Short intro:

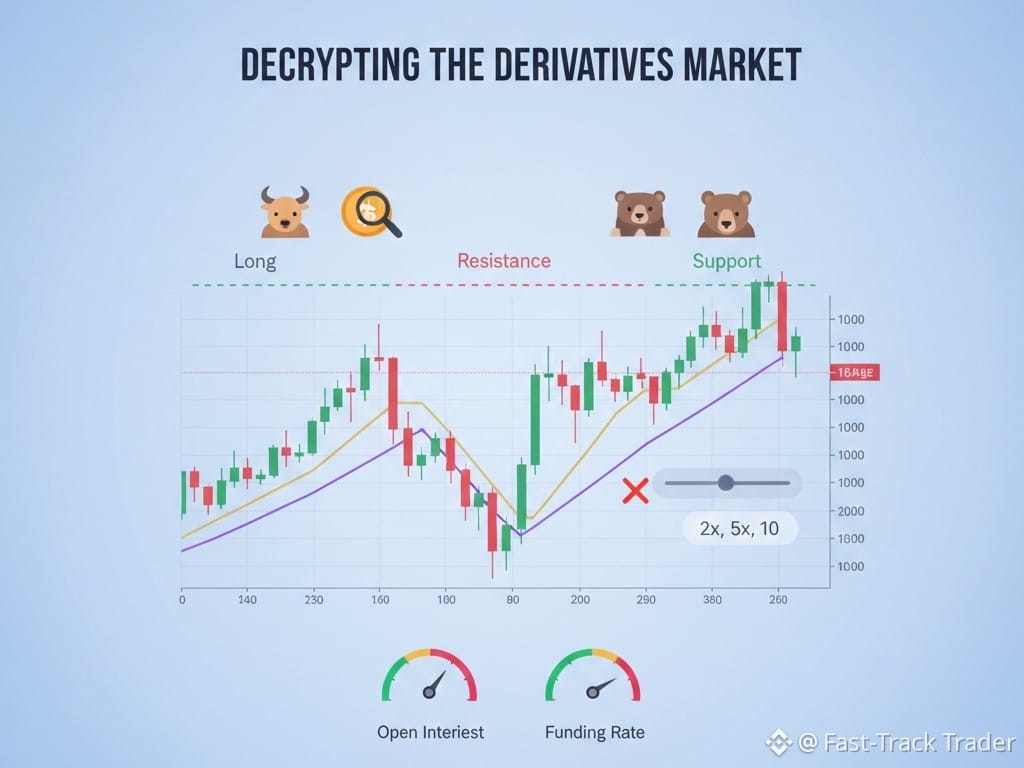

Today’s derivatives markets saw intense activity as large futures liquidations wiped out significant leveraged positions. This event shows how leveraged trading can amplify volatility — for better or worse.

What happened:

In the last trading session, exchanges reported over $600M in futures liquidations within a single hour, with total daily liquidations exceeding $1.5B across Bitcoin, Ethereum, and other major tokens. These events occur when leveraged positions fail as prices move against traders.

Why it matters:

Liquidations don’t signal direction by themselves, but they reflect risk dynamics. Heavy liquidations can deepen volatility and trigger cascading effects in markets tied to leverage, especially during sharp moves. Beginners should note that derivatives trading introduces risks far beyond spot markets.

Key takeaways:

Over $600M in liquidations occurred within one hour.

Derivatives markets can magnify price volatility.

Market stress events offer learning points on risk and leverage.

#CryptoFutures #Liquidations #Bitcoin $BTC #Ethereum $ETH #Derivatives