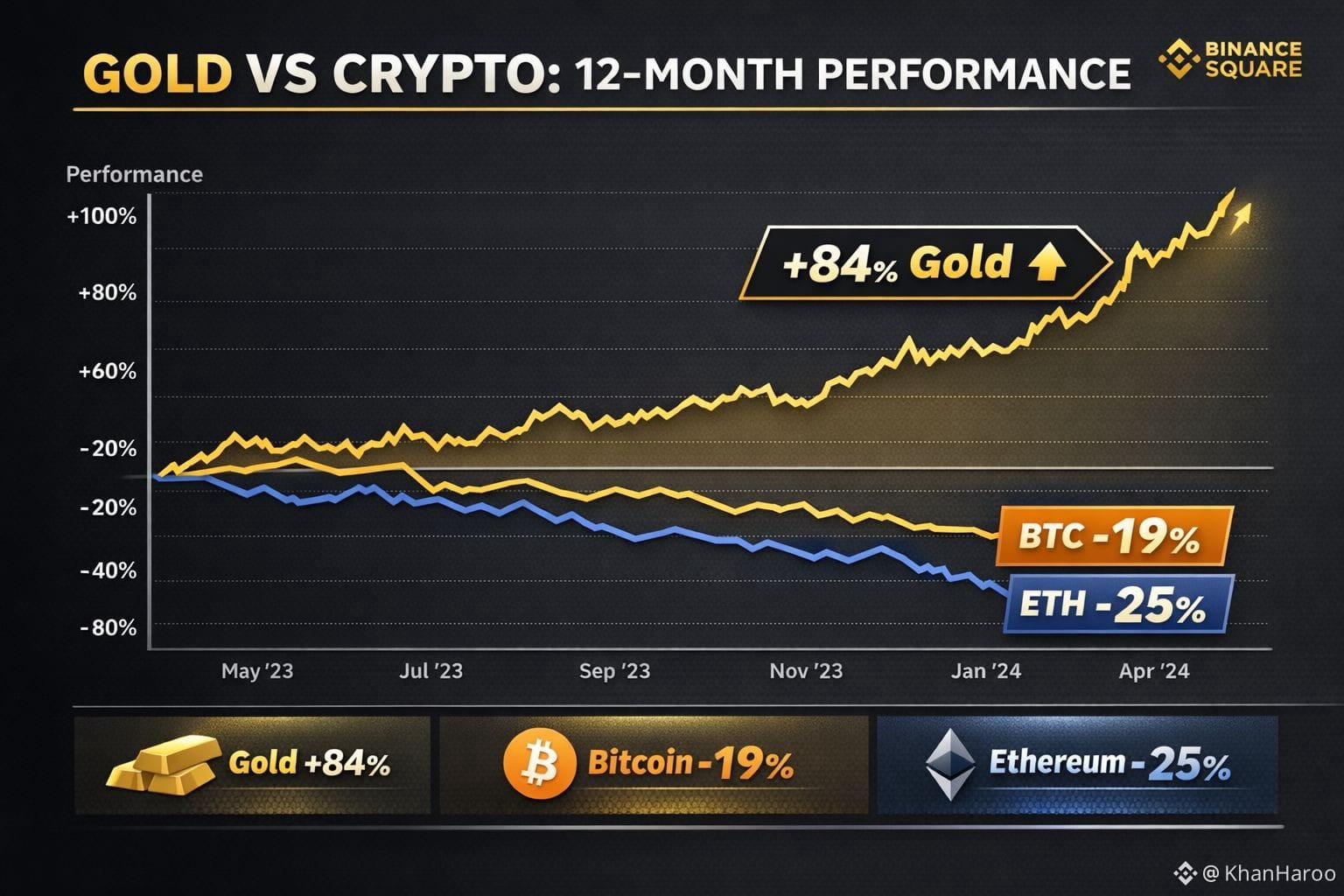

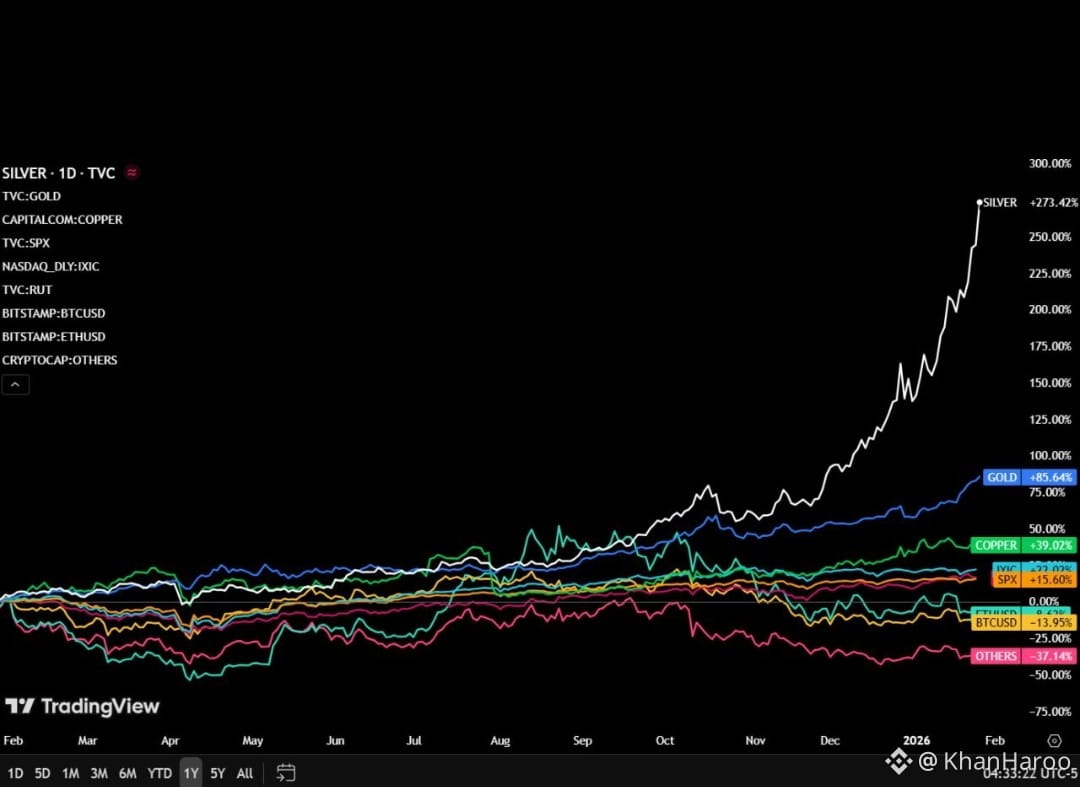

Over the past year, traditional and digital assets have shown a stark divergence in performance. Gold, long considered a safe haven, surged +84%, while silver skyrocketed +267%, highlighting investor rotation into tangible assets amid macroeconomic uncertainty.

In contrast, Bitcoin and the broader crypto market faced significant headwinds. Bitcoin fell −14%, Ethereum −8%, and altcoins averaged −50%, reflecting persistent volatility, regulatory uncertainty, and market sentiment swings.

📌 Key Takeaways:

Gold and silver continue to outperform in turbulent markets.

Bitcoin and crypto remain high-risk, high-reward bets—ideal for risk-tolerant investors.

Diversification between traditional and digital assets remains critical for portfolio resilience.

Insight: While crypto still offers asymmetric upside potential, recent data emphasizes that traditional assets like gold and silver maintain defensive value, especially during prolonged market drawdowns. Investors should balance conviction with risk management, particularly during macroeconomic uncertainty.