I started paying attention to stablecoin settlement after handling small cross-border transfers. Nothing fancy just moving USDT between wallets. Yet even these simple operations often felt frustrating. Fees fluctuated without warning, transfers slowed at inconvenient times and what should have been routine settlement suddenly felt unreliable. It made me wonder are general-purpose blockchains really built for this kind of work?

The core problem lies in a mismatch between transaction needs and network design. Most Layer 1 chains aim to do everything at once DeFi, NFTs, governance, and more. Simple stablecoin transfers end up competing for block space, causing unpredictable confirmation times, rising fees and fragmented liquidity. Bridges multiply, adding complexity to operations that should be straightforward.

It’s like routing freight trucks through streets built for pedestrians: technically possible, but inefficient.

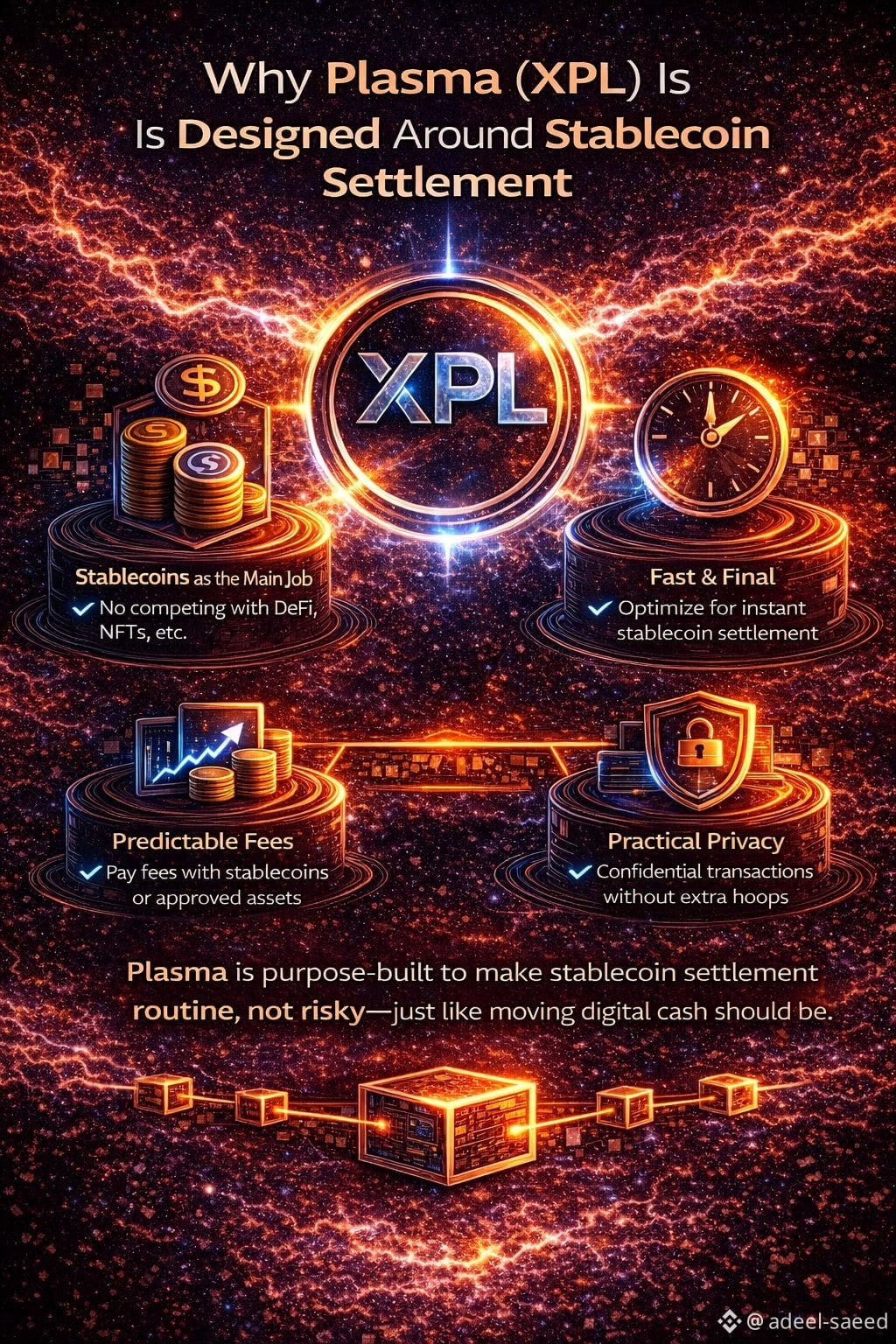

@Plasma solves this by narrowing its focus. Stablecoin transfers aren’t an afterthought they’re the network’s main priority. By streamlining overhead and isolating these flows from unrelated activity, Plasma makes payments fast, predictable, and boring in the best sense. High-volume, low-margin transactions can finally operate without friction.

Under the hood, the chain is optimized for consistent throughput and near-instant finality. Transfers settle in seconds even under sustained load, and the network remains compatible with Ethereum tooling so developers don’t have to relearn deployment practices. What changes isn’t the environment it’s the priority.

A key innovation is fee abstraction. Users aren’t required to hold a native token just to move stablecoins. Fees can be paid using stablecoins themselves or other approved assets. In some cases, gas can even be sponsored under controlled conditions, making small transfers predictable without introducing opportunities for abuse.

Privacy is handled with the same practical lens. Settlements like payroll, treasury movements, or internal transfers don’t need full transparency. Plasma supports confidential transactions without forcing custom tools or complex workflows, letting privacy remain an optional feature rather than a barrier.

No system is perfect. Extreme network demand and evolving regulatory expectations will always present challenges. But specialization shifts the calculus. Plasma doesn’t aim to be a general-purpose playground it aims to be reliable infrastructure for moving digital value.

If stablecoins are meant to act as digital cash, settlement must be simple, predictable, and uneventful. Plasma isn’t chasing hype or trying to do everything. It’s built to ensure that when dollars move, they move the way they should.#plasma $XPL