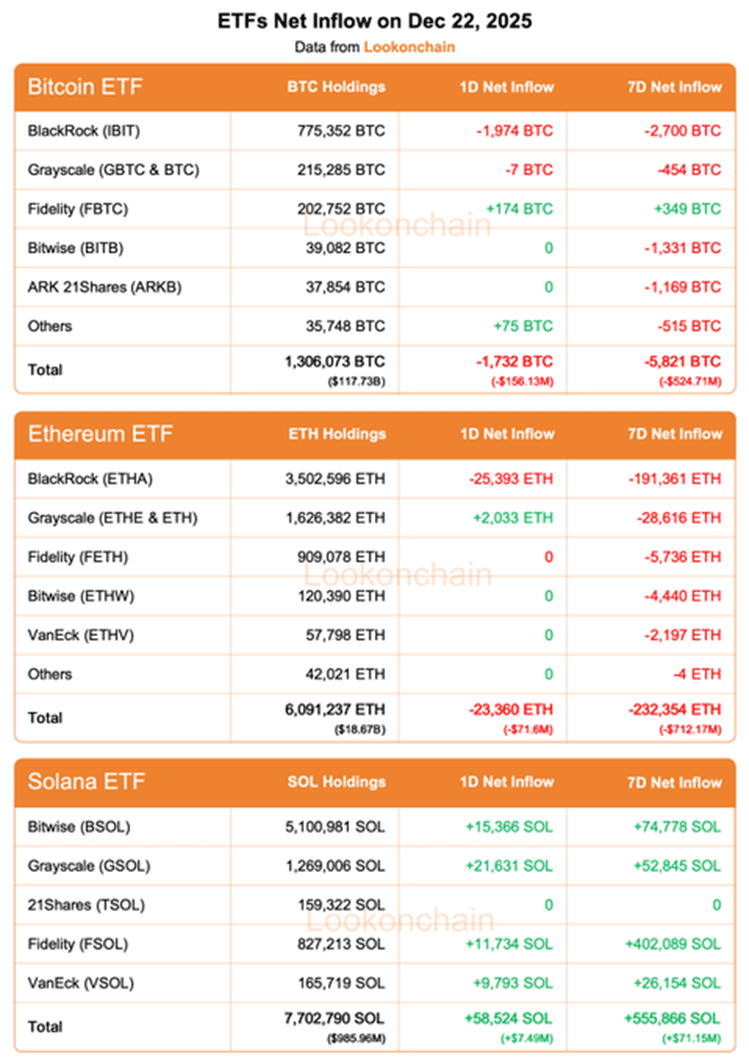

1) ETF flows: BTC/ETH — outflow, SOL — inflow

1. Briefly (essence):

— BTC ETF: −1,732 BTC per day (≈ −$156.13M), −5,821 BTC for 7d (≈ −$524.71M).

— ETH ETF: −23,360 ETH per day (≈ −$71.6M), −232,354 ETH for 7d (≈ −$712.17M).

— SOL ETF: +58,524 SOL per day (≈ +$7.49M), +555,866 SOL for 7d (≈ +$71.15M).

2. What does this mean for the market (honestly):

— BTC: pressure/profit taking through the ETF channel. This is not the “end of the market,” but it is a negative for demand.

— ETH: the situation is tougher — weekly outflow is large, institutional impulse is weak.

— Altcoins/liquidity: in fact, a rotation is visible: money is not 'in crypto', but between segments.

— Risk appetite: selective. Not 'risk-on', but 'choosing where there will be movement'.

3. Real effect: moderately strong (especially for ETH over 7d).

— Short-term: increases the chance of sawtooth/liquidity gathering.

— Medium-term: does not yet provide clear bullish confirmation for BTC/ETH.

4. News risks:

— If outflows continue: the market will more often 'liquidate' on stops on news/movements.

— Local bounces are possible, but without sustainable support through ETFs, they can be easily broken.

5. Result (1 phrase):

Outflows for BTC/ETH strengthen the defensive phase, while inflows for SOL look like rotation, not general capital inflow.

