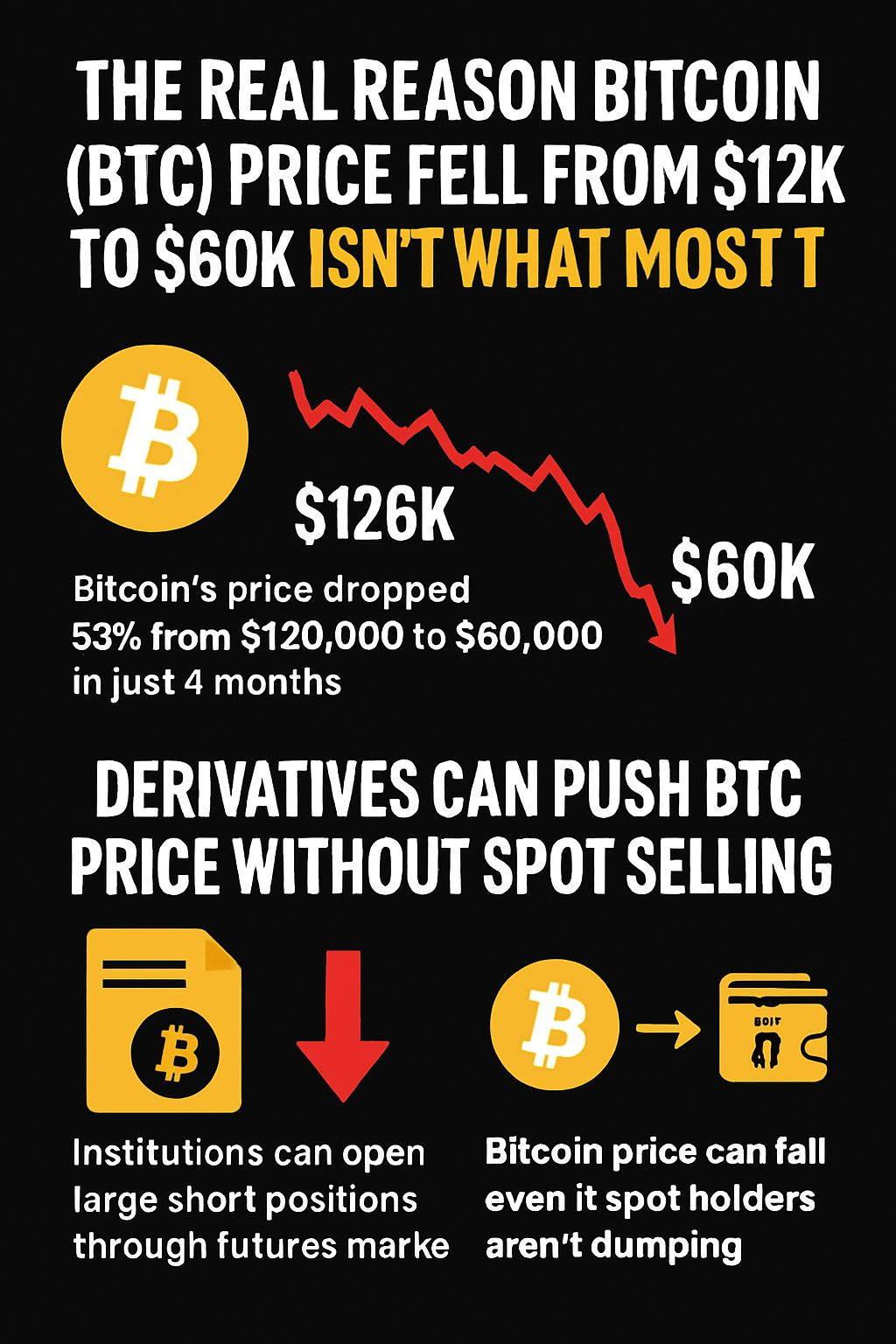

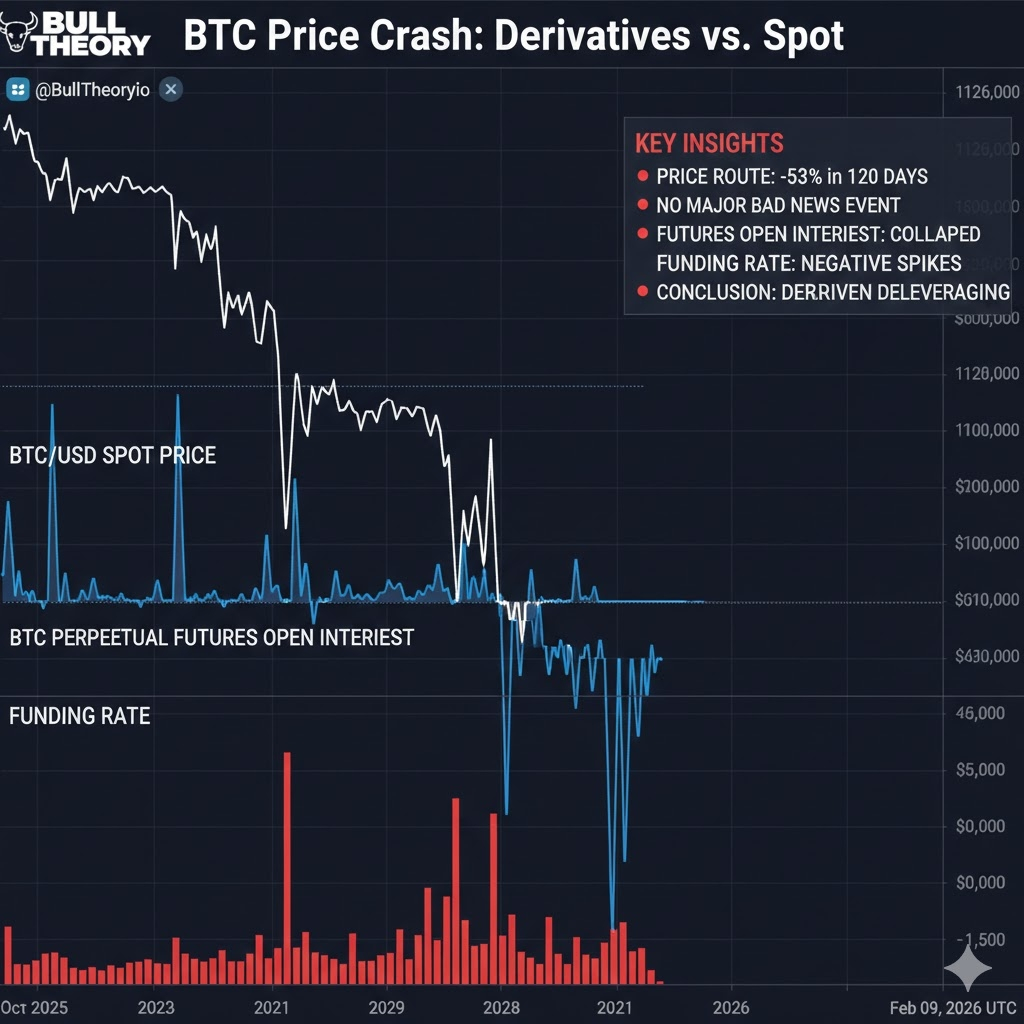

Bitcoin’s -53% drop in just 120 days feels abnormal — because it is.

No exchange collapse.

No outright bans.

No single black-swan headline.

Yet price kept bleeding.

So what actually changed?

🔄 Bitcoin No Longer Trades Like Old Cycles

In early cycles, BTC price was driven by:

Spot buyers & sellers

On-chain coin movement

Fixed supply meeting real demand

That model is no longer dominant.

Today, Bitcoin trades as a synthetic, leveraged asset.

A huge share of price discovery now happens via:

Futures & perpetuals

Options

ETFs

Prime broker lending

Wrapped BTC & structured products

👉 Exposure without touching real BTC.

⚙️ How Derivatives Pushed BTC Lower — Non-Stop

Institutions can short Bitcoin at scale through derivatives:

No need for spot selling

No coins leaving wallets

Once price slips:

Longs get liquidated

Forced selling kicks in

Liquidations trigger more liquidations

That’s why this drop looked mechanical, not emotional:

Funding flips negative

Open interest collapses

Bounce attempts get sold instantly

This wasn’t retail panic.

This was positioning being unwound.

❌ The “21M Supply” Narrative Isn’t Enough Anymore

Bitcoin’s hard cap didn’t change — but effective supply did.

Paper BTC now trades at scale.

Price reacts to:

Hedging flows

Leverage resets

Risk-off macro behavior

Not just spot demand.

Crypto is now treated like a leveraged macro asset.

When stocks wobble → crypto gets sold first.

🌍 Macro = Background Pressure, Not the Trigger

Yes, macro matters:

Equity weakness

Volatile gold & silver

Fed liquidity expectations

Geopolitical tension

But macro amplified the move — it didn’t start it.

This sell-off looks controlled, not capitulatory:

Red candles stacking

Shallow relief rallies

Large players quietly reducing exposure

🔮 What Happens Next?

⚠️ Relief bounces are possible — liquidation events usually get them.

But:

Sustained upside is harder

Derivatives still control price

Global risk remains fragile

📌 The key takeaway:

Bitcoin didn’t dump because fundamentals broke.

It dumped because BTC now trades through leverage, not just supply.

And leverage cuts both ways.

#Bitcoin #BTC #CryptoMarkets #Derivative #MarketStructure #Macro #RiskOff