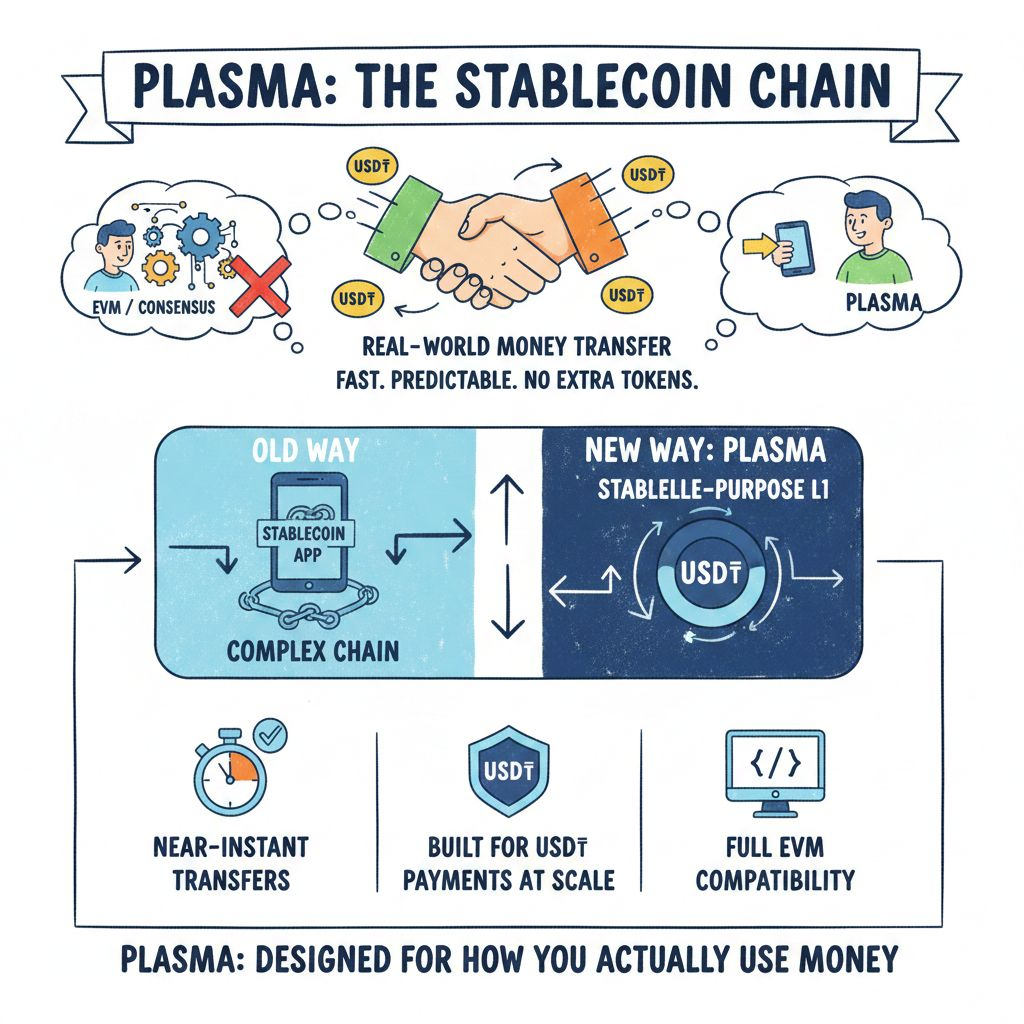

When I try to explain Plasma to a friend who doesn’t care about blockspace debates, I don’t start with “EVM compatibility” or “consensus.” I start with the feeling of sending money in the real world: you don’t want a tour of the banking system, you want the transfer to land—quickly, predictably, and without having to buy a weird extra token just to press “send.”

Plasma reads like a chain built by people who noticed that stablecoins are already the most successful “consumer product” crypto ever shipped, and then asked a blunt question: what if we stopped treating stablecoins as an app on top of a chain, and instead designed the chain around stablecoin behavior? That philosophy is explicit in Plasma’s positioning as a stablecoin-purpose Layer 1 built for USD₮ payments at scale, with full EVM compatibility and near-instant transfers.

The stablecoin-first instincts show up in two product choices that sound small until you try to onboard real humans. First, Plasma’s “stablecoin-first gas” approach aims to let users pay fees in approved ERC-20s via a protocol-maintained paymaster, instead of forcing a native-gas-token detour. Second, there’s an explicit track for gasless USD₮ transfers: a relayer flow that sponsors only direct USD₮ sends, with guardrails to keep it from turning into a free-for-all.

