#BNB ✅ What’s positive / bullish for BNB

According to a December 8, 2025 report, BNB “gained fresh momentum,” trading around $895.92 and prompting some analysts to target ~$1,100 by the end of the week — driven by rising trading volume.

The support zone near $900 seems to be holding: some technical models and analyst commentary suggest this level as a base from which BNB could rebound.

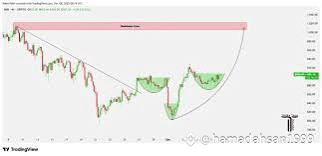

The support zone near $900 seems to be holding: some technical models and analyst commentary suggest this level as a base from which BNB could rebound.Short-term technical indicators (on some platforms) show bullish signals: for example, on-chain momentum and certain chart indicators have recently flashed oversold conditions, which could favour a near-term rebound toward $950–$1,020.

Longer-term views (though speculative) remain mildly optimistic: some forecasting models (depending on ecosystem growth, adoption, and broader crypto cycles) still project that BNB could see solid growth by 2026 and beyond.

⚠️ What’s risky / bearish or uncertain

Recent on-chain data suggests a drop in network activity: transaction volume and certain BSC metrics have reportedly fallen, which reduces fee-burn and weakens one of BNB Chain’s core value drivers.

From a chart-technical standpoint: if selling pressure increases, BNB might drop toward $850–$880, potentially testing lower supports — especially if key levels around $900 fail.

Momentum and sentiment remain fragile: some technical signals remain mixed or conservative, meaning BNB could face sideways action or sluggish recovery rather than strong rally if macro or crypto-market conditions turn cautious.

📊 Possible Short-Term Scenarios (Next few weeks)

ScenarioWhat Could HappenPrice RangeBullish bounceBNB reclaims support at ~$900, volume picks up, bullish momentum returns$950 – $1,020 Sideways / consolidationMarket stays mixed, BNB trades between support and resistance$880 – $950 Bearish dipOn-chain activity stays weak, macro/crypto sentiment sours, sellers regain control$850 – $880 (maybe lower if broader crypto market down)

🧠 What to Watch / What Could Change the Outlook

On-chain activity & ecosystem usage on BNB Chain — fewer transactions or less network usage weakens long-term value.

Broader crypto-market conditions and macroeconomic events — crypto remains volatile; global macro, regulation, and sentiment swings can swing BNB either way.

Technical breakout or breakdown — a strong push above recent resistance (~$950–$1,020) could reignite bullish momentum; failure may lead to deeper corrections.

Developments in BNB’s ecosystem (dApps, DeFi, institutional adoption, staking/utility improvements) — may revive investor interest and support price.