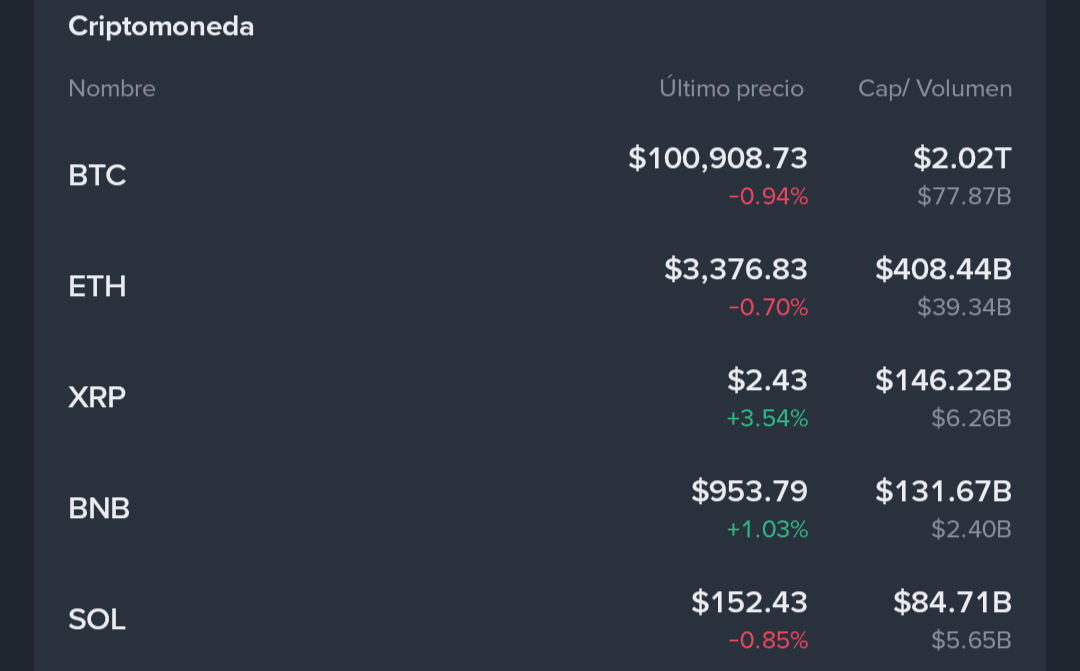

The crypto market awakens with a slight bearish pressure. Bitcoin (BTC) retreats by 0.94%, trading at $100,908, and Ethereum (ETH) falls by 0.70% to $3,376, confirming a consolidation scenario after weeks of controlled volatility. However, XRP (+3.54%) and BNB (+1.03%) break the trend, positioning themselves as the two most resilient assets in the last 24 hours.

Technical resistance and fundamentals at play

The momentum of XRP seems linked to institutional movements detected in recent days. On-chain data reveals significant accumulation by whales, suggesting bullish expectations tied to RippleNet's advancements in international payment corridors and its integration with traditional financial infrastructures.

For its part, BNB shows a firm consolidation driven by the sustained growth of BNB Chain, the increase in TVL in DeFi protocols, and the expansion of artificial intelligence projects that the ecosystem has begun to support. Its price, close to $953, marks a key psychological resistance around $1,000.

The market contrast

Meanwhile, Solana (SOL) and Ethereum (ETH) are adjusting positions in response to profit-taking after recent local highs. Capital flows seem to be temporarily migrating towards assets with a higher risk-reward ratio, in a market that continues to await stronger signals from the BTC dominance index, which still exceeds 53%.

Short-term technical outlook

Both XRP and BNB remain above their 50 and 200-period moving averages, indicating moderate bullish momentum. A weekly close above current levels could confirm the continuation of the cycle, especially if Bitcoin maintains support above $100,000.