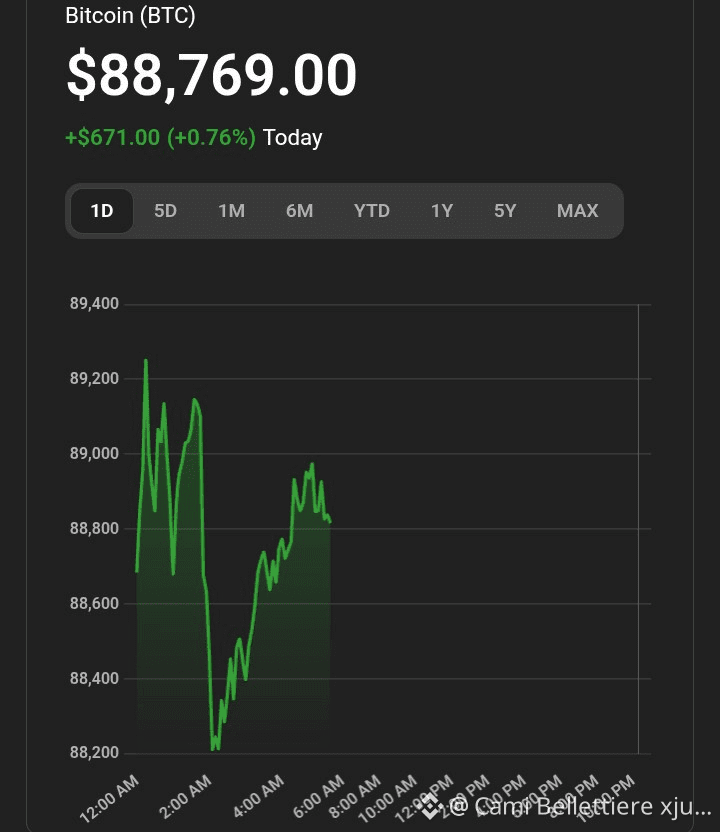

#BTC is trading near ~$88,700, showing modest stability after recent volatility. The market is in a consolidation phase, with prices oscillating in a range rather than displaying a clear trend. Technical models show mixed signals — short-term indicators hint at a possible rebound, while broader trend metrics remain cautious. AInvest

#USNonFarmPayrollReport #CPIWatch #TrumpTariffs

📈 Bullish Factors

Analysts predict potential rebounds toward ~$95,000 if key resistance levels are breached. Blockchain News

Long-term models and institutional forecasts still suggest significant upside potential in 2025 “cycle” scenarios. Cointelegraph

📉 Bearish / Risk Considerations

Recent momentum suggests weak price action and possible corrective pressure, keeping bears in control until major levels are reclaimed. DL News+1

Seasonal patterns and historical December weakness could extend short-term downside. CoinCentral

🧠 Sentiment & Macro

Investor sentiment currently leans toward fear/uncertainty, with holiday-week low volume and cautious positioning. Broader macro data and ETF flow dynamics will play a key role into early 2026. marketwatch.com

If you want more detailed support/resistance levels or a concise trade bias summary, just let me know!

Is this conversation helpful so far?