Season 6, Episode 9 – The Finale

The Dark Market of Cryptocurrencies: How Bitcoin (BTC) Controls Everyone, and Why Other Coins Cannot Break Free

In February 2026, the cryptocurrency market stands on the edge of the abyss. After years of promises about the “super cycle” and institutional adoption, it appears that the traditional four-year cycle (which began with the 2024 halving) has reached its darkest conclusion. This is not just a temporary correction; it is the final episode in a long series of illusion and manipulation, where the black side of Bitcoin’s dominance is finally exposed.

1. The Current Scene: BTC at the Top… While Everyone Bleeds

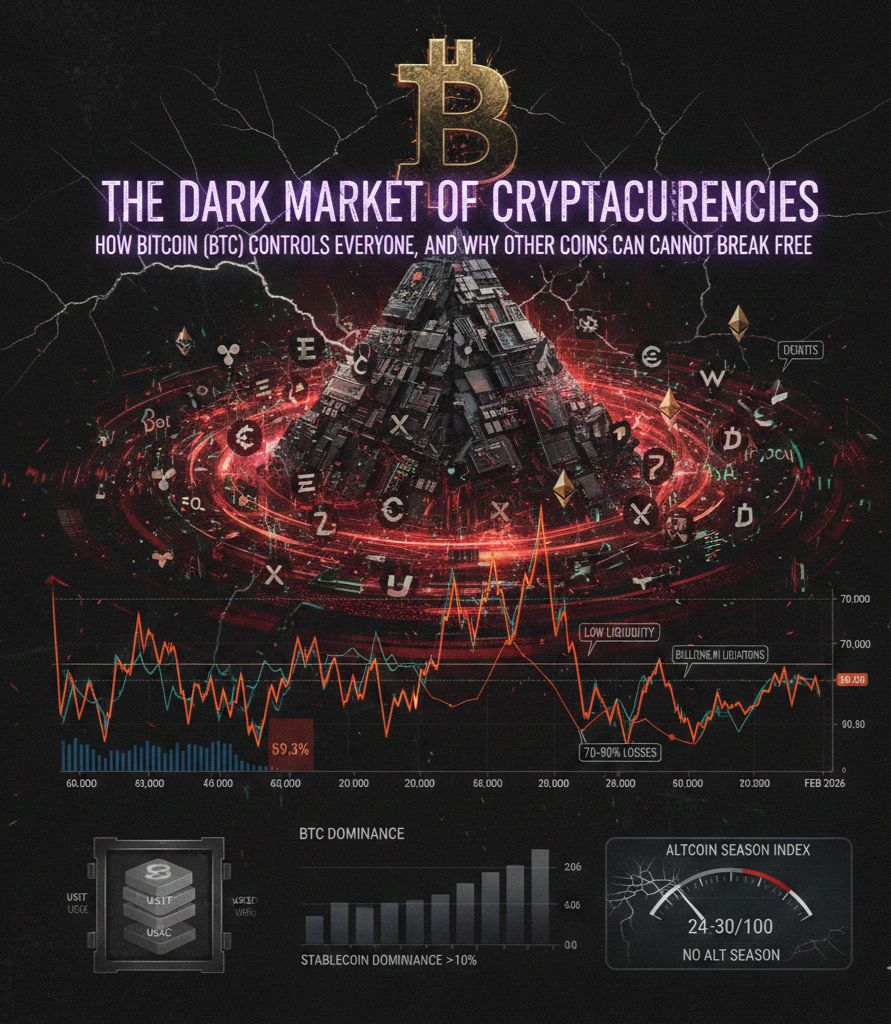

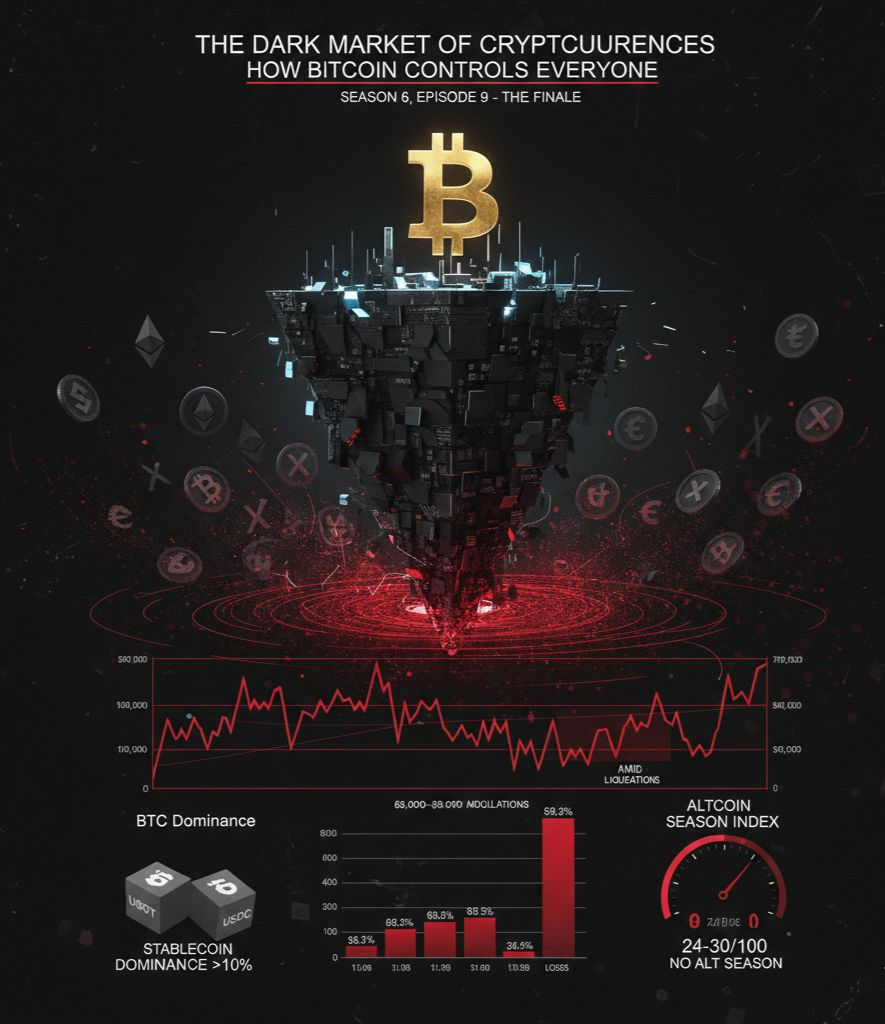

Bitcoin’s price is now oscillating between $66,000 and $70,000 (with sharp drops reaching around $60,000 in early February before partial recoveries), after being heavily promoted as an easy “$100,000+” target throughout 2025. Recent action shows violent volatility: a drop below $70,000 intensified, with BTC trading near $66,000–$68,000 amid ongoing deleveraging and billions in liquidations. Bitcoin Dominance fluctuates between approximately 58.6% and 59.3% (hovering stubbornly high, often near 59–60%), alarmingly elevated despite repeated crashes. This means capital continues to flee into BTC as the “safe haven,” while altcoins bleed heavily: losses of 70–90% across many projects, amid extremely low liquidity that turns any selling pressure into a catastrophe.

This is not a normal “Bitcoin season”; it is a brutal defensive phase. Stablecoin dominance has risen above 10% (the highest levels since the FTX collapse), signaling that people are sitting on digital dollars (USDT/USDC) and refusing to re-enter the market. The Altcoin Season Index remains stuck in the low 20s to low 30s (around 24–30/100 in recent readings), confirming that an “altcoin season” has not started… and perhaps never will in this cycle.

2. The Dark Side Revealed: Whales Are Ending the Game

Whales have not stopped selling—they have accelerated. Billions moved to exchanges ahead of every major drop, aggressive liquidation of leveraged positions (with over $9B in liquidations reported in recent weeks), and recycling of liquidity exclusively inside BTC. Tether (USDT) remains highly suspect: large mints coincide with short-lived recoveries, but they are nowhere near enough to rescue the market from its structural collapse.

