🚀 Key Takeaways

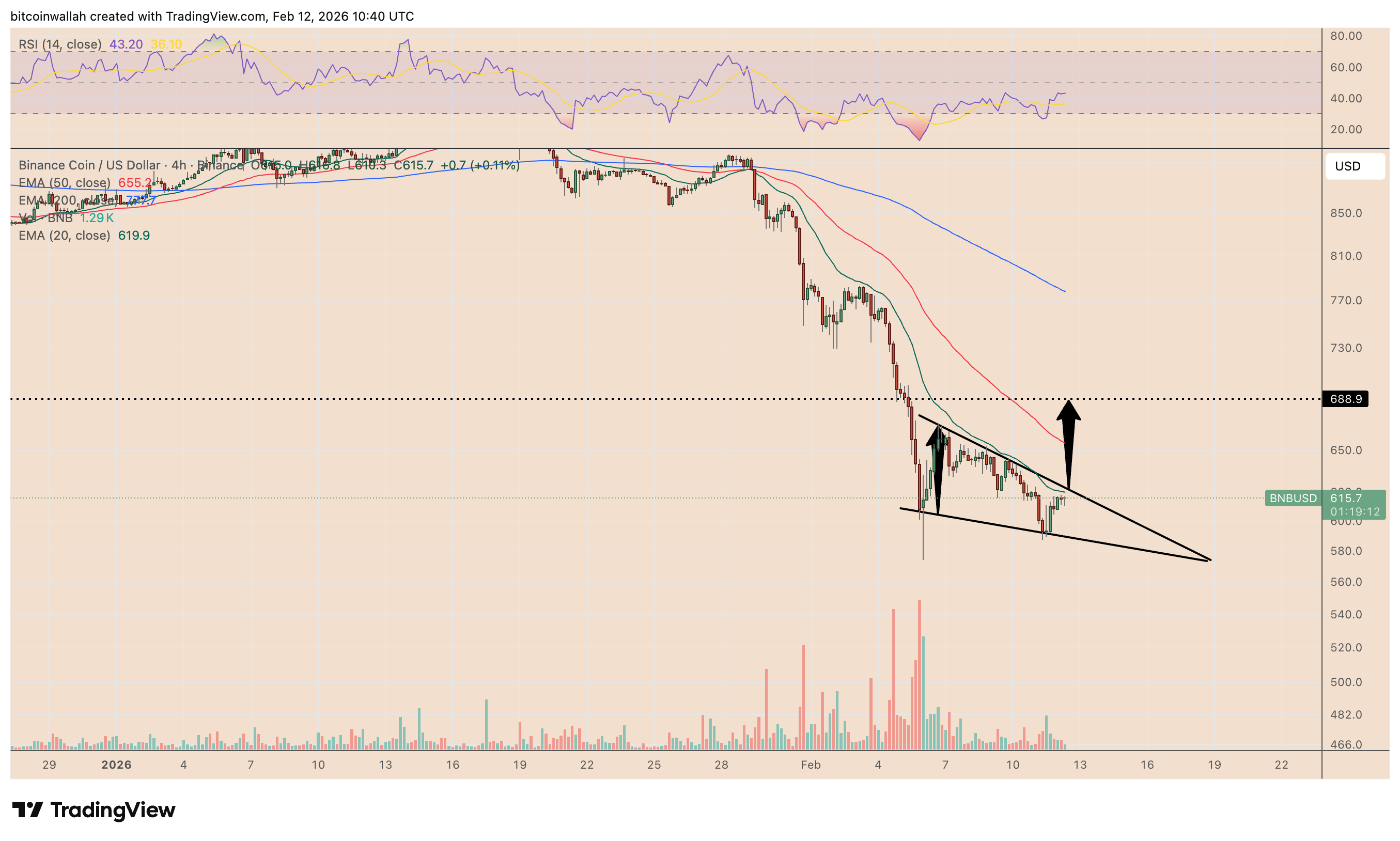

Falling wedge breakout in play — BNB is forming a classic bullish reversal pattern on the 4-hour chart, signaling weakening bearish momentum

$680–$700 in sight — A confirmed breakout above wedge resistance could trigger a sharp move toward this key zone, backed by prior breakdown levels

Short squeeze setup building — Binance's liquidation heatmap reveals a dense cluster of short positions at $680–$700, creating potential fuel for a momentum-driven rally

Retail apathy may signal bottom — Social volume has plunged, historically a contrarian indicator that has preceded recoveries

📈 BNB Eyes $700 as Falling Wedge Nears Breakout

BNB is coiling inside a textbook falling wedge — a structure that often appears late in corrective phases and paves the way for trend reversals.

The pattern, defined by converging downward-sloping trendlines, reflects deteriorating bearish momentum. With the Relative Strength Index (RSI) bouncing from oversold territory, downside pressure appears to be fading.

A decisive breach above the wedge's upper boundary would break the sequence of lower highs — and likely ignite follow-through buying. Technicians are eyeing an immediate target in the $680–$700 range, a zone defined by prior breakdown levels and horizontal resistance.

Should the breakout fail, however, BNB could revisit the $580 support zone near the wedge's base.

