Headline:

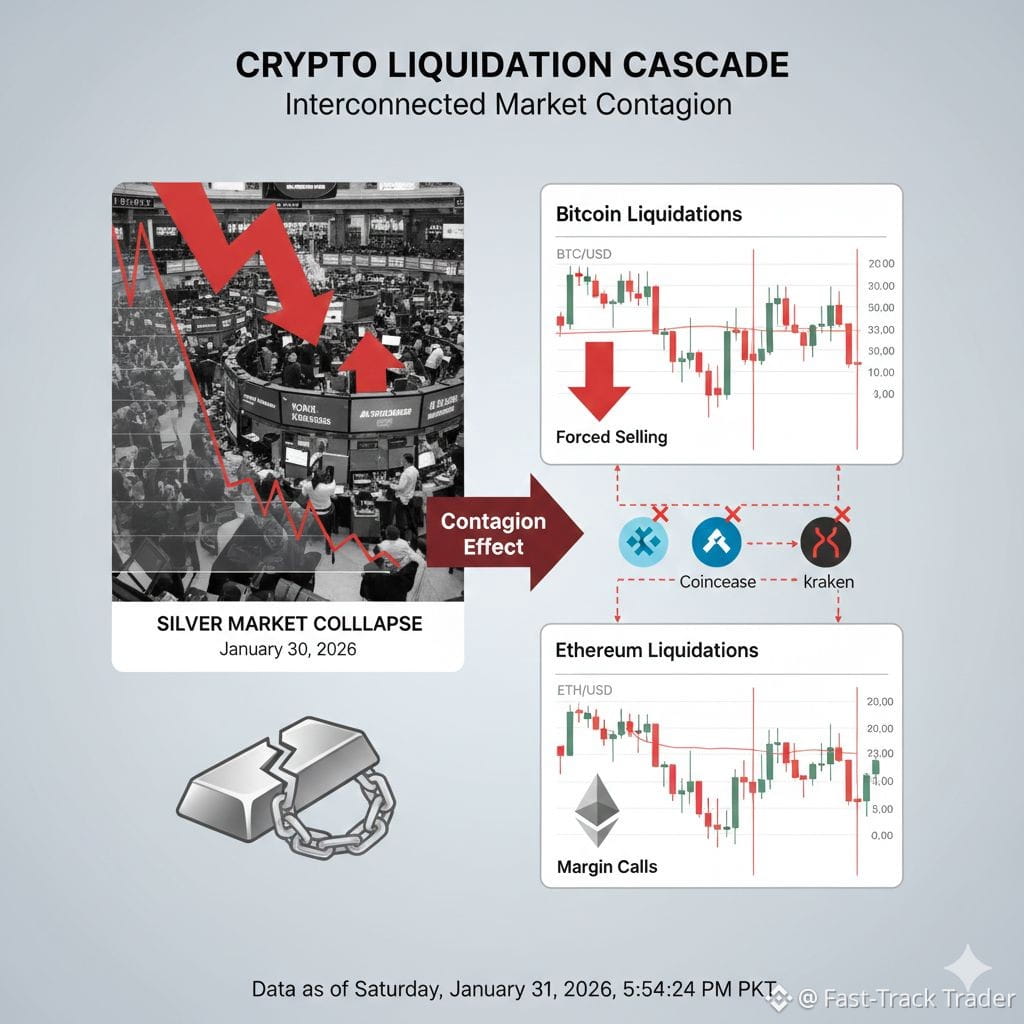

Silver Market Shock Sends More Than $140M in Crypto Liquidations

Short Intro:

An unexpected sell-off in the silver market rippled across digital assets today, triggering substantial liquidations — not just in Bitcoin and Ethereum, but even beyond them. This unusual cross-asset event has become a major talking point in crypto circles.

What happened:

A sharp crash in silver prices caused more than $142 million in crypto liquidations across several exchanges, with tokenized silver trading contributing directly to sell pressure in digital assets. This event overtook liquidations tied to Bitcoin and Ether in the same timeframe, highlighting how traditional asset movements can spill over into crypto markets.

Why it matters:

This trend illustrates that crypto markets aren’t isolated — macro and commodity sell-offs can trigger derivative liquidations and risk-off behavior among traders. For beginners, understanding how cross-market contagion works helps explain sudden moves that may otherwise seem crypto-specific.

Key Takeaways:

Silver price crash triggered significant crypto sell-offs.

More liquidations occurred in tokenized silver than in Bitcoin or Ethereum.

Cross-asset volatility can materially impact crypto derivatives.

#CryptoLiquidations #MarketCorrelation #SilverCrash #Bitcoin $BTC #Ethereum $ETH