The truth is not in the chart... but in the liquidity flows

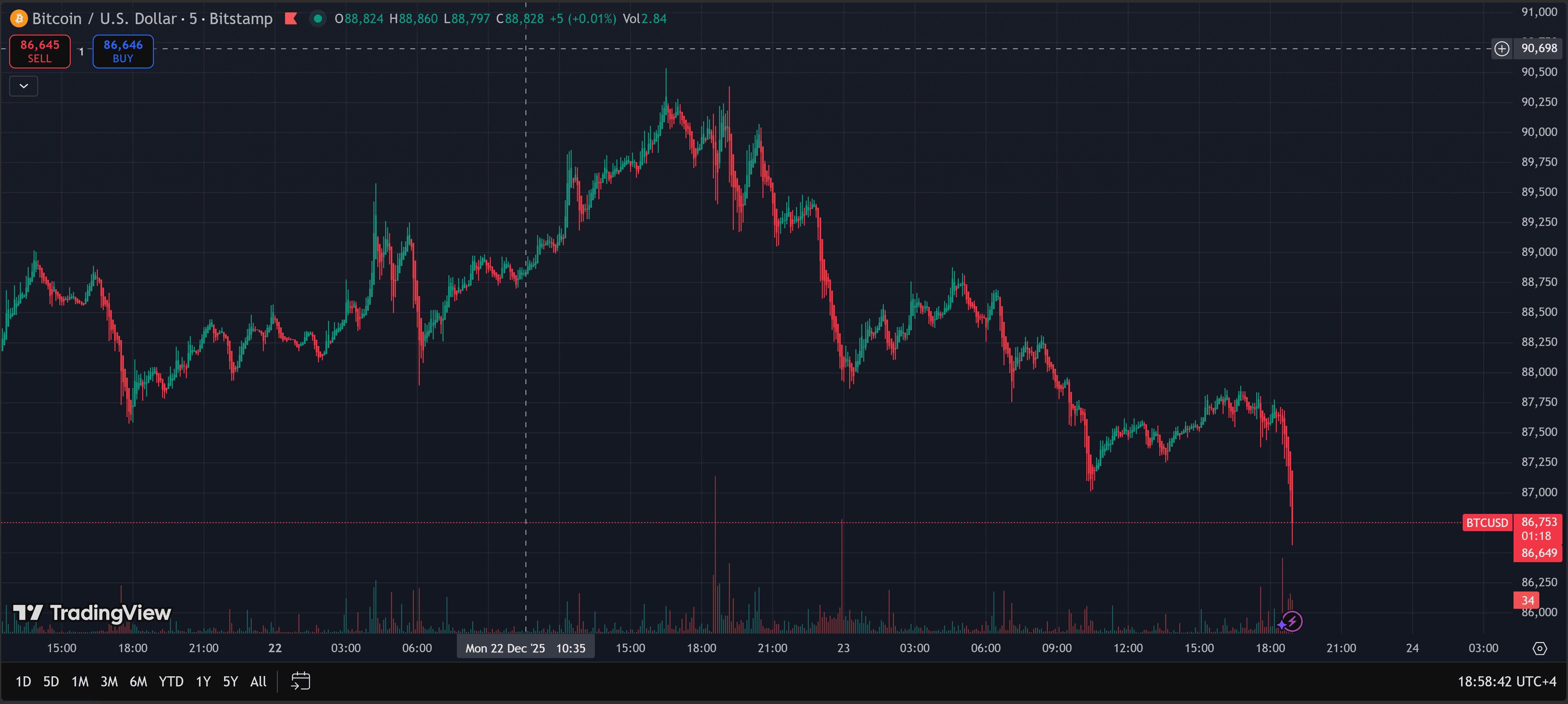

In the past few hours, traders have noticed a clear drop in the price of Bitcoin, which has opened the door to a flood of superficial explanations related to technical indicators or general news.

But the reality is that the most important reason does not appear on the price chart, but in another place that most traders ignore: the flow of currencies to the platforms.

🔍 What does the on-chain data reveal?

According to on-chain tracking data, large and repeated transfers from wallets linked to BlackRock ETF products (such as IBIT and ETHA) to Coinbase Prime have been recorded over a short period.

What do we clearly observe?

Frequent BTC transfers of large values (300 BTC, 219 BTC, and others)

The destination is one: Coinbase Prime

The timing is close and the pattern is repeated

Synchronization with a clear weakness in price during US trading sessions

This data can be verified through reliable tracking platforms like Arkham Intelligence.

🧠 Why is Coinbase Prime an important indicator?

Coinbase Prime is not an ordinary storage wallet, but a platform dedicated to:

Institutions

Liquidity providers

Asset managers

ETF funds

Sending Bitcoin to Coinbase Prime often means preparing to sell or providing liquidity to the market, not just a random internal transfer.

Important note:

Not every transfer to a platform means a direct sale, but when the pattern is repeated, the volume is large, and the timing is sensitive, the implication becomes stronger.

💧 Weak liquidity = Greater impact

In the current market conditions:

Liquidity is low

Leverage is accumulating

Buy orders are limited

In such an environment, the market does not need billions of dollars to drop.

A few tens of millions are enough to push the price down, especially if sold gradually and thoughtfully.

And this is what we see:

Every small price bounce is sold into

Every recovery attempt fails quickly

Quiet but ongoing selling pressure

🏦 When a large institutional player sells...

When a name of the size of BlackRock (the largest asset manager in the world) starts adding supply to the market, you do not need negative news or collective panic for the price to drop.

The market simply responds to changes in supply and demand balance.

📌 Summary for new traders

Bitcoin does not always move due to news

And not just because of technical indicators alone

But often due to liquidity decisions from large players

If you really want to understand the market:

Watch the flows

Watch who sends coins to the platforms

And ignore the noise that is not supported by data

#bitcoin

#Onchain

#blackRock

#CryptoMarket