Detail (by structure):

BTC ETF: IBIT −1,974 BTC/day, total −1,732 BTC/day.

ETH ETF: ETHA −25,393 ETH/day, total −23,360 ETH/day.

SOL ETF total +58,524 SOL/day.

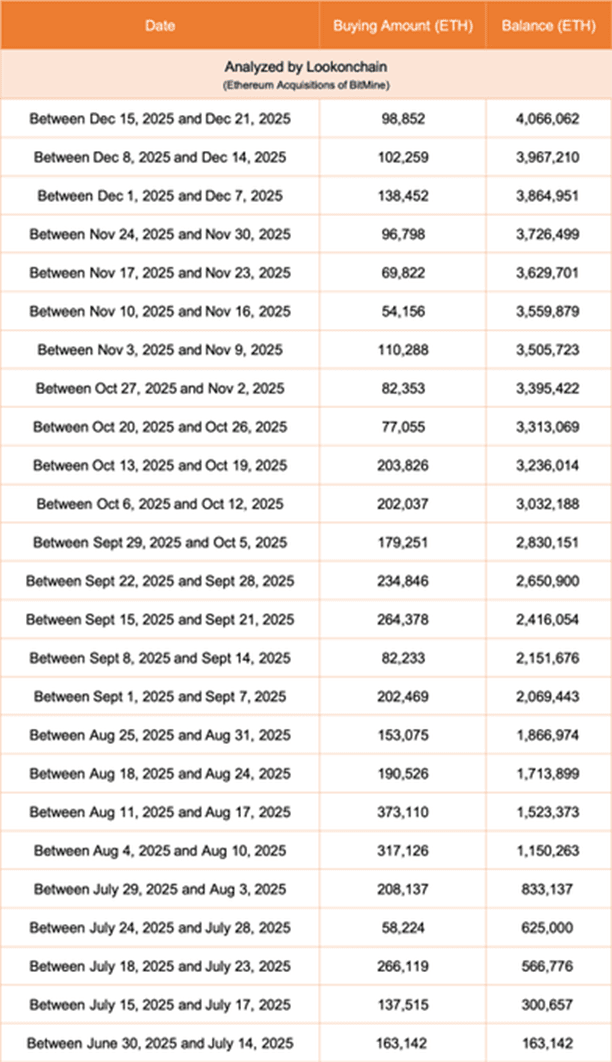

2) BMNR (Bitmine) bought more ETH: +98,852 ETH in a week.

1. Briefly:

During the period Dec 15–Dec 21, 98,852 ETH was bought, balance 4,066,062 ETH.

2. What does this mean:

— ETH: this is not a 'pump signal', this is a fact of accumulation by a large player.

— Market: a corporation's purchase ≠ automatic price growth. The price lives on liquidity/flows, not press releases.

3. Real effect: moderate.

— Short-term: more of an informational reason than a driver.

— Medium-term: supports the narrative of 'corporate ETH accumulation', but does not negate outflows from ETFs.

4. Risks:

— If the market is weak, such accumulations can 'sit in the red' for a long time.

— In case of volatility, a large holder will not save the price from a drop.

5. Result:

BMNR's purchase supports the long-term thesis on ETH but does not change the current weakness of demand through ETFs.

3) AAVE: the whale returned and bought more.

1. Briefly:

The wallet after a pause bought AAVE for 500 ETH (~$1.53M), totaling about 39,213 AAVE.

2. What does this mean:

— AAVE: this is a bet on the DeFi core, but this is mid-cap volatility, not a 'quiet asset'.

— Altcoins: such purchases often go against the crowd, but the market can still 'torture' for a long time.

3. Real effect: weak-moderate (locally for AAVE).

4. Risks:

— Even 'smart money' sits in drawdowns. This is normal.

— For trading: AAVE easily makes sharp moves in both directions.

5. Result:

Accumulation of AAVE is a local bullish marker, but does not influence the market as a whole.

4) FARTCOIN: a new wallet bought a meme coin for $1M.

1. Briefly:

A new wallet withdrew $1M from Binance and bought ~3.22M tokens on DEX (via SOL).

