Taking another look at $NEAR and while the broader trend is still clearly bearish, there are a few subtle signs worth watching for a contrarian setup. This is not a rush-to-buy situation — patience and confirmation are key.

📉 Trend & Volume Snapshot

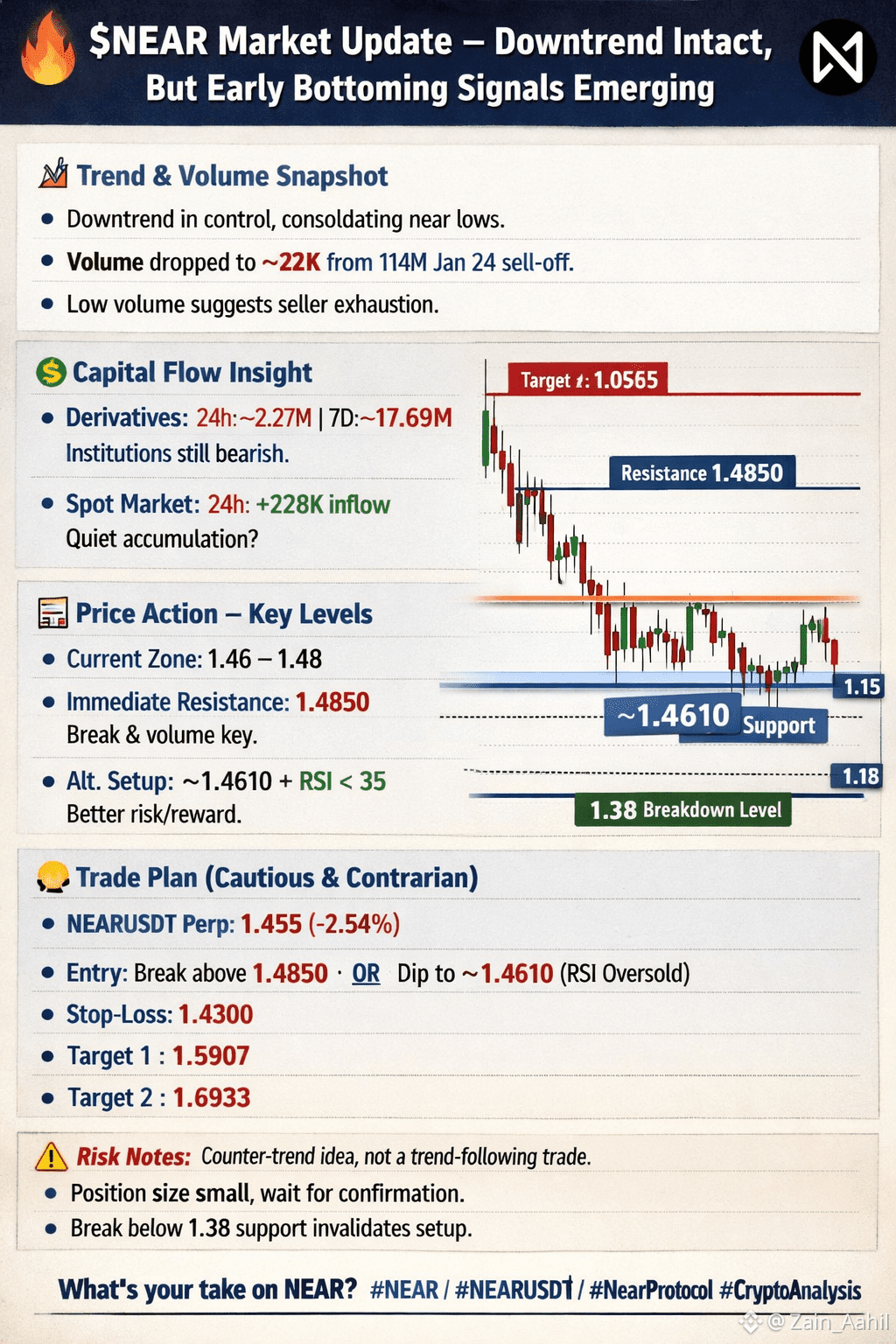

Downtrend remains in control, with price consolidating near the lows.

Volume has collapsed to ~22K, a massive drop from the 114M spike during the Jan 24 sell-off.

This kind of low-volume consolidation after panic selling often hints at seller exhaustion — pressure may be drying up.

💰 Capital Flow Insight

Derivatives / Contracts:

24h: –2.27M

7D: –17.69M

→ Institutions are not bullish yet.

Spot Market:

24h: +228K inflow

→ Could be early retail or smart money quietly accumulating near the bottom.

📊 Price Action – Key Levels

Current zone: 1.46 – 1.48

Immediate resistance: 1.4850

A clean break + volume could trigger a short-term reversal.

Alternative setup:

Pullback to ~1.4610 (yesterday’s low)

RSI < 35 = better risk-reward long opportunity.

🧠 Trade Plan (Cautious & Contrarian)

NEARUSDT Perp: 1.455 (–2.54%)

Entry options:

Break & hold above 1.4850

OR dip toward ~1.4610 with RSI oversold

Stop-loss: 1.4300 (below recent structure)

Target 1: 1.5907 (key resistance)

Target 2: 1.6933 (only if market flips risk-on)

⚠️ Risk Notes

This is a counter-trend idea, not a trend-following trade.

Position size small, wait for confirmation.

A break below 1.38 support invalidates the entire setup.

👀 What’s your take on $NEAR

Do you see bottoming signs forming, or are you waiting for more downside before getting interested?

#NEAR #NEARUSDT #NearProtocol #CryptoAnalysis