A Market That Quietly Changed

There was a time when crypto markets felt electric. New tokens appeared overnight, price charts moved faster than fundamentals, and speculation was often mistaken for innovation. Gains were immediate, narratives were loud, and participation rewarded speed more than understanding.

That atmosphere has faded—not with a crash, but with a shift. The market still moves, but differently. Overnight gains have become rare, hype cycles shorter, and attention harder to capture. What replaced them is less visible but far more consequential: systems being built to last. The market did not lose energy; it redirected it.

The End of the Speculation-First Cycle

Speculation-driven cycles depend on constant novelty. When narratives repeat without progress, fatigue sets in. Over time, markets learned a hard lesson: price momentum without underlying utility cannot sustain itself.

Meme-driven projects and hype-first launches still appear, but they struggle to retain relevance. Liquidity exits faster, communities thin out sooner, and attention moves on. Participants—retail and institutional alike—have become more selective. Short-term price action no longer compensates for the absence of real use. Utility, reliability, and endurance have quietly replaced virality as the primary filters.

Crypto as Infrastructure, Not a Product

The most important crypto systems today are not consumer products; they are infrastructure. Blockchains function as settlement layers for value, data layers for records, and coordination layers for decentralized systems. Their success is measured not by attention, but by uptime, throughput, and reliability.

The most important crypto systems today are not consumer products; they are infrastructure. Blockchains function as settlement layers for value, data layers for records, and coordination layers for decentralized systems. Their success is measured not by attention, but by uptime, throughput, and reliability.

This mirrors the early internet. Few users ever cared about TCP/IP or HTTP, yet those protocols quietly enabled global communication. In the same way, blockchain adoption often happens invisibly. End users interact with applications that feel familiar, unaware that cryptographic settlement is occurring underneath. Infrastructure does not demand attention—it earns trust by working consistently.

