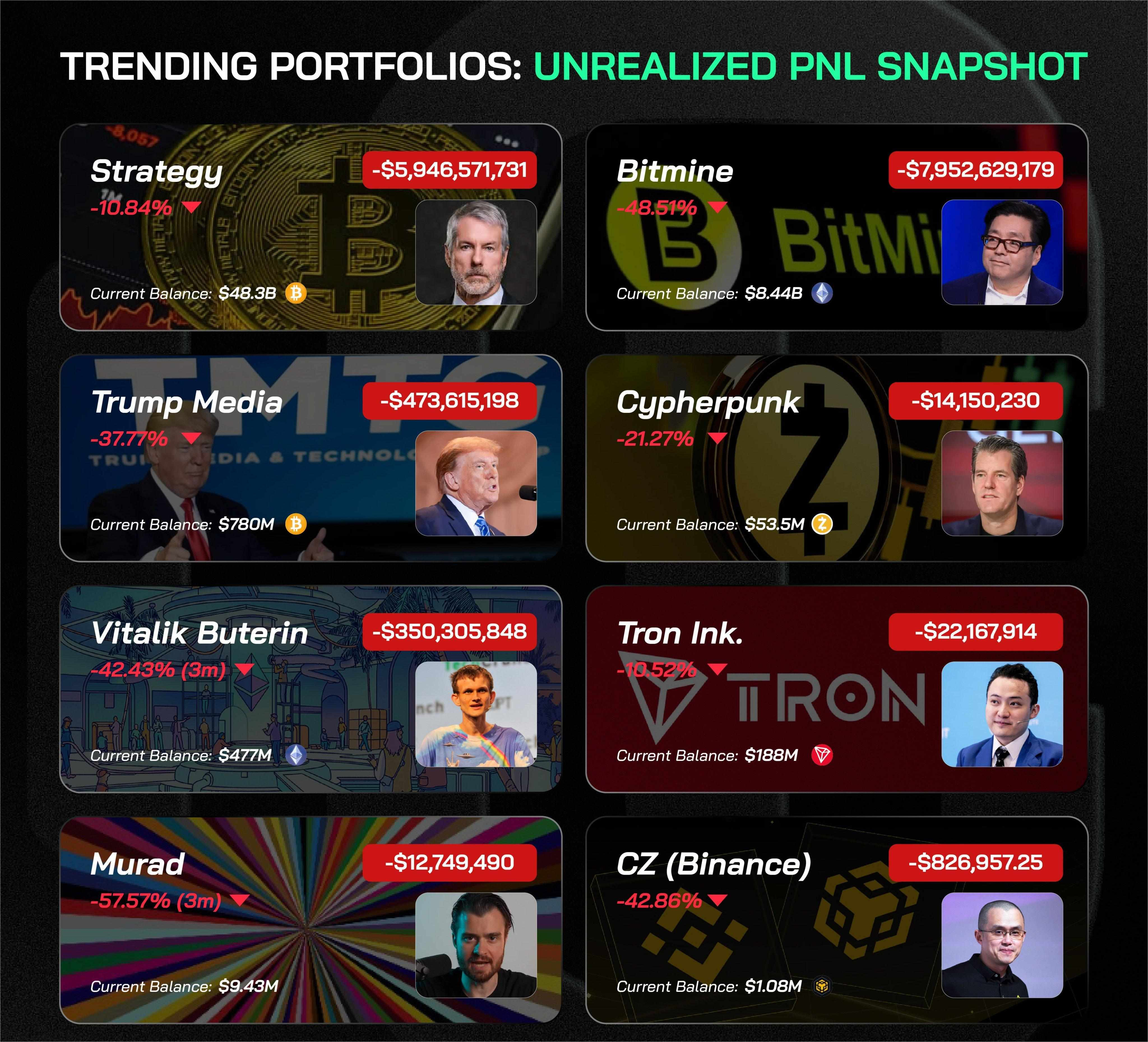

Digital asset treasuries are feeling the heat as unrealized losses continue to stack up across the board.

As of February 6, 2026, major institutional treasuries heavily concentrated in Bitcoin ($BTC ) and Ethereum ($ETH ) are sitting on substantial paper losses. The so-called diamond hands of the industry are being tested at a scale rarely seen before.

Largest Unrealized Losses by Treasury

Strategy: Leading the pack with a staggering -$8.9B unrealized loss on its Bitcoin holdings

Bitmine: Close behind at -$8.6B, primarily exposed to Ethereum

Twenty One: Down -$1.9B

Bitcoin Standard: Sitting at -$1.7B in losses

Metaplanet: Holding through approximately -$1.4B

Even treasuries with significant $SOL exposure, such as Forward and Solana Company, have not been spared, posting combined losses exceeding $1.4B.

In total, unrealized losses across the top 10 digital asset treasuries now exceed $26B.

Despite the drawdown, institutional conviction remains intact at least for now. The key question the market is watching closely:

Is this a generational accumulation zone… or the calm before another wave of capitulation?

The answer will likely define the next major phase of the crypto cycle.