Over the past few years, #Stablecoins have quietly become one of the most useful things in crypto. People use them to send money home, pay freelancers, move funds between countries, and protect savings from unstable currencies. In many places, stablecoins already work like digital dollars. What hasn’t kept up is the infrastructure underneath them.

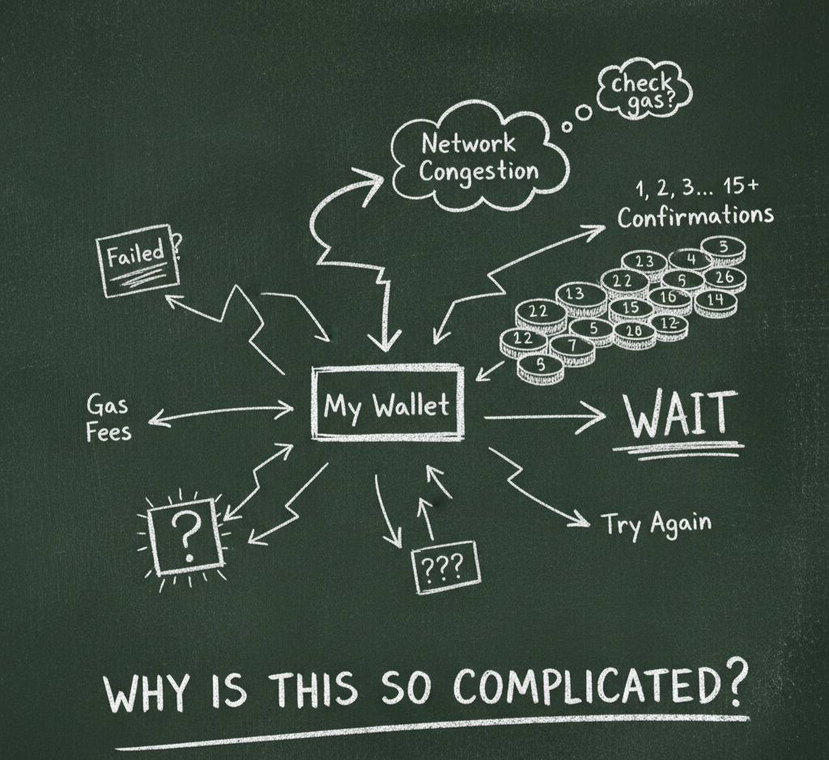

Most blockchains were never built for everyday payments. They were designed for experiments, trading, and smart contracts first. Payments were added later as a side feature. That’s why sending money on-chain still feels stressful sometimes. You worry about fees. You check gas prices. You wait for confirmations. You wonder if something went wrong. None of that belongs in a real payment system.

This is where Plasma feels different.

Instead of trying to be everything at once, it starts with one simple question: what would a blockchain look like if moving stablecoins was the main job, not a secondary use case? When you design from that angle, priorities change. Speed matters differently. Fees matter differently. Reliability matters more than flexibility.

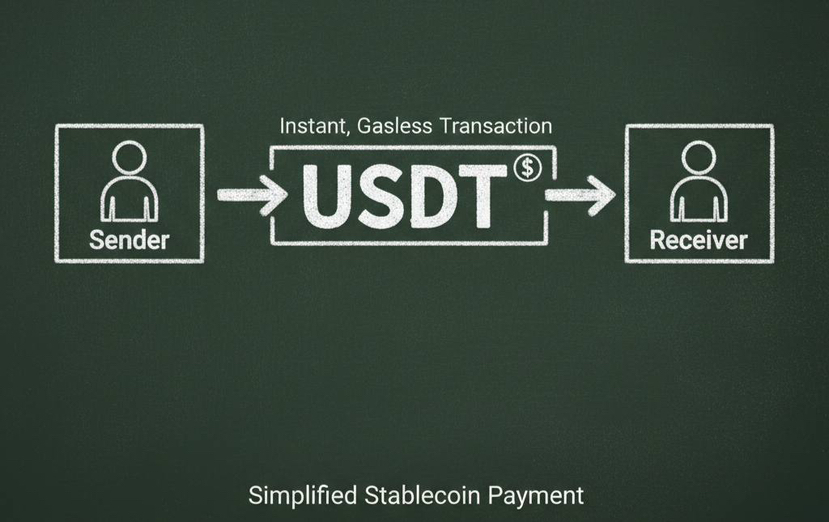

On most networks, users have to hold a volatile token just to pay fees. That alone makes no sense for payments. Imagine needing a separate stock just to swipe your debit card. Plasma removes that mental burden. With gasless or stablecoin-based fees, people can move USDT without thinking about extra steps. It sounds small, but it changes behavior completely. When people stop hesitating before clicking “send,” money starts flowing naturally.

