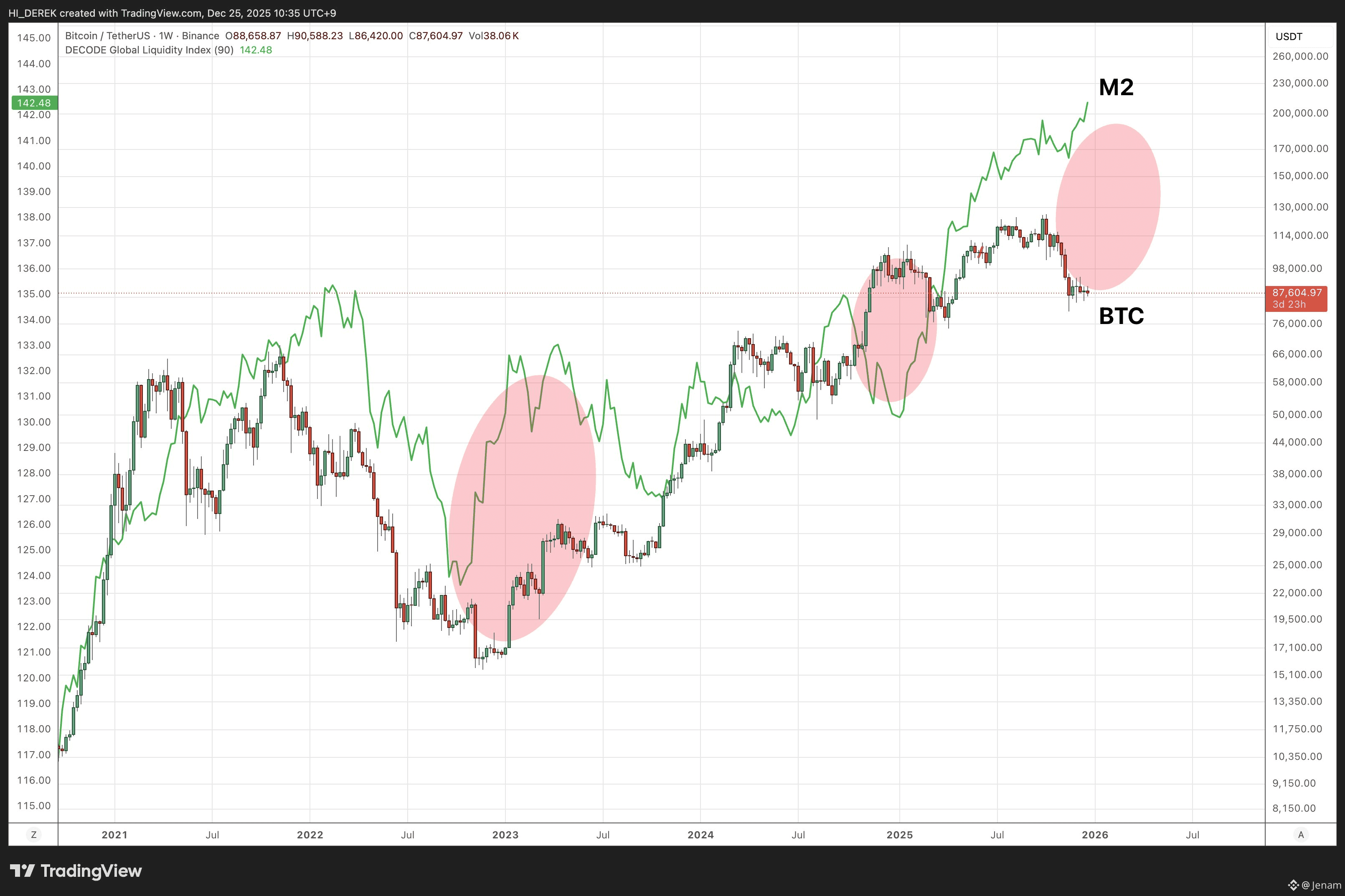

Global M2 money supply is hitting all-time highs, gold prices are breaking records, the dollar index is weakening, and the Fed has begun cutting interest rates. Traditionally, these have all been leading indicators for a Bitcoin price surge; however, the market is currently moving in the opposite direction. As we can see, the crypto market is completely defying these typical bullish signals.

I attribute this decoupling to the approval of Bitcoin and Ethereum ETFs in the U.S. and the subsequent influx of massive institutions, which has led to a heavy concentration of capital. This shift appears to have triggered a capital flight from non-U.S. markets where small-to-mid-sized VCs used to operate with more agility and diversity. Furthermore, over the past year, the crypto market has been uniquely plagued by political exploitation and manipulative circumstances. These "absurd" events have disrupted the natural mechanics of the market, forcing investors into a passive or "wait-and-see" stance.

The current price decline is likely the final "growing pain" before the market is fully integrated into the mainstream institutional system. For liquidity to flow back normally, the fundamental structure of the crypto market needs to be refined. In this period of extreme stagnation, it seems evident that the "architects" have entered an intentional phase of stalling, biding their time until the right moment.

Get BNB Free - Click here