Regulation plays its lethal role: Bitcoin ETFs attract institutional flows, but they concentrate liquidity exclusively in BTC, making altcoins appear as prohibited or non-compliant speculation. Institutions do not merely want “digital gold”; they want BTC as a defensive asset, while altcoins are treated as high-risk garbage.

3. Season Finale: No Altseason, No Liberation, Just Reordering of the Pyramid

In this final episode, there is no explosive “altseason” like in 2017 or 2021. Instead, we are witnessing an “inverted altseason”: selective pumps in a handful of whale-favored altcoins, while the rest slowly die. Bitcoin dominance never drops below 55% meaningfully; it remains elevated (often testing resistance near 60%), proving that the market has matured… but matured into an even harsher pyramid structure.

The four-year cycle is over: 2026 is the real “bear leg.” Forecasts from analysts (e.g., Canary Capital's Steven McClurg) point to BTC falling toward $50,000 in the summer, before any possible rebound in the fall… but even that rebound will be weaker, because retail investors have permanently exited, and institutions now fully control the game.

4. Final Lesson from Season 6

Bitcoin was never about “freedom”; it has always been the king that devours everyone when hunger strikes. Altcoins never liberated themselves—they were reused as tools to absorb losses and FOMO. The market is not a free economy; it is a closed system controlled by a tiny minority, with organized manipulation, fake liquidity, and fear that is reproduced cycle after cycle.

If you are still here at the end of this season: perhaps you have finally understood the lesson. Avoid leverage, stop chasing hype, and hold only what you truly understand. As for the rest… the season is over, the screen has gone black. Wait for Season 7…

If God wills it and grants us a Season 7, it will be the season of uncompromising realism—waging war on charlatanism, hypocrisy, and deception without mercy or leniency. Stay safe.

This episode is dedicated to every brother 💚✌🏼and follower who wishes me well.

Written by Giovanni

February 12, 2026

#Binance #BinanceSquare $BTC $ETH $SOL