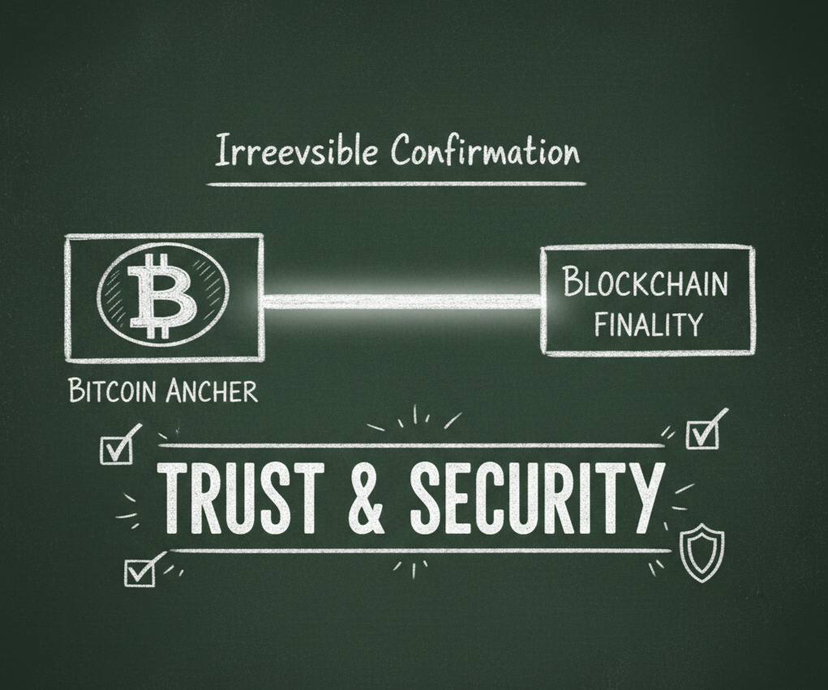

Another big difference is finality. On many chains, a transaction is “probably” done, then “more probably” done, and finally “done.” That uncertainty might be acceptable for traders, but it’s terrible for businesses. Plasma aims for near-instant finality, so once you pay, it feels settled. That confidence is what allows companies and apps to automate around payments without building safety buffers everywhere.

Security also plays a different role in payment networks. Speed alone isn’t enough. People need to trust that the system won’t suddenly change rules, get censored, or collapse under pressure. Plasma’s approach of anchoring parts of its security to Bitcoin is interesting in this context. It’s less about marketing and more about credibility. Bitcoin is slow, conservative, and politically neutral. Using it as a reference point sends a signal: this system cares about long-term stability more than short-term excitement.

What I find refreshing is that Plasma doesn’t seem obsessed with chasing every type of user. It’s not trying to attract yield farmers, NFT flippers, or meme traders. It’s focused on people who already use stablecoins seriously. Workers sending remittances. Small businesses paying suppliers. Platforms handling cross-border payments. Institutions settling large volumes.

These users don’t want flashy dashboards. They want things to work.

They want fees that make sense. They want transactions that don’t fail. They want systems that behave the same way today, tomorrow, and next year. Plasma feels built around those expectations, not around crypto culture.

The role of XPL fits into that picture. It’s not designed to be the emotional center of every interaction. Most users may never care about it directly. Instead, it secures the network and aligns validators around keeping payments reliable. If Plasma grows, XPL benefits from usage, not hype. That’s slower, but it’s also more durable.

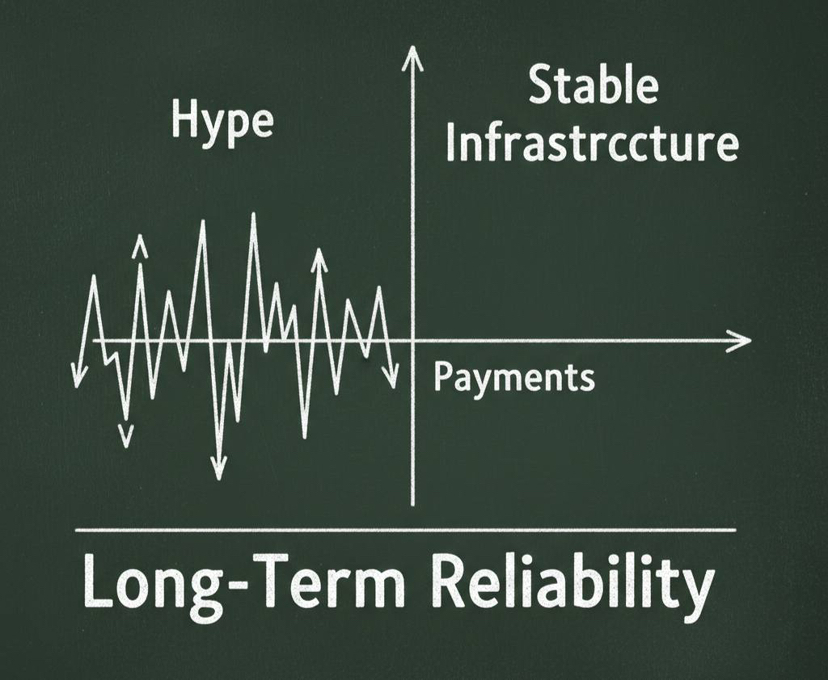

In crypto, we’re used to fast stories. New narratives appear every few months. Everyone rushes in. Then attention moves on. Payment infrastructure doesn’t work that way. It grows slowly. It earns trust over time. It becomes invisible.

And that’s the real goal.

When nobody is talking about how Plasma works, but millions of people are using it every day without stress, that’s success. When sending stablecoins feels as normal as sending a message, that’s adoption.

Crypto doesn’t need more “everything platforms.” It needs systems that do one job extremely well and don’t break when things get busy. Plasma is betting that stablecoin payments are important enough to deserve that kind of focus.

It’s not the loudest strategy.

But in finance, the quiet systems that keep running usually matter the most.