Everybody is ignoring it.

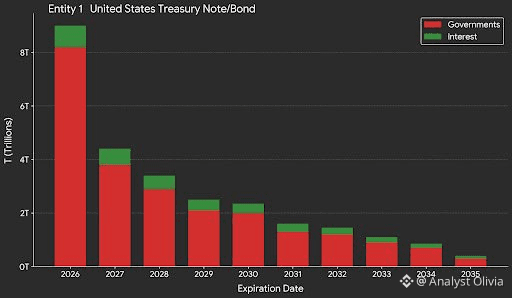

The massive red bar you see is the principal amount of US debt expiring in the next 12 months.

OVER $8 TRILLION DOLLARS.

Here’s why it matters:

The US Treasury made a FATAL MISTAKE.

They shortened the duration of their debt when rates were near zero.

NOW, THE BILL IS DUE.

We’re about to force a rollover of trillions in ZIRP-era paper (issued at ~0.5%) into a 4.5%+ rate environment.

Why this is a black swan:

This isn't about paying it off, it’s about repricing risk.

1: Debt Service Explosion: As this red bar rolls over, the Interest (Green) component on the budget will parabolic.

2: Liquidity problems: Who has the balance sheet to absorb this supply without yields spiking?

This is a mechanical squeeze on the US sovereign balance sheet.

It forces a choice: Austerity (Depression) or Yield Curve Control (Inflation).

Most analysts are looking at P/E ratios, but they should be looking at the structure.

Interest expense just hit $1 Trillion/year, consuming 19% of all federal tax revenue.

That’s not a projection, that’s today’s reality.

We are borrowing new debt just to pay the interest on old debt.

That’s the definition of a ponzi financing unit.

Btw, I’ve called every major top and bottom for over 10 YEARS.

When I make a new move, I’ll share it here for everyone to see.

If you still haven’t followed me, you’ll regret it. Trust me.