Vanar doesn’t behave like most L1s on a chart, and you notice that long before you understand its architecture. The first thing that stands out isn’t explosive upside or dramatic collapses, but a kind of uneven gravity. Price drifts, pauses, then moves in ways that feel disconnected from broader market rhythms. As a trader, that’s usually a red flag — until you spend enough time watching the order books thin out at odd moments and realize the market is reacting to something structural, not narrative-driven noise.

I first held VANRY expecting the usual cycle: announcement-driven volatility, liquidity floods around events, then decay. Instead, what I saw was a token that struggled to attract reactive liquidity. Moves happened, but they weren’t chased. Breakouts often stalled not because of selling pressure, but because participation simply didn’t show up. When volume dried up, it wasn’t dramatic — it was quiet. That’s when it became clear that Vanar’s market behavior was shaped less by speculation and more by how its ecosystem actually functions day to day.

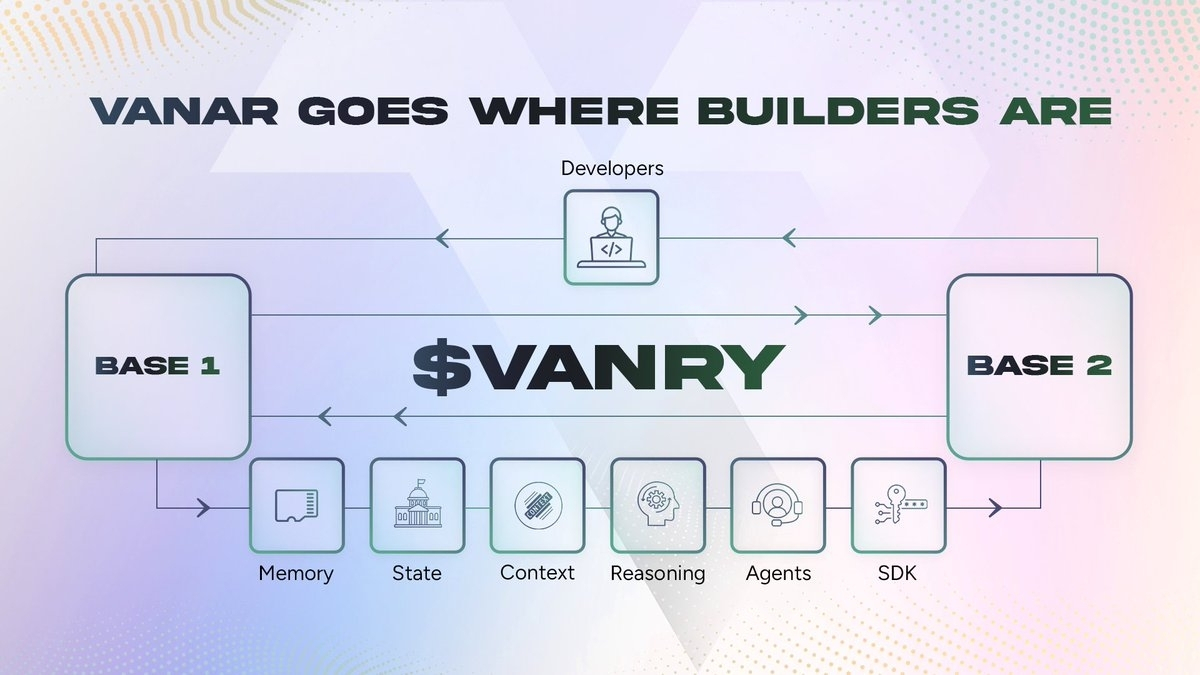

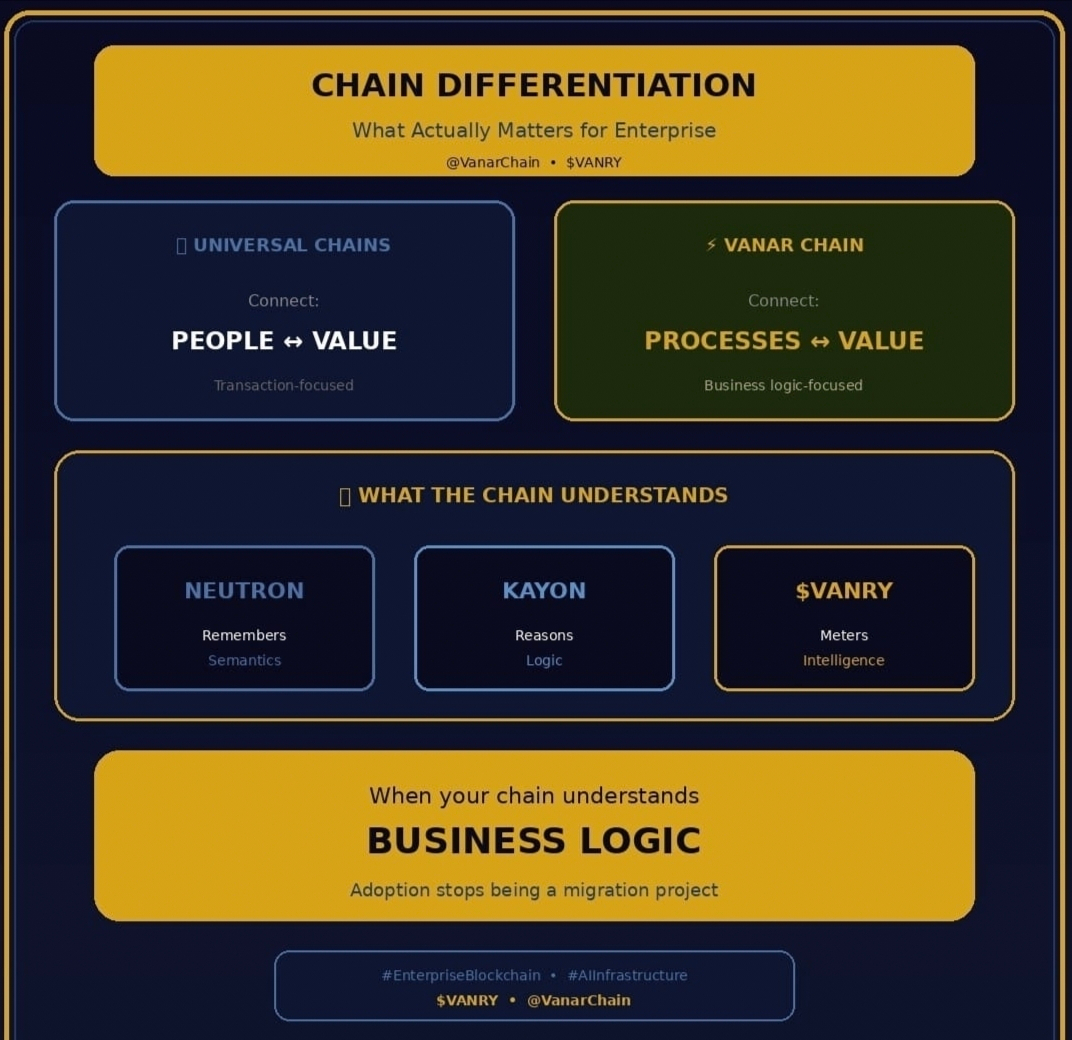

Vanar is built around consumer-facing applications — games, entertainment, branded digital experiences — and that design choice leaks directly into token behavior. Most L1s optimize for developer experimentation or DeFi composability, which naturally creates on-chain churn. Vanar optimizes for end users who don’t think in terms of transactions or yield. The result is that on-chain activity doesn’t translate cleanly into speculative flow. You can see usage without seeing aggressive buy pressure, and that confuses traders who expect usage metrics to front-run price.

