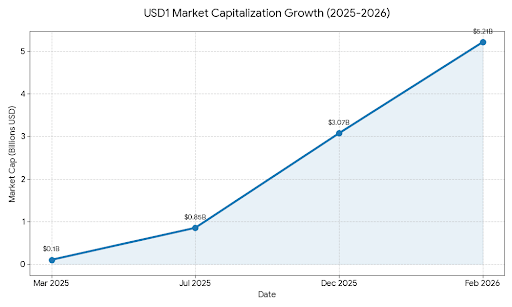

As of February 2026, USD1 (World Liberty Financial USD) has cemented itself as a top-tier stablecoin, reaching a market capitalization of $5.21 billion. Launched in early 2025 by World Liberty Financial (WLF)—a project closely tied to the Trump family—the token has transitioned from a new entrant to a major liquidity pillar in less than a year.

The following chart illustrates this aggressive growth:

Key Success Factors

Institutional Backing: High-profile deals, including a $2 billion investment from the UAE’s MGX using USD1, have provided massive utility and trust.

Low-Cost Efficiency: WLF’s zero-fee model for minting and redemptions has successfully courted high-volume traders who typically use USDT or USDC.

Multi-Chain Reach: Utilizing Chainlink’s CCIP technology, USD1 maintains seamless liquidity across Ethereum, BNB Chain, and Solana.

Regulatory Ambition: WLF is currently pursuing a U.S. national trust bank charter to bring the stablecoin under federal supervision.

Current Outlook

Despite its success, USD1 faces fresh scrutiny. In February 2026, the House Select Committee launched a probe into a $500 million investment from UAE-linked entities, citing potential national security concerns and conflicts of interest.

Nevertheless, market demand remains high. With a 50% increase in supply over the last month alone, USD1 is quickly becoming the preferred "digital dollar" for both retail yield-seekers and institutional settlements.