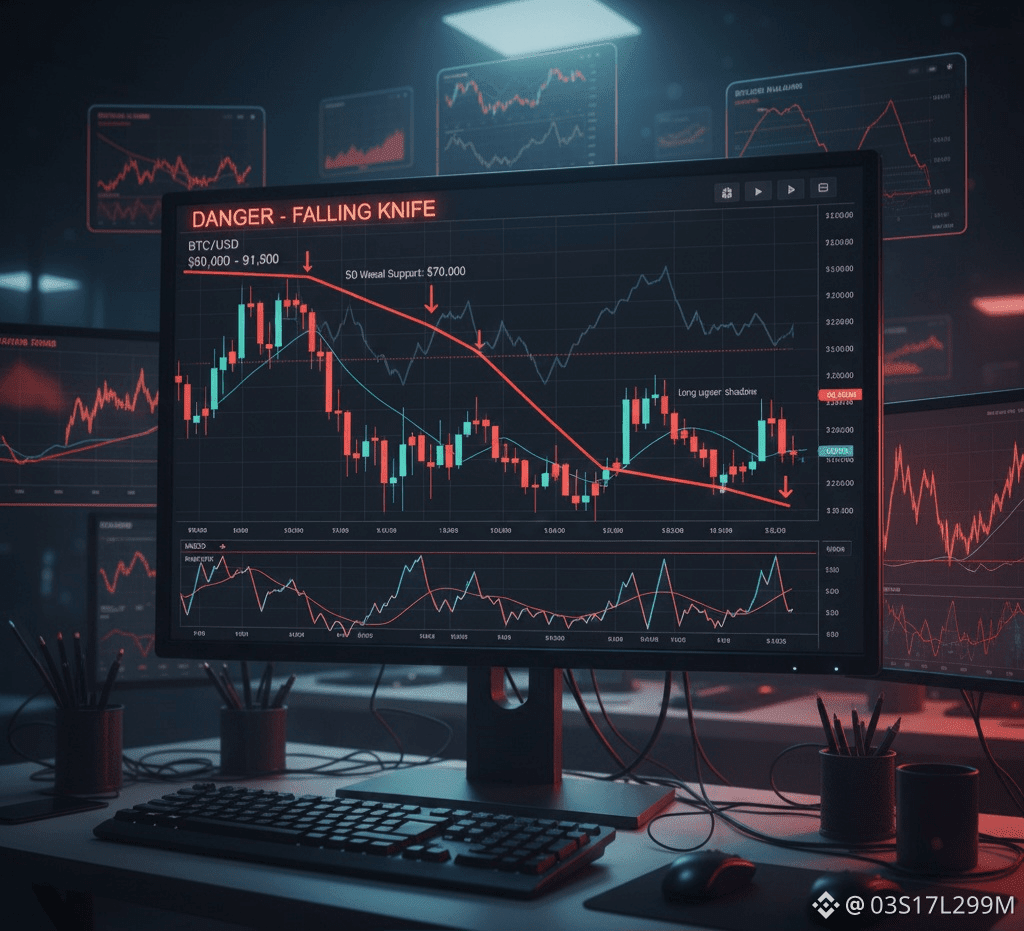

The financial markets frequently utilize the metaphor of a "falling knife" to describe a security experiencing a rapid and precipitous decline in price. In such a scenario, the momentum of the sell-off is so intense that attempting to "buy the dip" before a definitive floor is established can result in significant capital impairment. As of early January 2026, the Bitcoin $BTC chart is exhibiting several technical signals that suggest a high-velocity downward trajectory, prompting analysts to warn market participants against premature entries. Following a period of extreme volatility where the asset retreated from its all-time high near $126,000, the current price action around the $90,000 to $91,500 range appears precarious.

Technical Red Flags and "Danger" Zones

Recent technical analysis highlights a breakdown of critical support levels that previously anchored the bullish narrative. The "danger" signaled by current charts stems from a confluence of bearish indicators, including a negative crossover in the #MACD (Moving Average Convergence Divergence) and the price slipping below the 50-week moving average. Historically, when $BTC fails to maintain these structural supports, it enters a phase of discovery where the next psychological and technical floor may sit significantly lower—potentially between $70,000 and $80,000. The presence of "long upper shadows" on recent weekly candles indicates that every attempt at a relief rally is being met with aggressive selling pressure, further validating the "falling knife" thesis.

Market Sentiment and Macro Pressures

Beyond the charts, broader macroeconomic factors are intensifying the downward pressure. The market is currently navigating a "risk-off" environment, influenced by geopolitical uncertainties and shifting regulatory landscapes in early 2026. While institutional inflows through Spot #EFTs provided a temporary cushion, the sheer volume of liquidations—totaling hundreds of millions of dollars in recent sessions—suggests that the market is currently driven by forced selling and panic. In this high-volatility climate, the primary risk is not just the price drop itself, but the lack of clear "exhaustion" volume that usually precedes a true market bottom.