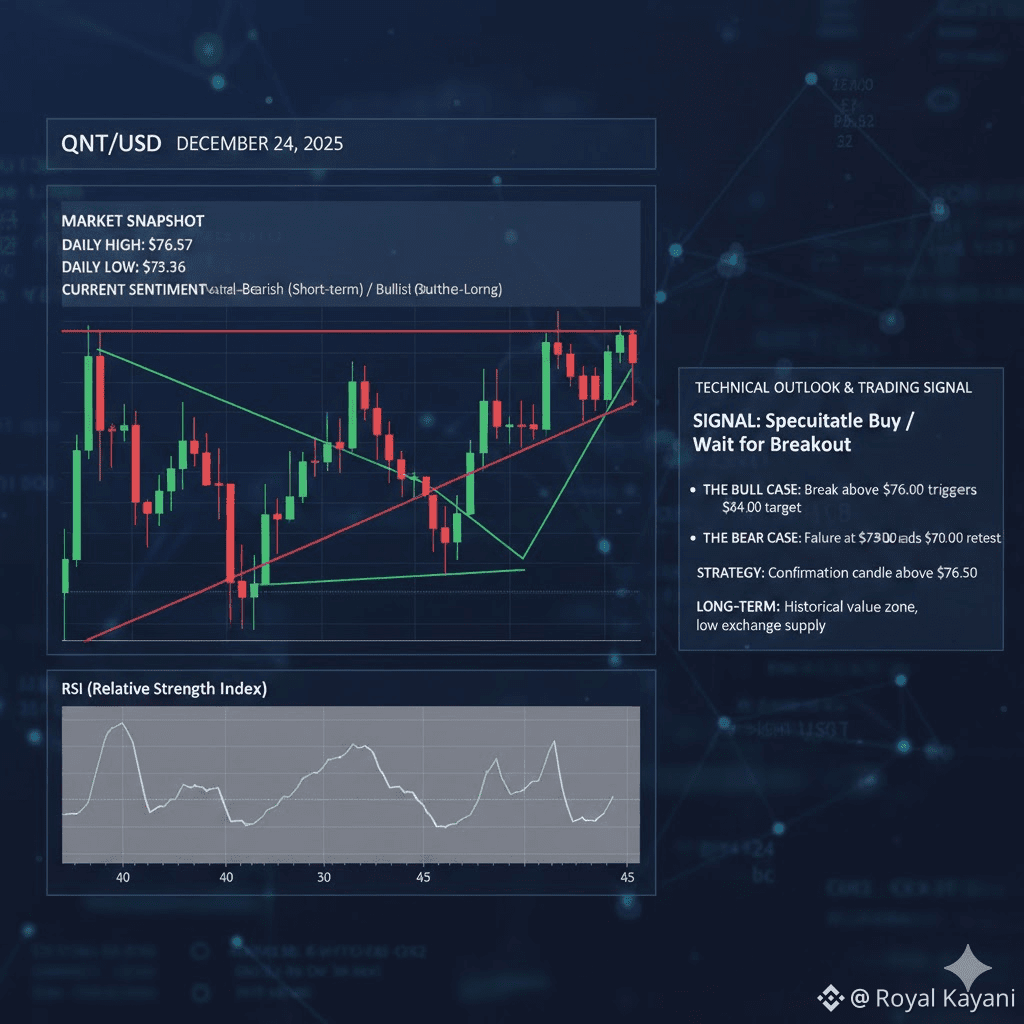

Today, December 24, 2025, Quant (QNT) is navigating a consolidation phase with significant attention on its key support levels. After a period of volatility, the coin is currently showing signs of a "quiet before the storm" setup.

Market Snapshot

• Daily High: $76.57

• Daily Low: $73.36

• Current Sentiment: Neutral-Bearish (Short-term) / Bullish (Long-term)

Technical Outlook & Trading Signal

Quant is currently trading below its 50-day moving average, which is acting as a stiff resistance overhead. However, technical indicators like the RSI (Relative Strength Index) are hovering in the neutral 40–45 range, suggesting that the asset is neither overbought nor severely oversold.

Signal: Speculative Buy / Wait for Breakout

• The Bull Case: QNT is currently compressing within a falling wedge pattern. A high-volume break above the $76.00 level would trigger a bullish signal, potentially targeting $84.00 as the next major hurdle.

• The Bear Case: If the price fails to hold the current support at $73.00, we may see a quick retest of the psychological $70.00 floor.

Strategy: Traders should look for a "confirmation candle" above $76.50 before entering a long position. For long-term holders, the current price represents a historical value zone, as exchange supplies of QNT remain at multi-month lows.

#TradingSignals #cryptotrading #TechnicalAnalysis #BinanceSquare