South Korean financial regulators confirmed Monday that 86 users sold some or all of the Bitcoin that was mistakenly deposited into their accounts by crypto exchange Bithumb last week, following one of the most dramatic operational errors in recent exchange history.

What Actually Happened?

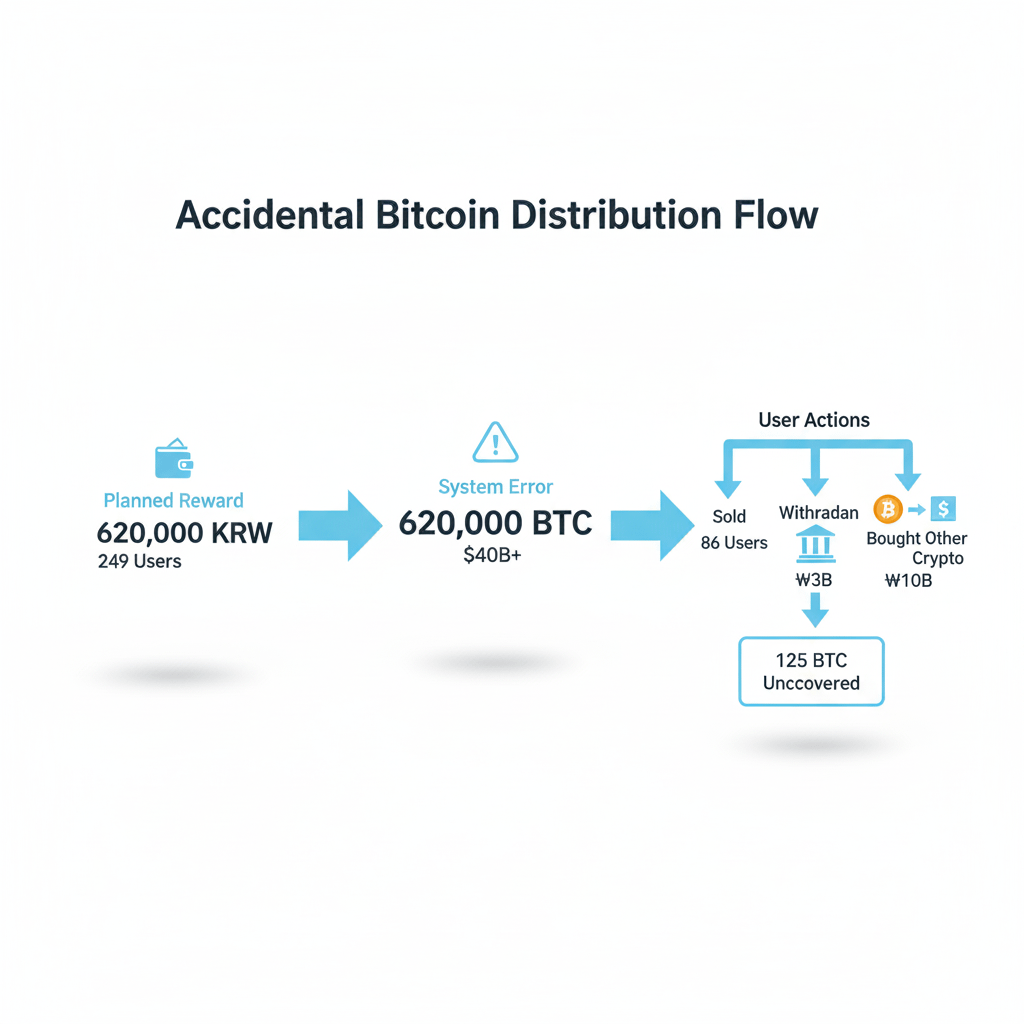

The incident took place during what was supposed to be a minor promotional campaign. Bithumb had planned to distribute small cash rewards totaling 620,000 won (around $424) to 249 selected participants.

However, due to a critical internal system error, the exchange accidentally transferred 620,000 bitcoins instead of 620,000 won — a staggering mistake valued at over $40 billion at the time. For a brief period, affected users appeared to hold massive Bitcoin balances, effectively turning ordinary traders into instant multimillionaires.

The error triggered immediate selling pressure on the platform as some users began liquidating the mistakenly credited BTC.

Immediate Response from Bithumb

The exchange quickly halted transactions at approximately 7:40 p.m. Friday after detecting the abnormal activity. Emergency recovery procedures were launched, including:

Freezing affected accounts

Blocking withdrawals where possible

Coordinating with financial authorities

Initiating direct contact with impacted users

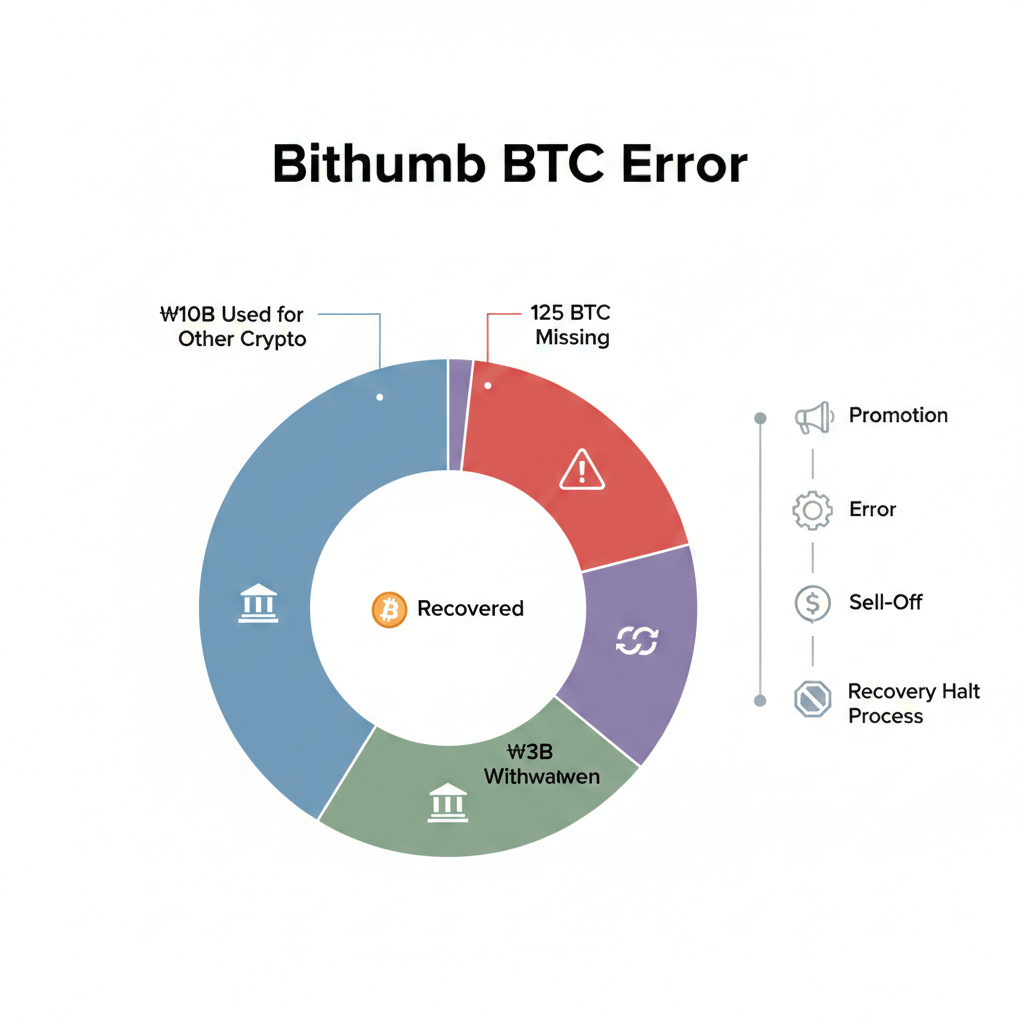

According to officials, Bithumb has successfully recovered most of the wrongly distributed assets. However, 125 bitcoins remain unrecovered, with an estimated value of approximately 13 billion won.

Where Did the Missing Funds Go?

Authorities disclosed that:

Around 3 billion won has already been withdrawn into users’ bank accounts.

The remaining 10 billion won was reportedly used to purchase other digital assets on the exchange.

This complicates the recovery process, as some funds have moved beyond the original Bitcoin balances and into different asset classes.

Legal and Regulatory Implications

This case raises several important legal and ethical questions:

1. Obligation to Return Mistaken Transfers

Under South Korean law, funds transferred in error are typically considered unjust enrichment. Recipients may be legally obligated to return assets they were not entitled to receive.

2. Potential Criminal Liability

If individuals knowingly exploited the error for personal gain, authorities may examine whether criminal intent can be established.

3. Exchange Risk Controls

The incident highlights serious concerns about internal risk management, transaction validation systems, and operational safeguards at centralized exchanges.

Market Impact and Industry Lessons

Although the broader crypto market remained relatively stable, the incident sparked intense discussion within the industry about:

Centralized exchange vulnerabilities

Internal control mechanisms

Automated reward systems

Emergency response protocols

This event serves as a reminder that even major exchanges can experience catastrophic operational failures — and that system-level safeguards must be airtight, especially when handling assets worth billions.

It also demonstrates how quickly liquidity events can unfold when unexpected balances appear in user accounts. In a highly automated trading environment, even a short delay in detection can lead to significant asset movement.

Ongoing Recovery Efforts

A Bithumb representative stated that the company is individually contacting users who sold the mistakenly credited Bitcoin, requesting cooperation in returning the proceeds and negotiating recovery methods.

Authorities are closely monitoring the situation, and further regulatory review is possible.

Bigger Picture

Mistakes like this are rare but when they happen in crypto, the scale can be extraordinary. The incident reinforces three critical truths:

Operational precision is non-negotiable in digital asset platforms.

Transparency and rapid crisis management are essential to maintain trust.

Users who receive mistaken transfers may not legally or ethically be entitled to keep them.

As recovery efforts continue, the case may become a significant reference point for how crypto exchanges handle large-scale internal errors in the future. #BTC #BithumbNews