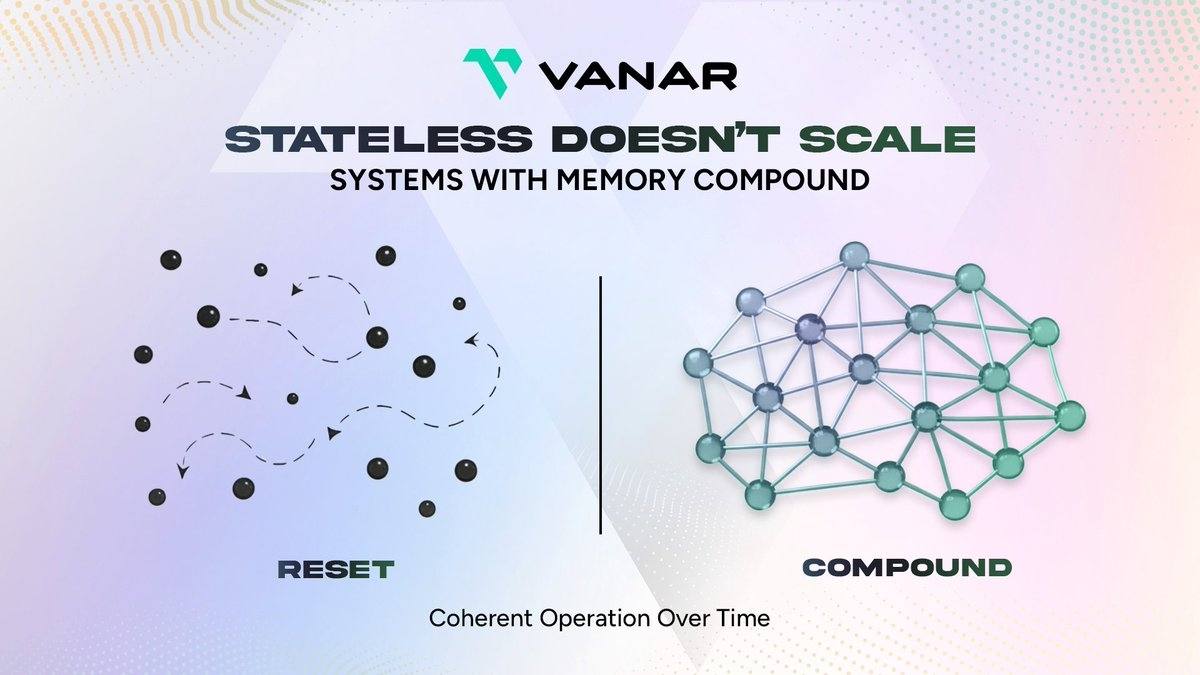

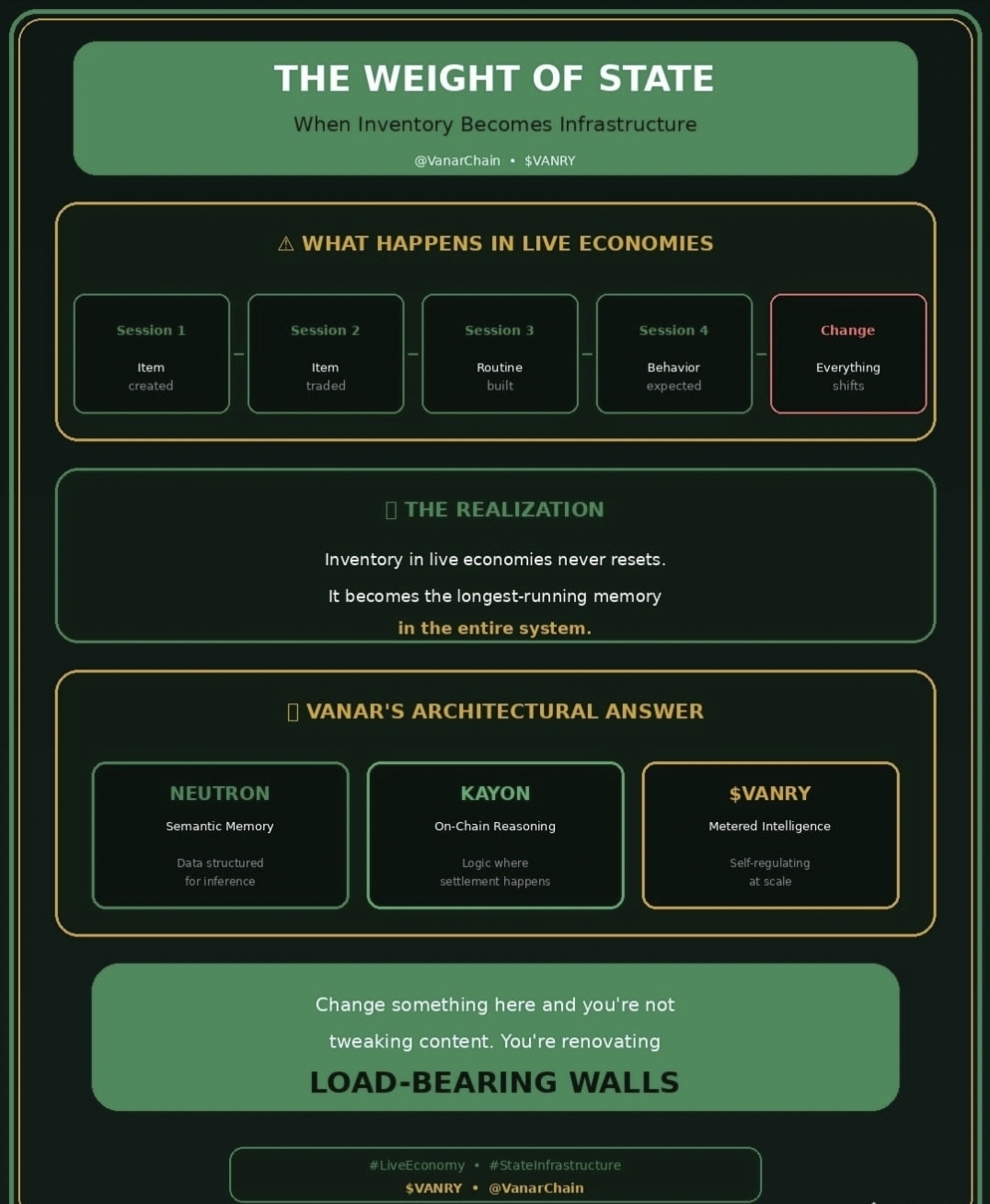

This disconnect creates persistent mispricing. VANRY often trades as if it’s waiting for a narrative catalyst that never quite arrives, because the real demand is diffuse and slow. When tokens are used indirectly — embedded into systems where users don’t consciously acquire or trade them — demand doesn’t show up as sharp spikes. It shows up as a reduction in circulating velocity. That’s subtle, and markets are terrible at pricing subtlety. Traders look for momentum, but Vanar’s design dampens momentum by design.

Liquidity gaps form because holders aren’t uniformly speculative. Some supply is sticky for reasons unrelated to price: infrastructure commitments, ecosystem integrations, or long-term exposure tied to product roadmaps rather than market cycles. When price moves into these zones, it either slips through too easily or gets pinned unexpectedly. You see this when price drops through levels that should hold, not because conviction is gone, but because there simply aren’t enough active bids to absorb flow. Then later, price grinds upward with almost no resistance, catching shorts off guard.