2. What does this mean:

— This is degenerate demand. It usually appears when the market is sluggish and people seek 'quick gains'.

— For the overall market (BTC/ETH) — almost no benefit.

3. Real effect: zero for the market / strong only within the meme segment.

4. Risks:

— Maximum: pump/dump, liquidity is thin, 'will liquidate without warning'.

— For trading: only if you understand the mechanics of memes and are prepared for loss.

5. Result:

This is an indicator of speculative greed in memes, not a signal of market strength.

5) BlackRock transfers to Coinbase Prime.

1. Briefly:

2,019 BTC (~$181.7M) and 29,928 ETH (~$91.3M) were transferred to Coinbase Prime.

2. What does this mean:

— Most often this is operational/liquidity/rebalancing, not 'they will sell now'.

— But for the market, this is a fear trigger, so the crowd's reaction can be sharp.

3. Real effect: moderate (not based on sales, but on psychology).

4. Risks:

— Such transfers are often used for quick 'liquidations/shakeouts' — the market collects liquidity on panic.

5. Result:

Transfers amplify the noise, but do not prove sales by themselves.

6) LINK: 11 new wallets withdrew 1.567M LINK (~$19.8M) from Binance.

1. Briefly:

In 3 days, 1,567,000 LINK (≈ $19.8M) was withdrawn.

2. What does this mean:

— Decrease in supply on the exchange = potentially bullish factor for LINK.

— But growth will only happen if demand appears, otherwise it's just 'stored for safekeeping'.

3. Real effect: moderate (locally for LINK).

4. Risks:

— In a weak market, even good on-chain signals may not work out quickly.

— Possible 'pump on expectations' → sharp pullback.

5. Result:

Withdrawal of LINK — a plus to the structure for the coin, but not a guarantee of movement today.

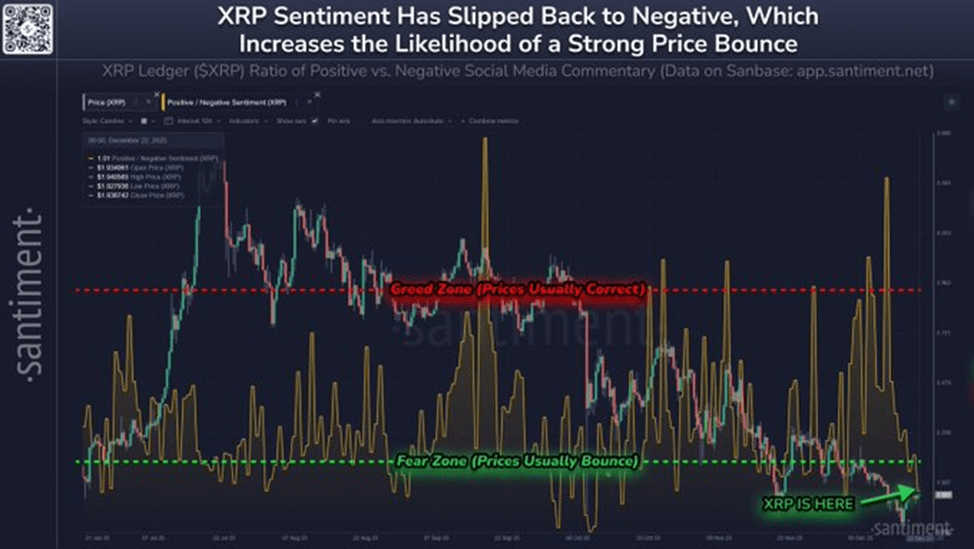

7) XRP: sentiment is negative again.

1. Briefly:

Santiment shows the metric leaving the 'fear zone', where historically there are often bounces.

2. What does this mean:

— This is a signal not to 'buy', but that 'the crowd is afraid again'.

— A bounce is possible, but the trend does not automatically reverse.

3. Real effect: weak-moderate.

4. Risks:

— Negativity can persist for a long time, while the price may 'chop at the bottom' in waves.

