The global cryptocurrency market showed tentative signs of recovery today, with the total market capitalization rising 0.5% to $3.17 trillion. However, beneath this modest bounce lies a market gripped by uncertainty, as the Crypto Fear & Greed Index registers a score of 22—firmly in "Extreme Fear" territory .

Bitcoin and Ethereum held steady, with BTC trading near $90,420 and ETH pushing above $3,120, gaining 1.86% in the last 24 hours. The action, however, was concentrated in select altcoins and specific news-driven sectors .

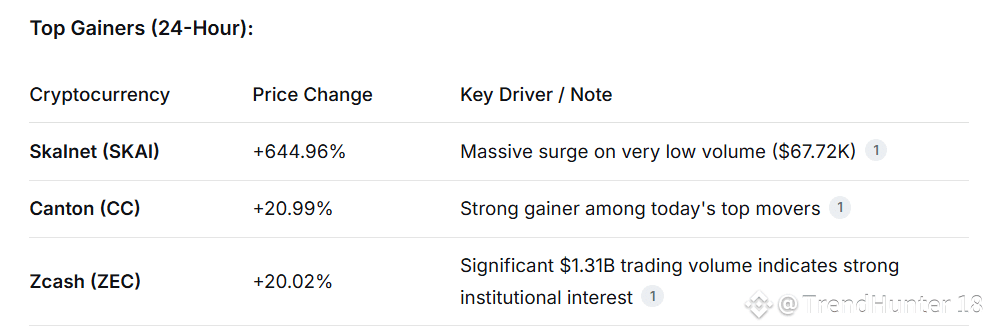

Today's Top Movers and Market Segments

The market presented a mixed picture, with notable divergence between gainers and losers. The decentralized finance (DeFi) sector was a bright spot, rising 1.6% to reach a total market cap of $112 billion .

Top Losers (24-Hour):

DoubleZero (2Z): -8.84%

Bitcoin Cash (BCH): -2.87%

TRON (TRX): -2.43%

Key News Driving the Market

Several significant developments are shaping investor sentiment:

Regulatory Push: The U.S. Commodity Futures Trading Commission (CFTC) launched a pilot program allowing Bitcoin (BTC), Ether (ETH), and USDC to be used as collateral for derivatives trades, a major step for institutional crypto integration .

New Listings: Coinbase announced it will list two new tokens—Plume and Jupiter—for spot trading starting December 9, 2025 .

Institutional Moves: Asset management giant BlackRock has officially filed for a staked Ethereum ETF, seeking to offer investors exposure to ETH's staking yields . Meanwhile, bitcoin-focused firm Strategy purchased an additional 10,624 BTC (worth $962.7 million), bringing its total holdings to 660,624 BTC.

Legal Clarity: The U.S. Securities and Exchange Commission (SEC) has closed its two-year investigation into Ondo Finance without pursuing charges, providing relief for the tokenized real-world assets (RWA) sector .

#CryptoMarket #fearandgreedindex #defi #CFTC #blackRock

$BTC