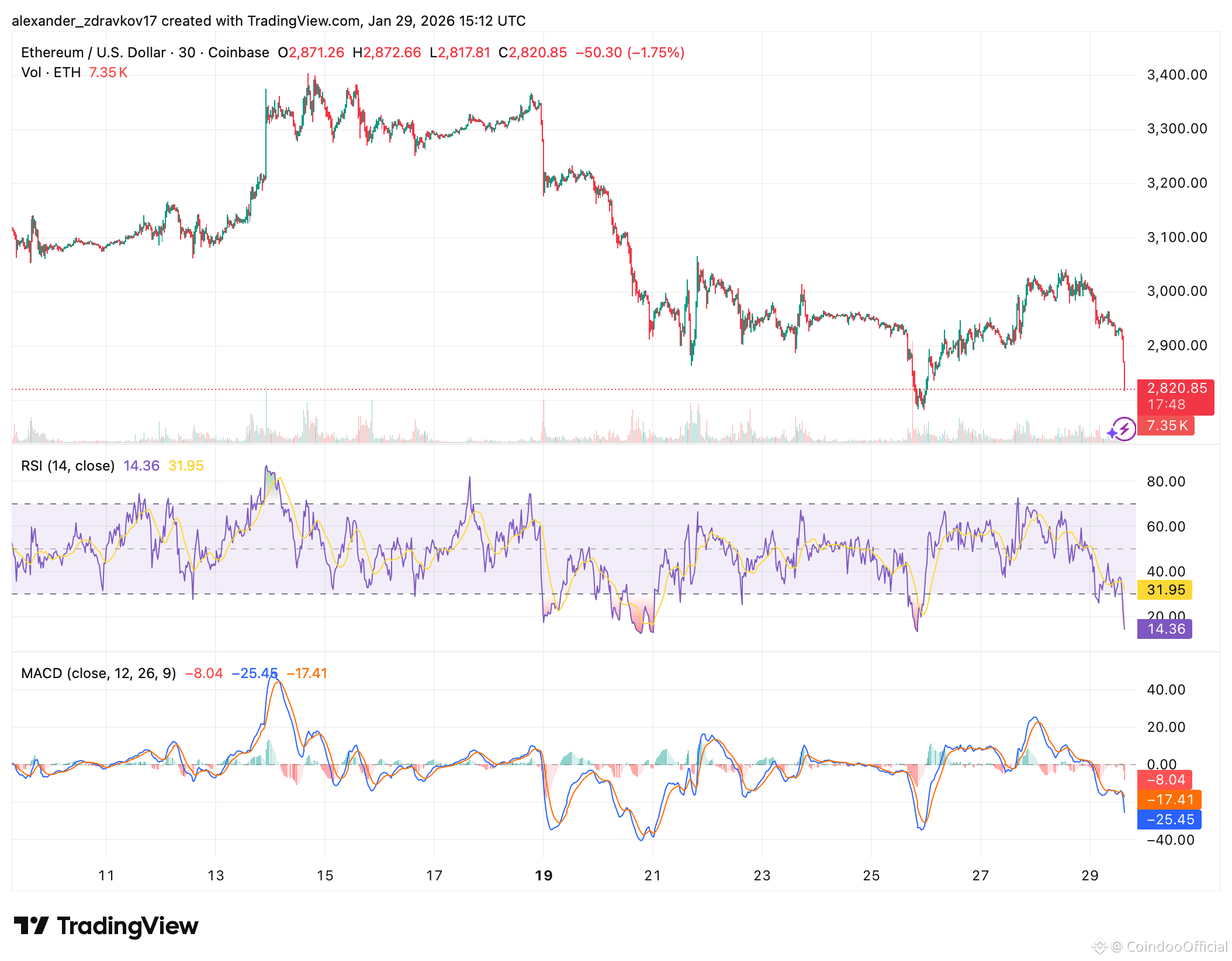

Ethereum has broken below the key $2,900 level, extending its short-term downtrend and increasing pressure across leveraged positions.

The move followed a steady grind lower that accelerated into a sharp selloff, pushing ETH toward the lower end of its recent range.

Key takeaways:

Ethereum has lost the $2,900 support, shifting short-term momentum bearish

Leverage is heavily concentrated on both sides, increasing liquidation risk

Volatility is likely to rise as price approaches major liquidation zones

From a derivatives perspective, positioning is now extremely sensitive. According to the latest liquidation data, $11.22 billion in short positions would be liquidated if ETH rallies 30 percent, while $10.50 billion in long positions face liquidation if Ethereum drops another 30 percent.

https://twitter.com/TedPillows/status/2016870706274078862

This creates a tightly compressed setup where a strong move in either direction could trigger cascading liquidations and amplify volatility. With leverage stacked on both sides, price is entering a zone where directional conviction will likely define the next major move.

Ethereum Technical Structure and Momentum

Technically, Ethereum is showing clear signs of short-term weakness. The Relative Strength Index has dropped into the low 30s, approaching oversold territory, signaling intense selling pressure but also raising the probability of a short-term reaction.

However, oversold conditions alone do not confirm a reversal. The Moving Average Convergence Divergence remains firmly negative, with bearish momentum still dominant and no confirmed bullish crossover in place.

From a structural standpoint, Ethereum has broken below its recent consolidation range, turning former support into resistance. The loss of this structure shifts the near-term bias lower unless price can reclaim key levels quickly.

What investors should watch next

The $2,850–$2,800 zone is now the most important area of interest on the downside. A sustained hold here could lead to a relief bounce, particularly given the large concentration of short-side leverage above current price. On the upside, reclaiming the $2,950–$3,000 region would be the first signal that bearish momentum is fading.

A failure to stabilize, however, increases the risk of a deeper flush into lower liquidity pockets, where long liquidations could accelerate. With liquidation risk elevated on both sides, Ethereum is positioned for sharp, fast moves, making volatility the dominant theme in the near term.