Real-World Demand Is Now the Growth Driver

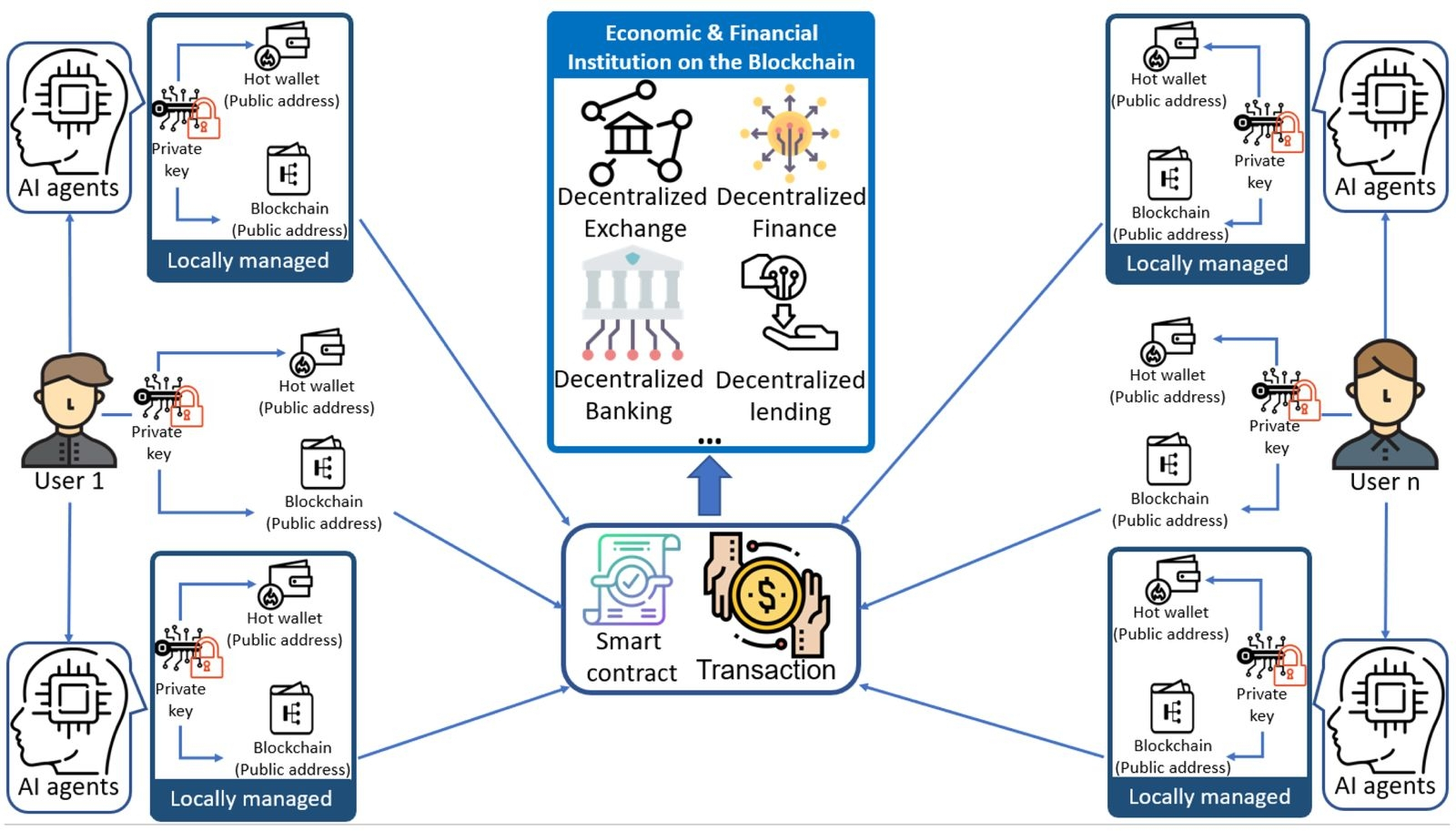

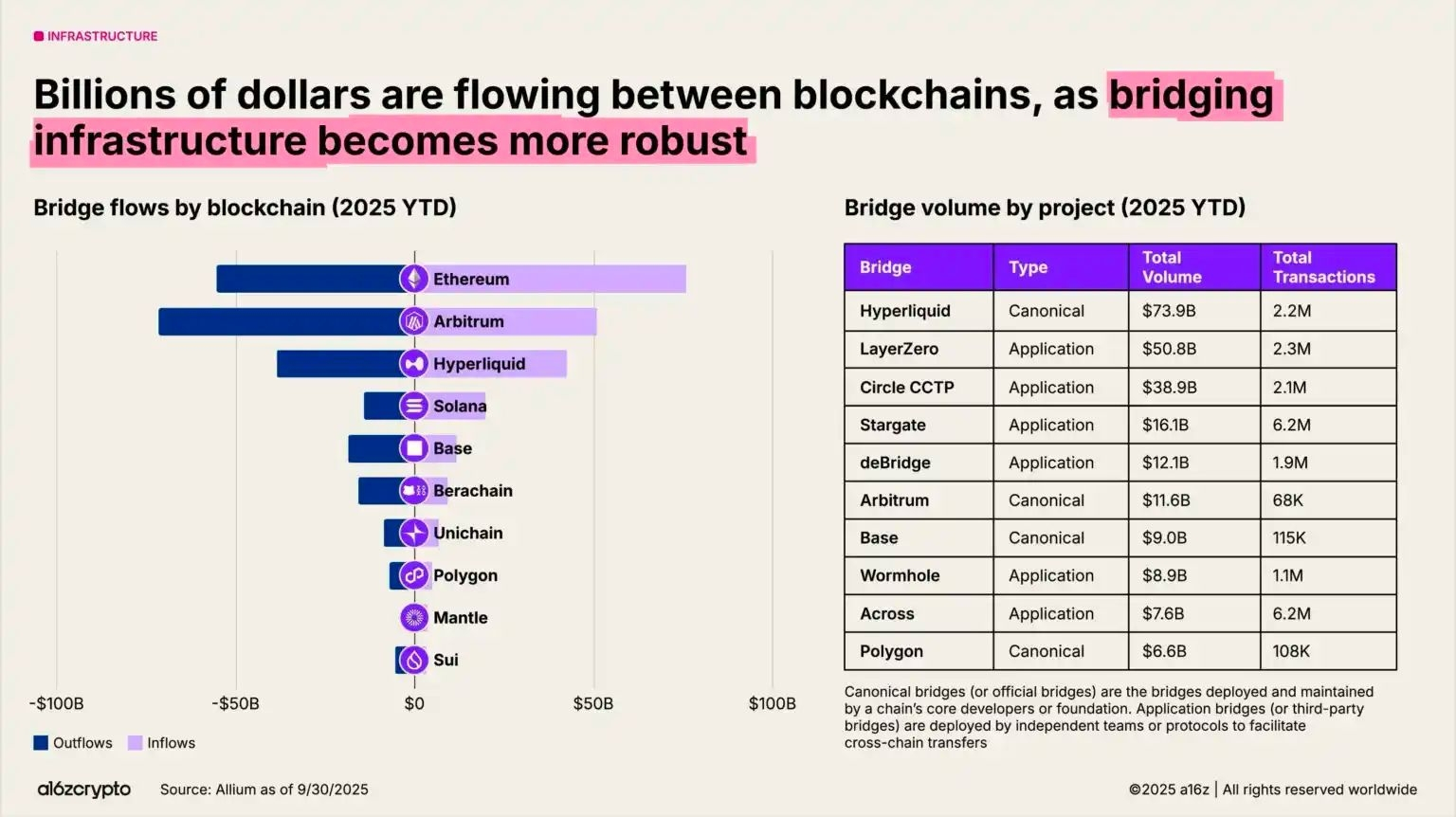

The strongest growth today is not coming from retail excitement, but from practical demand. Enterprises use blockchains for reconciliation and settlement. Fintech platforms integrate them for cross-border payments and asset movement. Institutions adopt them to reduce operational friction, not to make headlines.

The strongest growth today is not coming from retail excitement, but from practical demand. Enterprises use blockchains for reconciliation and settlement. Fintech platforms integrate them for cross-border payments and asset movement. Institutions adopt them to reduce operational friction, not to make headlines.

Crucially, these use cases do not require users to care about crypto. They care about speed, cost, transparency, and reliability. This demand is structurally different from hype-driven adoption—it grows slowly, compounds steadily, and is less sensitive to market sentiment. Once infrastructure is integrated, it is rarely removed.

What This Means for Builders and Investors

In an infrastructure-led market, fundamentals matter more than narratives. Builders are optimizing for resilience, security, and scalability rather than attention. Roadmaps prioritize maintenance and integration over spectacle. Reliability becomes the product.

For investors, this shifts the lens entirely. Capital flows toward teams capable of execution across cycles, not just during rallies. Returns are less explosive, but more defensible. Infrastructure rewards patience, due diligence, and long-term alignment rather than constant repositioning.

The Next Market Cycle Will Look Boring — and That’s a Good Thing

Future cycles are unlikely to resemble the past. Fewer dramatic pumps, fewer sudden collapses, and more consistent progress. This may feel uneventful to speculators, but it is a sign of maturation.

Boring markets build real value. They allow systems to stabilize, standards to emerge, and adoption to deepen without constant disruption. In infrastructure-driven ecosystems, quiet reliability is a feature, not a flaw.