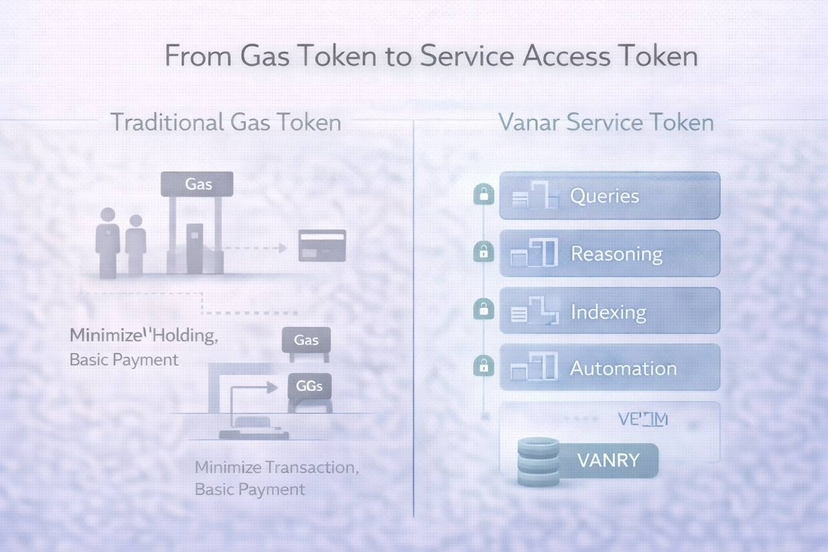

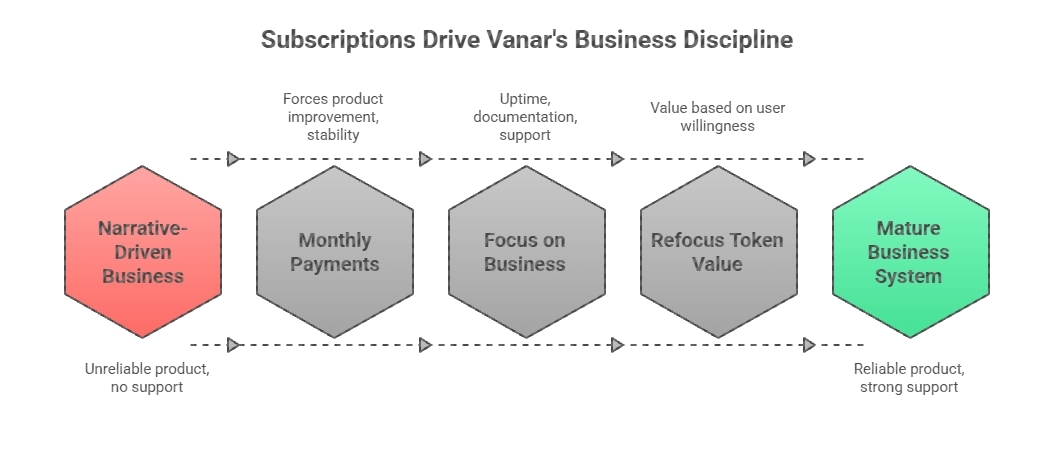

Token utility is another area where surface-level analysis fails. VANRY does things, but not in the clean, reflexive way traders are trained to recognize. It’s not a pure fee-capture token, and it’s not a governance chip people fight over. Its utility is contextual, embedded across products that prioritize seamless user experience. That means utility doesn’t immediately translate into “buy token now” behavior. From a chart perspective, that delays feedback loops. The market underestimates utility that doesn’t scream for attention.

This creates psychological friction. Traders want confirmation. They want volume to validate price, and Vanar rarely gives that in the moment. Moves feel unsupported even when they’re structurally sound. That’s why VANRY often retraces not because fundamentals weaken, but because traders lose confidence in what they can’t immediately measure. The irony is that this same hesitation keeps the token from becoming overheated. Excess leverage doesn’t build easily. You don’t see cascading liquidations because positioning rarely becomes crowded.

Adoption, too, moves differently here. Vanar’s products aim at audiences that don’t rotate capital aggressively. Gamers, brands, and entertainment platforms onboard slowly and leave even slower. That kind of adoption doesn’t produce sudden network effects that light up dashboards. It produces steady baseline activity that keeps the chain alive without exciting speculators. From a market standpoint, this is uncomfortable. Slow adoption feels like no adoption if you’re conditioned to chase acceleration.

There are weaknesses in this model, and they matter. Without clear speculative hooks, Vanar risks being perpetually undervalued relative to its actual usage. That sounds like an opportunity, but it also means liquidity can remain fragile longer than expected. When macro conditions tighten, tokens like VANRY don’t benefit from reflexive hype cycles to offset risk-off behavior. Price can drift lower simply because attention leaves, not because anything breaks.

At the same time, the architecture that limits upside explosions also limits downside chaos. I’ve watched VANRY during broader market stress, and while it doesn’t rally aggressively, it also doesn’t unravel spectacularly. There’s a kind of structural resilience that comes from not being over-financialized. For traders, this creates a strange profile: less exciting, less dangerous, and harder to trade using conventional strategies.

The biggest misunderstanding around Vanar is that people try to read it like a narrative L1. They wait for headlines, partnerships, or ecosystem announcements to justify price movement. But the market doesn’t respond strongly to those because the token isn’t designed to amplify them. Vanar should be read like infrastructure that quietly absorbs activity rather than monetizing attention. That’s not how most crypto markets are trained to think.

Over time, incentives either leak or compound. With Vanar, compounding happens slowly through integration, not speculation. That’s invisible until it isn’t. When enough supply becomes functionally illiquid due to real usage, price behavior changes abruptly — not in a vertical pump, but in a shift in how easily the market can move the token at all. Spreads widen. Slippage increases. Small flows have outsized impact. Traders often misinterpret that as manipulation, when it’s really a sign that structure has changed.

Reading Vanar correctly requires flipping the usual lens. Instead of asking when the market will care, you ask how much of the token is actually free to move. Instead of watching headlines, you watch how price reacts to low-volume conditions. Instead of chasing momentum, you observe absence — the absence of sellers, the absence of leverage, the absence of panic.

That’s the realization Vanar forces on the market. It’s not a story about being early or late. It’s about understanding that some protocols don’t express their value loudly. They express it by quietly altering the shape of the market around them. Vanar doesn’t reward traders who chase narratives. It rewards those who pay attention to structure, patience, and the uncomfortable spaces where price moves without permission.