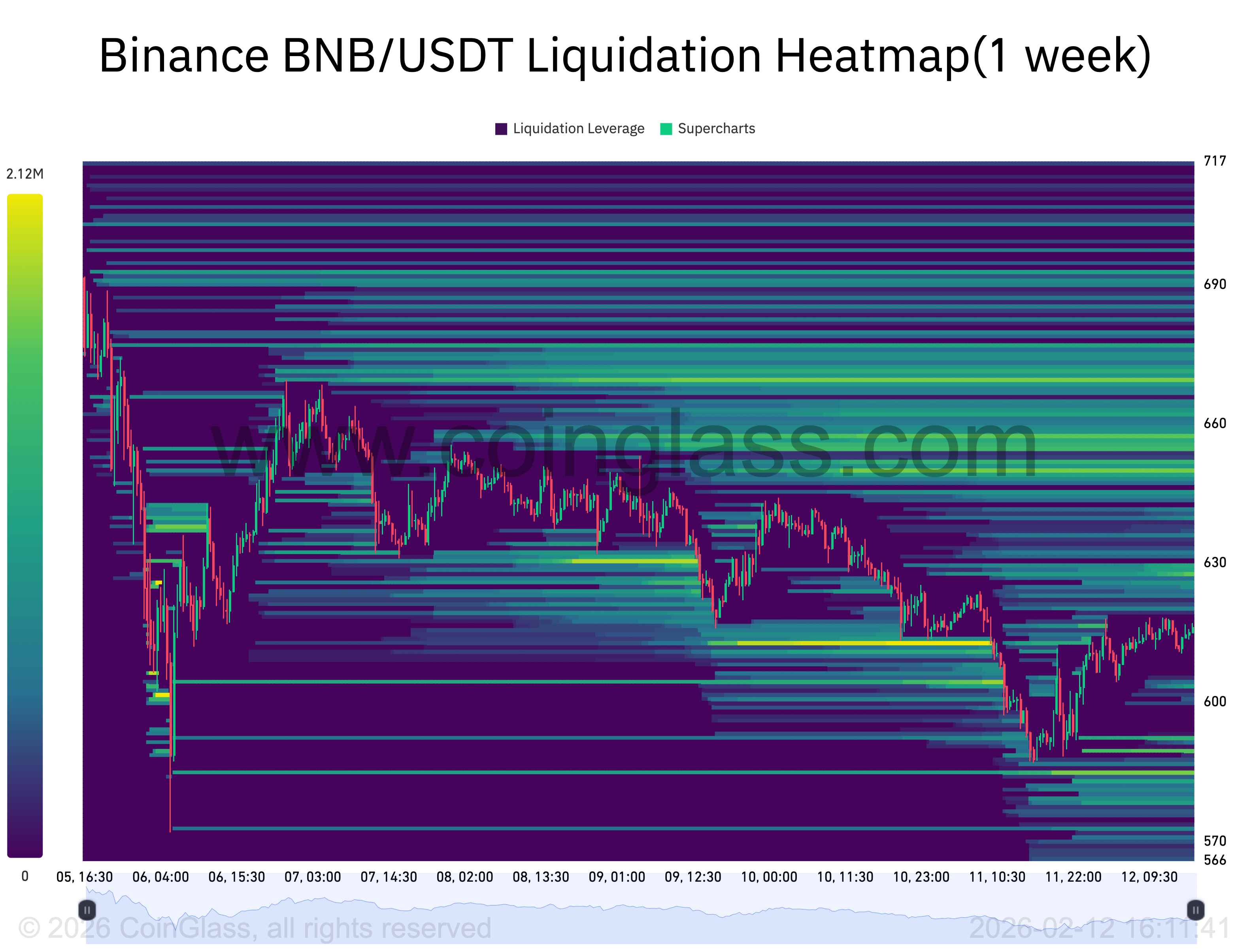

⚡ Liquidation Cluster Adds Fuel to Bullish Case

Derivatives data adds weight to the $700 thesis.

Binance's one-week liquidation heatmap shows a thick concentration of short positions stacked between $680 and $700. These liquidity pools often act as price magnets, drawing the market toward them to trigger stop-losses and forced buybacks.

If BNB clears wedge resistance, momentum could accelerate into this cluster — forcing short sellers to cover and creating mechanical buying pressure on top of organic demand. That combination raises the odds of a sharp squeeze toward $700.

📉 Silence in Social Chatter: Capitulation or Calm Before the Storm?

BNB's Social Volume — a measure of how frequently the coin is mentioned online — has dropped sharply in recent weeks. While often interpreted as retail disinterest, such pullbacks have historically coincided with late-stage corrections and preceded rebounds.

Traders are watching whether BNB can hold the $600 support zone while social chatter begins to recover. A stabilization here, followed by a wedge breakout, would complete the bullish setup.

🔮 The Bottom Line

BNB is compressing at a technical inflection point. With a bullish reversal pattern, dense short liquidity overhead, and signs of waning bearish sentiment, the stars may be aligning for a February push toward $700.

Confirmation hinges on one thing: a clean break above wedge resistance.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.