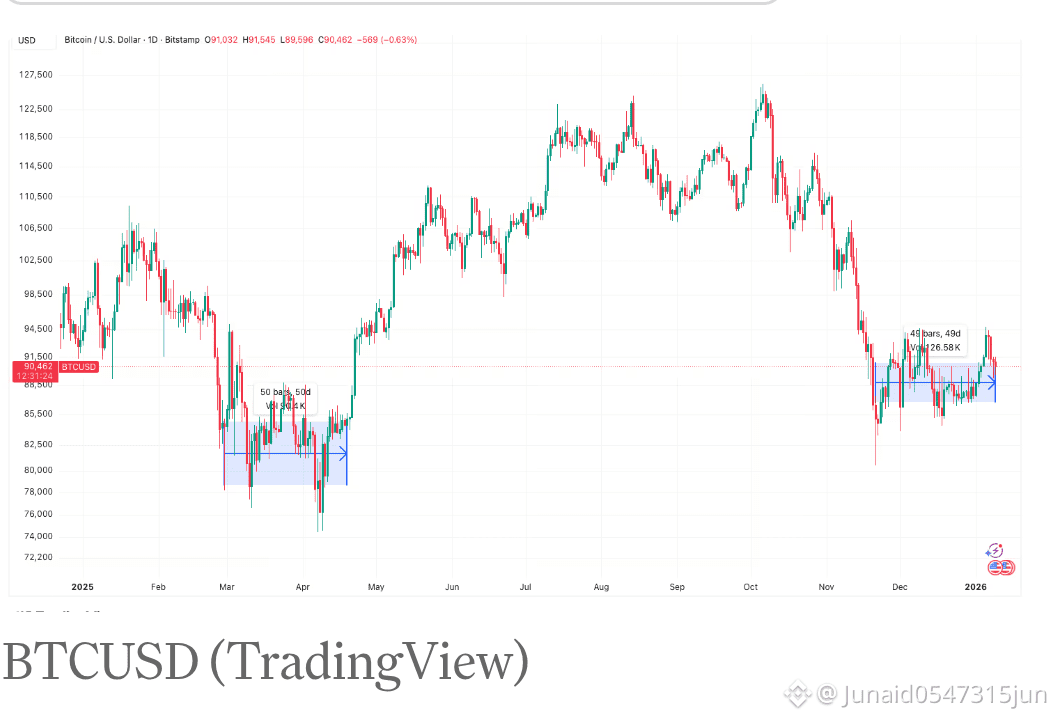

$BTC trading near $90–92K, down ~28% from the all-time high set in late 2025. �

Coinbase

Trading volume & participation has recently softened — buyers slightly outweigh sellers, but momentum is muted. �

Coinbase

📈 Bullish Indicators

Tight consolidation in recent weeks reflects a Bollinger Bands squeeze — often a precursor to big moves. �

APnews

Some technical setups historically precede strong recoveries; certain valuation metrics forecast a 96 % chance of a price rebound over the next 12 months. �

Cointelegraph

Discussion of rare historical signals suggests the price being close to a strong momentum trigger last seen in 2020. �

BeInCrypto

📉 Bearish Pressure

Breaking below longer-term moving averages and key levels could push $BTC toward low-$70K or $65K zones before stabilizing. �

Finance Magnates +1

Broader market weakness (risk assets under stress) could keep upside capped in the short term. �

CryptoPotato

🎯 Price Targets & Scenarios

2026 outlook is wide and volatile — analysts and models span from a consolidation phase near current levels to major breakouts:

Scenario

Target Range

Basis

Near-term pullback

~$65K–$74K

Technical support tests & bearish setups �

Finance Magnates

Base-case rebound

~$90K–$120K

Consolidation breakout & renewed buying �

APnews

Bullish rally

$150K+

Macro easing + institutional inflows �

Finance Magnates

📊 Key Drivers to Watch

✔ Volatility breakout from consolidation — direction will shape the next trend. �

✔ Institutional interest & ETF flows — strong capital inflows may support higher ranges. �

✔ Macro conditions (rates & liquidity) — easier policy tends to lift risk assets like $BTC . �

APnews

Finance Magnates

Business Insider

🧠 Summary

Bitcoin is in a critical consolidation phase. Short-term charts imply a possible volatility explosion, but direction is undecided — downside risks remain if support breaks, while upside catalysts could trigger a renewed bullish trend later in 2026.

Not financial advice: Bitcoin remains volatile and affected by macro trends, sentiment shifts, and broader markets.