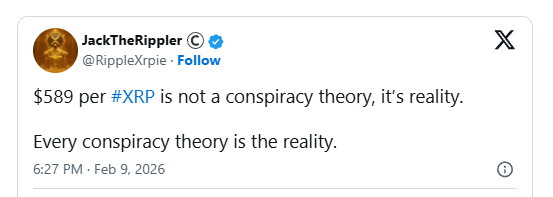

In the world of crypto, bold predictions often face ridicule—until they don't. While a target of $589 per $XRP sounds like science fiction to some, a dedicated segment of the community, led by voices like JackTheRippler, argues it’s a matter of structural inevitability. 🚀

🧱 The Foundation of the $589 Thesis

The argument for such an extreme valuation isn't based on simple "hype," but on the potential for a total shift in global finance:

Bridge Asset Utility: XRP is designed to provide instant liquidity for cross-border payments. If XRP captures a significant portion of the $27 Trillion currently locked in global Nostro/Vostro accounts, the demand could theoretically push prices to astronomical levels. 🌍

The "Rule 589" Connection: Some theorists point to COMEX Rule 589, which manages price spikes in precious metals, suggesting XRP could be positioned as a "digital gold" standard for a new financial system. 🏛️

Institutional Adoption: As Ripple secures more partnerships with central banks for CBDCs, XRP’s role as the universal "bridge" becomes more critical.

⚖️ Skepticism vs. Structural Potential

⚖️ Skepticism vs. Structural Potential

Critics often point to the Market Cap problem—at $589, XRP’s market cap would exceed the GDP of most nations. However, proponents argue that in a "liquidity-driven" model where XRP facilitates trillions in daily volume, traditional market cap metrics may become obsolete. 📊

"Extraordinary ideas frequently face ridicule before gaining traction." — JackTheRippler reframes the target not as a guess, but as an early acknowledgment of a global financial reset.

💡 Investor Takeaway

Whether $589 is a literal target or a symbol of XRP's massive scale, the focus remains on utility. For long-term holders, the real value lies in Ripple’s ability to replace aging systems like SWIFT with high-speed, low-cost blockchain technology.

Do you think $589 is a "fantasy" or the "final destination" for XRP? Let’s hear your thoughts below! 👇