5. Result:

Negative sentiment increases the chance of a local bounce, but does not change the overall structure without confirmation by money.

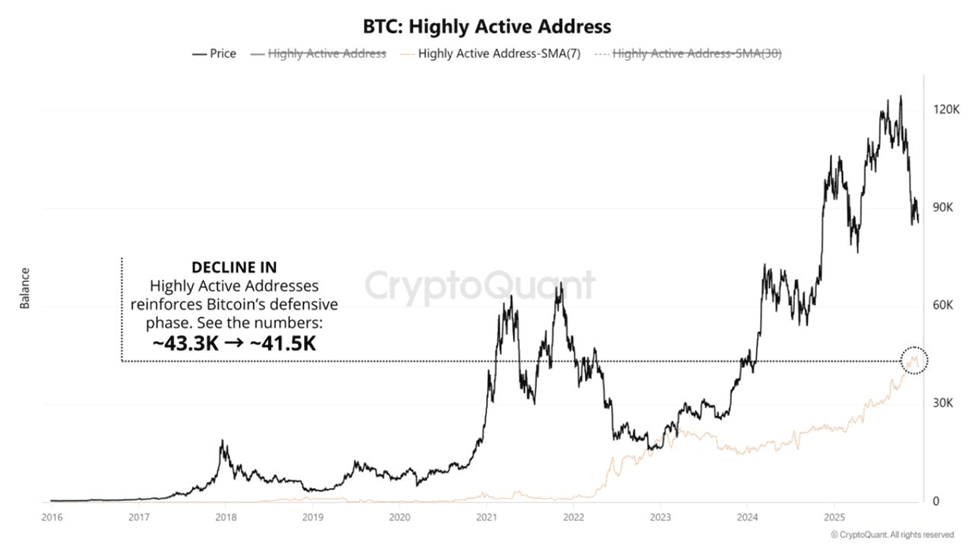

8) BTC network: decrease in Highly Active Addresses.

1. Briefly:

The indicator fell: ~43.3K → ~41.5K (CryptoQuant).

2. What does this mean:

— Activity is decreasing → the market is in a defensive phase (less aggression, more anticipation).

— This often happens before a future surge in volatility, but the timing does not provide.

3. Real effect: moderate (as confirmation of the phase).

4. Risks:

— In such a phase, the market loves sawtooths and 'false reversals'.

5. Result:

The metric confirms: BTC is currently more about caution than acceleration.

9) Saylor / StrategyTracker: 'Green dots → Orange dots'

1. Briefly:

On the tracker, it shows: about 671,268 BTC, total purchase value $59.04B, average about $84,972 (according to the screenshot).

2. What does this mean:

— This supports the narrative of 'corporate accumulation of BTC'.

— But the market is not obliged to grow every time Saylor posts.

3. Real effect: weak (more media/mood).

4. Risks:

— The crowd begins to 'believe in a savior' → jumps in without a plan → they get liquidated.

5. Result:

Information noise + confirmation of long-term buyers, without a direct signal for growth today.