That combination makes Plasma feel less like a general-purpose “crypto computer” and more like a payments appliance. Think of it like the difference between a full Linux desktop and a point-of-sale terminal: the POS terminal is “less powerful” in a philosophical sense, but it wins because it’s optimized around one job and does it without asking the cashier to learn what a package manager is.

Under the hood, Plasma pairs an EVM execution environment (they highlight Reth in their materials) with a BFT-style consensus (PlasmaBFT) tuned for fast finality. The docs describe a pipelined BFT design (derived from the Fast HotStuff family) to reduce time-to-finality while preserving BFT guarantees under partial synchrony. I’m not bringing that up to score technical points; I’m bringing it up because payments traffic behaves differently than DeFi traffic. Payments are bursty, repetitive, and operationally unforgiving. A chain designed for settlement needs to behave like a clearinghouse: finality should be boring, not a cliffhanger.

The “is this real or just a deck?” check is always on-chain activity. Plasma’s explorer (Plasmascan) currently shows a very large aggregate transaction count (150M+ total transactions) and a steady block cadence that visually reads as ~1-second-ish blocks on the overview pages. The same explorer’s USDT0 token page is especially revealing because Plasma’s thesis is stablecoin settlement: it shows a large holder base (183,896 holders) and an on-chain market cap figure around ~$1.44B for USDT0 at the time the page snapshot is rendered. Those numbers don’t “prove” retail payments adoption by themselves, but they do show something more meaningful than vibes: stablecoin balances and transfers are not an afterthought on this network.

