Let me talk about something most crypto investors never think about.

Blockchains don’t just process transactions.

They quietly define who has authority.

Who can upgrade contracts.

Who can pause markets.

Who can reverse mistakes.

Who can intervene during crises.

And here’s the strange part:

Most chains either give nobody this power…

Or give one group too much of it.

Neither model works for real financial systems.

This is where my thinking about Dusk changed recently.

Not because of privacy.

Not because of RWAs.

But because Dusk is tackling a question almost nobody in crypto is designing for:

How do you build on-chain markets that can handle authority without becoming centralized?

The Authority Problem Nobody Solved

In real finance, authority is layered.

Exchanges can halt trading.

Courts can freeze assets.

Issuers can correct mistakes.

Regulators can intervene.

But it’s never one single party.

Public blockchains, on the other hand, usually choose extremes:

Either: • No one can intervene (even during fraud)

Or: • Admin keys control everything

Both are dangerous.

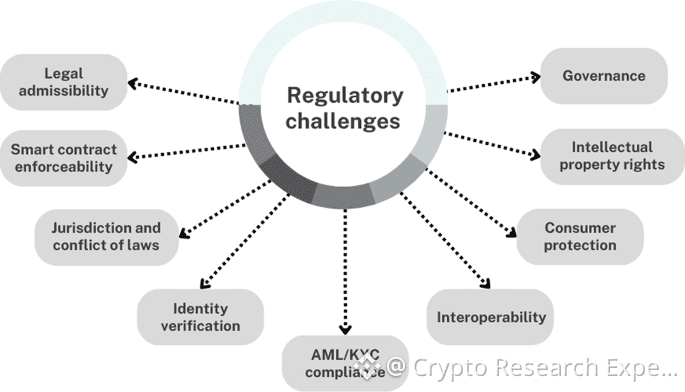

“No authority” breaks regulation.

“Single authority” breaks decentralization.

Dusk is trying to design a third model.

Role-Based Control Instead of Token Governance

One thing I find very different about Dusk is how it treats governance.

Most chains rely on token voting.

This works for protocol upgrades.

It does not work for financial markets.

In capital markets:

• Issuers have rights

• Exchanges have authority

• Custodians have obligations

• Regulators have oversight

• Users have protections

Dusk is building systems where authority is role-based, not popularity-based.

That means:

• Certain actors can enforce compliance

• Certain actors can intervene legally

• But no one actor controls the system fully

This is subtle.

But this is exactly how clearing systems and settlement networks work today.

And without this layer, regulated on-chain markets simply cannot exist.

Settlement Is Where Most Blockchains Break

Another angle I rarely see discussed is settlement.

In crypto, settlement is instant and final.

In finance, settlement is complex:

• Delays

• Corporate actions

• Disputes

• Reversals

• Reporting

Public chains were never designed for this.

Dusk is.

By combining:

• Privacy

• Identity

• Programmable compliance

• Authority layers

It can model things like:

• Trade cancellations

• Asset freezes

• Dividend handling

• Regulated clearing

This is boring.

But this is the part that actually moves trillions.

The Bigger Picture

The more I study Dusk, the more I realize something important.

It’s not building a blockchain.

It’s building a legal-aware financial network.

A place where:

Code executes

Law is respected

Privacy is preserved

Markets remain functional

This is not designed for retail hype.

It’s designed for the moment when governments and institutions finally say:

“Okay… now blockchain has to behave like real finance.”

And very few chains are ready for that moment.

Final Thought

Most crypto projects ask:

“How do we remove intermediaries?”

Dusk seems to be asking something much harder:

“How do we design decentralized systems that can safely coexist with law, authority, and real markets?”

That question might decide who survives when blockchain stops being experimental.

What do you think 👇

Should blockchains adapt to legal systems — or should finance adapt to blockchains?