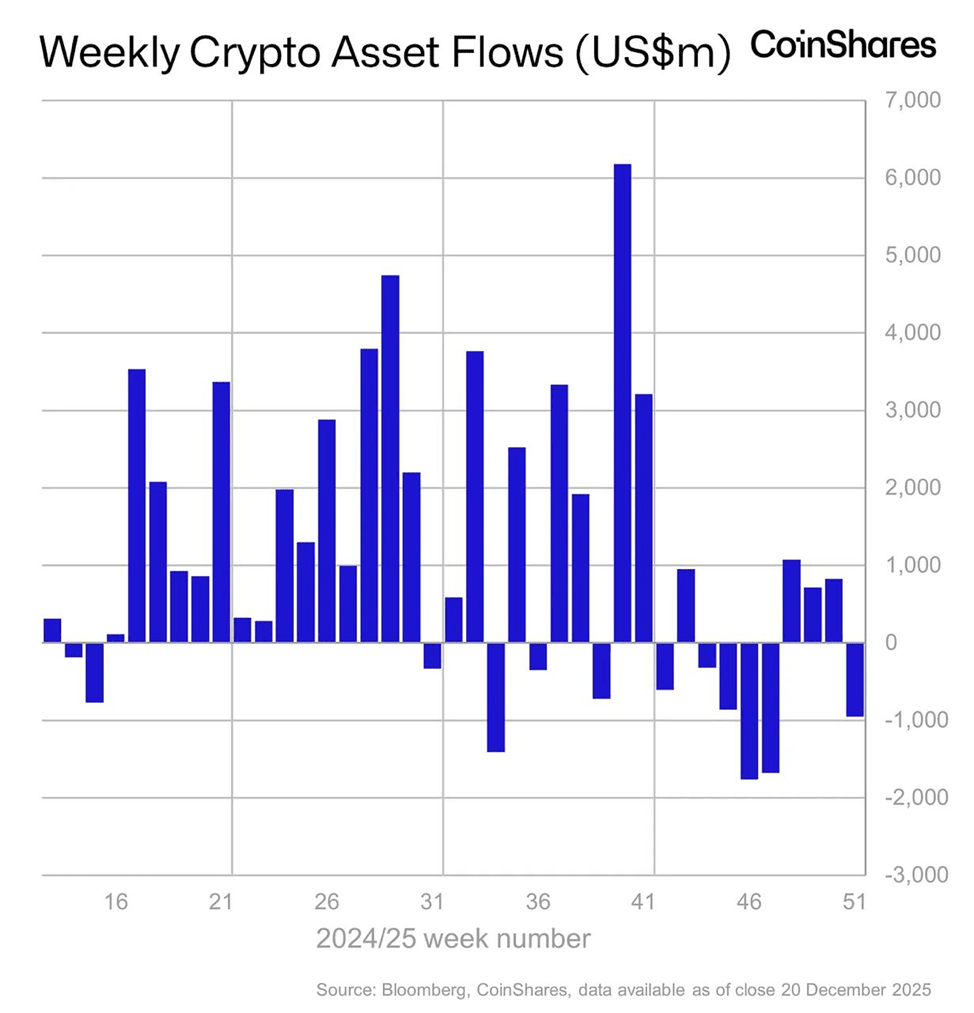

10) CoinShares: weekly outflow from crypto products −$952M.

1. Briefly:

A weekly outflow of $952M was recorded (the first outflow in 4 weeks — according to your text).

2. What does this mean:

— External capital has become more cautious.

— This coincides with the picture of ETF outflows for BTC/ETH: capital does not accelerate the market.

3. Real effect: strong (as macro confirmation of demand loss).

4. Risks:

— Until the flows return, the market will live off liquidity and stop hunting.

5. Result:

Flows have worsened — this is a minus for sustainable growth.

11) JPMorgan is exploring crypto trading for institutions.

1. Briefly:

The bank is exploring the possibility of providing cryptocurrency trading to institutions.

2. What does this mean:

— Long-term: legitimization/infrastructure.

— Short-term: most often does not move the price right now.

3. Real effect: weak (on the price today).

4. Risks:

— The crowd can 'buy the headline', and the market uses this to gather liquidity.

5. Result:

The news is good for the structure of the industry but is not a driver of today's movement.

6) Summary of all the news of the day (overall picture)

Today's vector is simple: the market is in a defensive phase, capital is not widely entering.

Facts confirm this:

— BTC/ETH ETF is in the red (day and especially week).

— SOL ETF is in the green → rotation, not 'risk-on'.

— Decrease in activity in the BTC network → caution, less aggression.

— The meme segment lives separately (degenerate liquidity), has almost no relation to the 'health of the market'.

What is important for the trader today:

— Do not 'guess the reversal', but look: has a real inflow appeared (flows/volumes/reaction to levels).

— In such an environment, the market more often makes shakeouts in both directions. Plan/stop/levels are mandatory.

👉 Structural trading scenario for the market — #strategy #CryptoTrading #Altcoins #CryptoNews

⚡ Strategies: LONG / SHORT, SPOT — how the market moves and where to enter—@INVESTIDEAUA