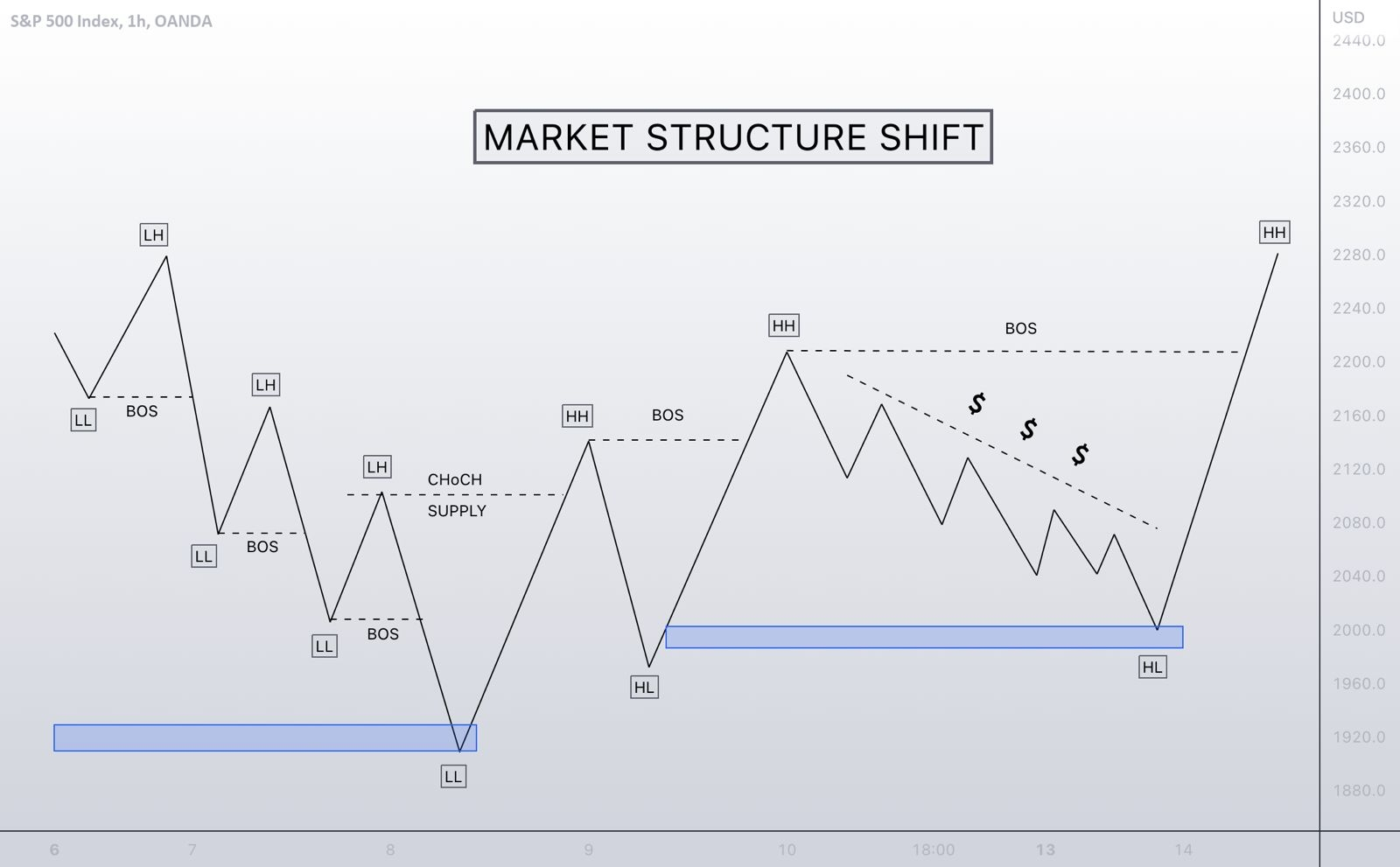

A Structural Shift, Not a Price Story

The most significant transformation in crypto is no longer reflected in price charts. It is structural. The market is evolving from speculation to infrastructure, from noise to necessity.

Infrastructure markets do not reward excitement. They reward patience, consistency, and long-term commitment. Crypto’s next chapter will not be defined by who moved first, but by who built systems sturdy enough to still be running when attention moved elsewhere.