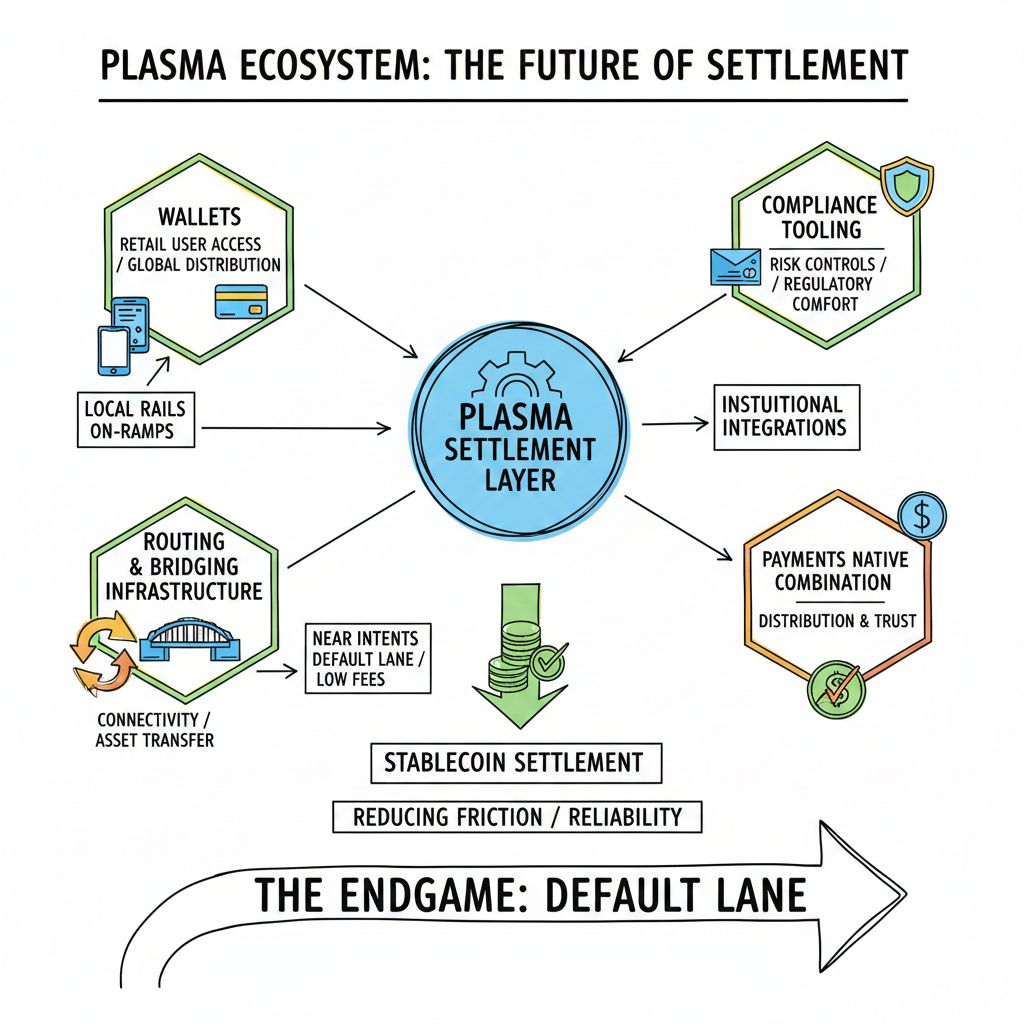

And that leads to what I’d call Plasma’s most important recent update: it’s moving toward becoming not just a place where stablecoins move cheaply, but a place where stablecoins can be routed intelligently across chains and venues. In late January 2026, Plasma integrated NEAR Intents—framed as enabling large-volume stablecoin cross-chain settlement and swaps via a decentralized solver network, with pricing aims that compete with centralized exchange execution.

Why does that matter? Because once payments become real, they stop living in a single walled garden. Merchants, remitters, and treasury desks don’t wake up thinking “Which chain am I loyal to today?” They think in routes: cheapest path, fastest settlement, least failure risk, best liquidity. NEAR Intents is basically an attempt to turn cross-chain settlement into an intent-based problem (“I want USD₮ there”) rather than a bridge-clicking ritual (“I guess I’ll hop here, then there, then pray”). If Plasma becomes a preferred destination for stablecoin settlement while intent solvers handle the messy multi-chain choreography, that’s a real wedge into institutional and high-volume payment flows.

There’s also a quiet point here about UX honesty. A lot of chains say “users don’t need to think about gas,” but what they mean is “users need to think about gas less often.” Plasma is more aggressive: “for the most common action (send USD₮), make the fee disappear, and for everything else, let stablecoins pay for it.” That’s not just kinder UX; it’s a distribution strategy for high-adoption markets where stablecoins already behave like informal digital dollars and nobody wants a second asset in the loop.

Now, the part that people tend to misunderstand: Plasma can be stablecoin-first without pretending token economics don’t exist. XPL is still the asset that secures the network and aligns validators and long-term incentives. Plasma’s tokenomics documentation states a 10B initial supply and lays out allocations across public sale, ecosystem/growth, team, investors, etc. A very concrete calendar detail matters for anyone watching supply dynamics: Plasma has said US public-sale participants’ distribution occurs on July 28, 2026 (12 months after the sale concluded), in line with applicable laws. That date isn’t narrative; it’s a potential liquidity and market-structure event.

Here’s my personal way of reconciling the “stablecoin-first UX” with “token-secured network”: Plasma is trying to make XPL feel like the electricity grid—critical infrastructure that you don’t hand to the end user as part of the checkout experience. You don’t ask someone buying groceries to purchase an “electricity token” first, but the grid still needs a pricing and incentive system behind the scenes. If Plasma succeeds, most users will experience the network through USD₮ flows, while XPL remains an operator/incentive primitive more than a consumer-facing object.

Ecosystem signals point in the same direction. Plasma publicly lists an ecosystem mix that includes wallets and routing/bridging infrastructure plus compliance tooling—an unusually “payments-native” combination. That matters because payments don’t scale on ideology; they scale on distribution and trust. Retail users arrive through wallets and local rails, institutions arrive through risk controls and operational comfort. If Plasma is serious about straddling retail in high-adoption markets and institutions in finance, then “boring integrations” are the real product.

The bigger story, to me, is that Plasma is trying to win stablecoin settlement the way successful logistics companies win shipping: by removing friction at the edges and making the middle absurdly reliable. Stablecoins already have demand; the market is choosing routes and venues. Plasma’s latest routing step (NEAR Intents) is a clue that the team understands the endgame isn’t just “low fees,” it’s “default lane.”

If you want a grounded way to watch whether this thesis keeps working over the next couple of quarters, ignore slogans and track three things: (1) whether gasless USD₮ transfers expand beyond Plasma’s own surfaces into third-party apps, (2) whether stablecoin-first gas becomes the norm for payments-style contracts (not just a demo feature), and (3) whether the on-chain stablecoin footprint (holders, transfers, consistent transaction flow) grows steadily rather than spiking around campaigns and then fading. The explorer data already gives you a starting baseline for (3).

Plasma isn’t pitching a new religion. It’s pitching a piece of infrastructure that behaves like money should: fast, neutral enough to be credible, and unreasonably easy to use compared to what most chains still ask of ordinary people.