🔹 First: General Direction

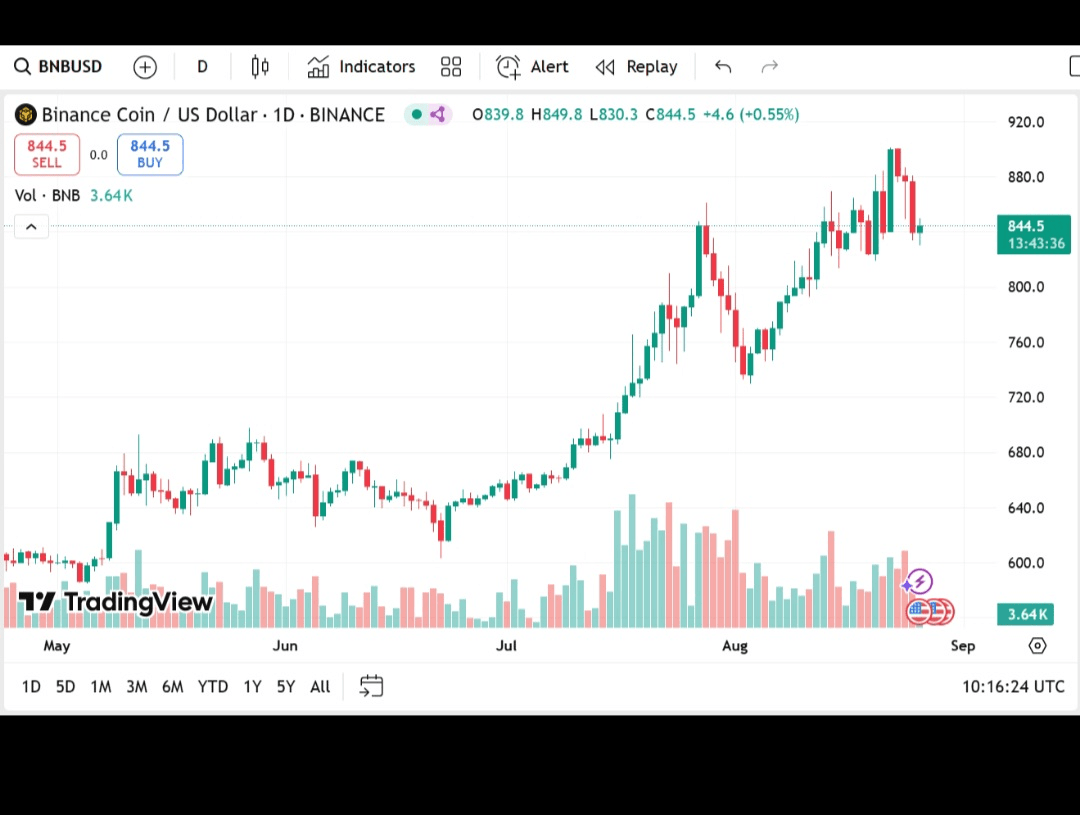

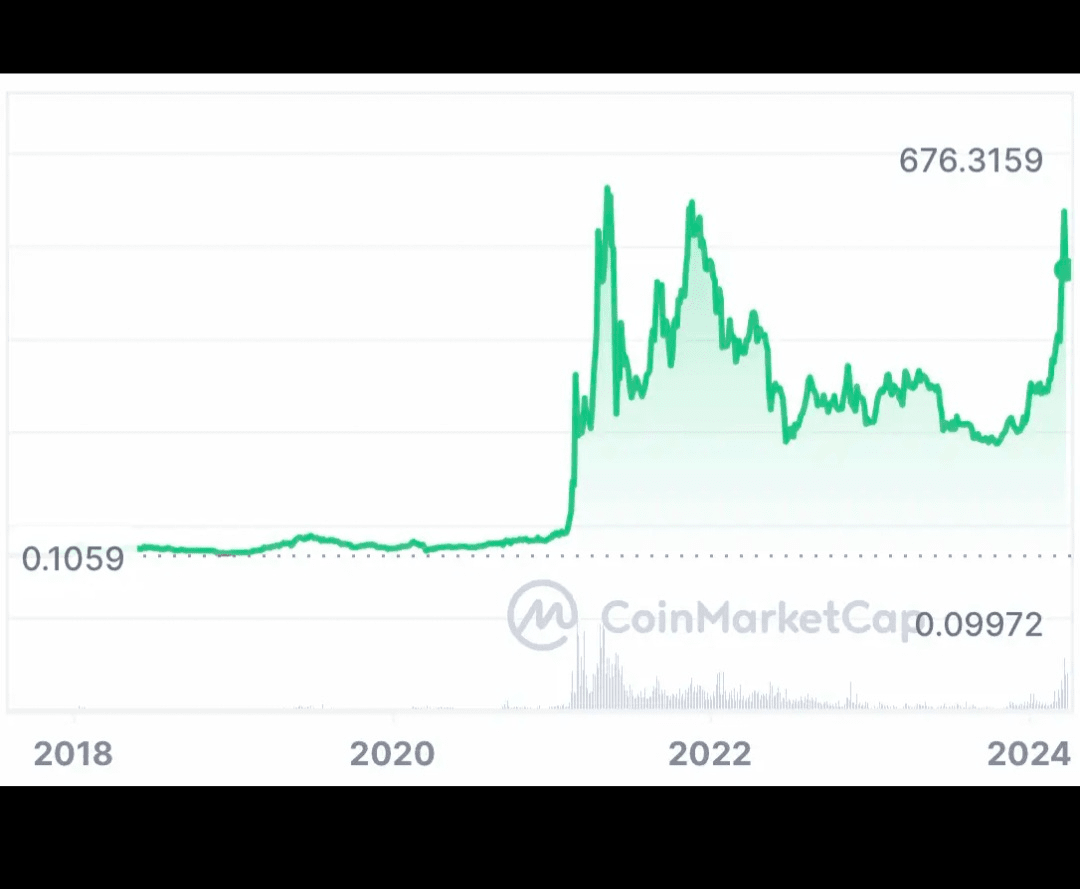

Long-term direction (5 years): Clearly bullish since 2020 despite periods of violent corrections.

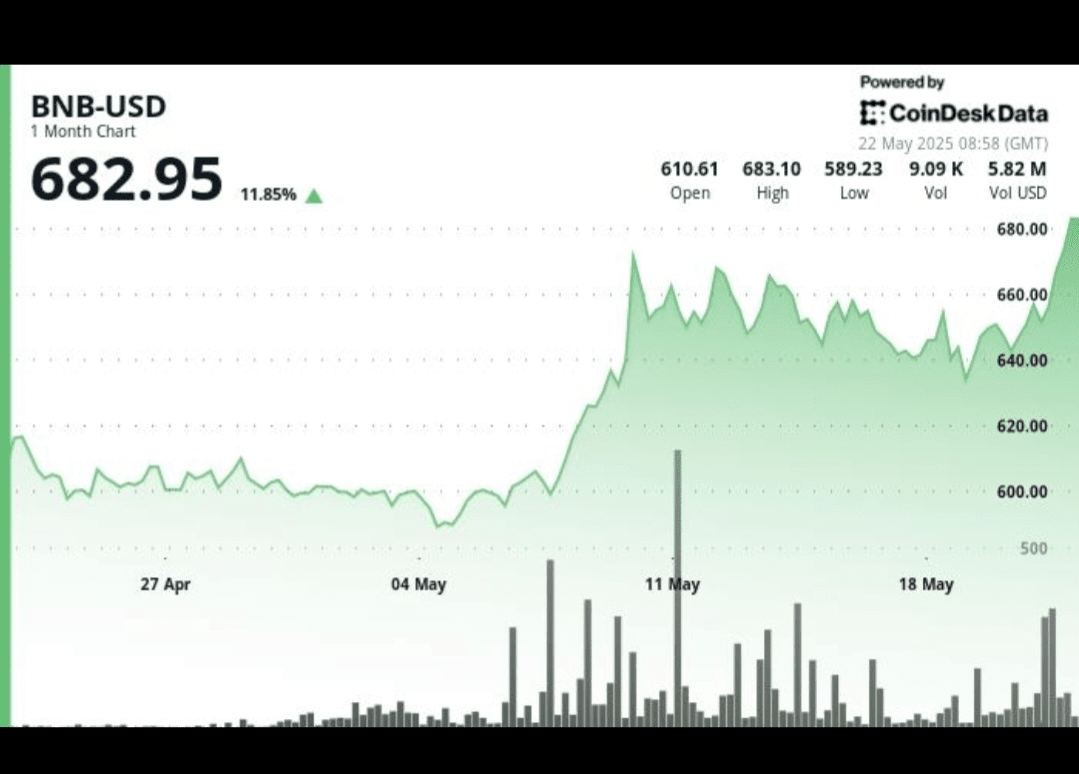

Medium-term direction (from mid-2024 to late 2025): Sideways oscillation leaning upwards after breaking previous peaks

🔹 Second: Approximate Support Levels

> These areas are where the price has historically shown clear buying strength and rebounds.

The level (in dollars) Reason for its importance

≈ $420 – $450 Major rebound area after the mid-2024 correction. Many buyers appeared here.

≈ $550 – $580 Recent support turned from previous resistance. Represents the 100-day average on the daily chart.

≈ $680 Dynamic support within the current channel; any clear break below may indicate a deeper correction.

🔹 Third: Approximate resistance levels

> Repeated selling pressure zones from traders who take profits at these levels.

The level (in dollars) Reason for its importance

≈ $800 – $820 Recent peaks the price failed to surpass multiple times, forming a ceiling for the channel.

≈ $855 (previous ATH) The highest historical peak, any firm breakout above it may open the way to new psychological levels.

≈ $900 – $950 Potential targets if buying momentum continues and ATH is broken firmly.

🔹 Fourth: Signals from technical indicators

Moving averages (MA 50 and MA 200): Still giving a positive crossover (Golden Cross), supporting the upward trend.

Relative Strength Index (RSI): Currently near 65–70 on the daily interval, indicating slight overbought conditions, it is advisable to monitor for a reversal before new entry.

Trading volumes: Still relatively high in the $850–$1050 range, which is a sign of genuine market interest.

🔹 Fifth: What does this mean for the investor?

If you are thinking about buying, the areas $550–$580 and $680 are considered “potential accumulation zones” provided strong reversal candles appear.

In the case of a confirmed breakout above $855 with high trading volume, this may represent a signal to continue the rise towards one thousand dollars.

But any weekly close below $850

will change the short-term outlook to negative.

will change the short-term outlook to negative.